China Hog Markets: Sow Inventories Fall, Prices Rise

CHINA - China is the pork powerhouse of the world with over 51 per cent of the world’s population of pigs raised there, writes Ron Lane, Business Director Asia Pacific.- Looking at the size of the breakdown of the inventory for April 2015, the adjusted information from MOA is indicating 387.12 million on-farm pigs and a 39.74 million-sow herd. (March 2015, there was 387.20 million on farm inventory and a 40.425 million-sow herd. The April 2015 387.12 million on farm inventory is down 0.02 per cent from last month (March 2015). This is a further drop of almost 18.63 million on-farm pigs in the first 4 months of 2015. The total drop in on-farm pigs as compared to April 2014 is 9.4 per cent . Looking at the April 2015 sow herd, it was down 1.7 per cent from March and was down 14.9 per cent from one year ago. Again in April, almost 687,000 sows disappeared and in March, a further 700,000 sows were eliminated from the national herd. With February’s total at about 800,000 sows and January’s total at about 1 million sows, then, during the first 4 months of 2015, a total of 3.19 million sows have been culled and/or eliminated from the total national herd. This is about equal to the top 25 pork powerhouses in the USA eliminating all of their sows in 4 months. Since February 2014 (the past 26 months), the China sow herd has seen more than 11.45 million sows eliminated-almost 2 times the current USA sow herd. The current sow inventory is the lowest level in more than 4 years. Several farm households are deep in financial difficulty and bankruptcies of large farms are beginning to happen. Some large-scale farms are being shut down or being bought up by larger scale systems and this consolidation will continue to happen.

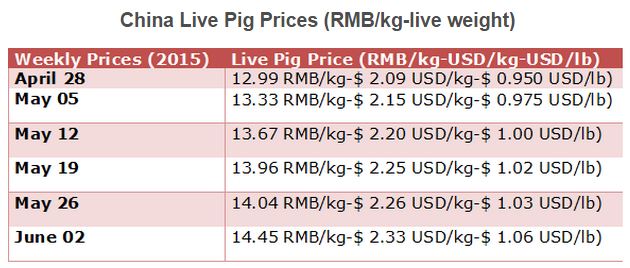

- With excessive elimination of sow production and with lower supply of market hogs, there has been a steady rise in pork prices since mid-March. During the next few months, market pig producers should see 2015 prices continue to rebound. The highest point of the year should be over 17 RMB/kg ($ 2.74 USD/kg-$ 1.24 USD/lb).

- Several Chinese experts have estimated that the sow herd will stabilize at around 40 million sows (currently we are at 39.74 million as of April 2015). As well, these experts project that the demand for live market pigs will be around 657 million head for 2016. If we look at 40 million sows producing 657 market pigs, then we see a number of 16.43 pigs marketed per sow per year. This is higher by about 1.53 market pigs over 2014. Probably not possible as from 2010 to 2014, the number of pigs marketed per sow only increased by a factor of 1.89 in total. If the demand forecast is accurate, then the shortfall will cause the live market pig prices to rise and a surge in imports from a vast number of countries.

- In 2014, the total domestic grain production in China reached 600 million tonnes, with corn production reaching 215.673 million tonnes (the second highest production ever recorded). With this, China is now having surplus carryover for corn-with 24.89 million tonnes (2013); 39.76 million tonnes (2014) and is projected to be 29.5 million tonnes in 2015. Average corn prices have been fairly stable for the past few weeks with corn at 2,420 RMB per tonne ($ 390.12 USD/tonne) for June 2nd and at 2,418 RMB per tonne ($ 389.80 USD/tonne) on May 05th, 2015. The national soybean meal price was 3,020 RMB/tonne ($ 486.85 USD/tonne) for June 2nd, 2015 and at 3,216 RMB/tonne ($ 518.44 USD/tonne) for May 5th, 2015.

- Pork prices in China had fallen continuously from early August 2014, but have risen during the past few months (since the low weekly price for this year on March 16th of 12.09 RMB/kg ($ 1.95 USD/kg-$ 0.884 USD/lb). Farmers in China are optimistic for further increases during the second and third quarter.

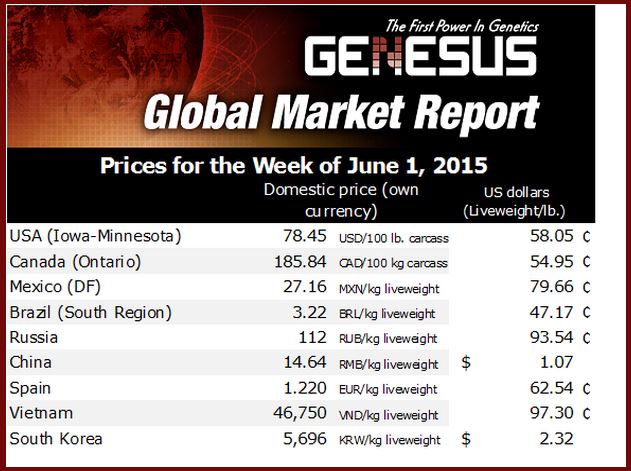

- In the northeastern region of China, market pig prices fell as demand has decreased (somewhat due to lower consumption as the weather gets warmer); whereas, in the southern region, there was a strong rise in prices due to a shortage of high quality pigs as well as heavy rains causing the shipping of pigs to be slowed down to the slaughterhouse. The Country's highest price was in Guangdong at 15.95 RMB/kg ($ 2.57 USD/kg-$ 1.17 USD/lb) with the lowest in Heilongjiang province at 13.40 RMB/kg ($ 2.16 USD/kg-$0.98 USD/lb.). Piglet prices continue to rise sharply. The Ministry of Agriculture (MOA) data shows that piglet prices have been rising for 13 weeks and are at a price that is 12.4 per cent higher than over the same period in 2014. The price for sows was 1588.75 RMB/sow ($ 256.12 USD/head) and this is down 1.88 per cent from last week.

- Profit margins are now showing marginal positive returns and are improving since our last report. At the end of May, the estimated farrowing to finish profit from pig production was 62.5 RMB/market pig ($10.08 US/market pig). This is an increase of 17.15 RMB/head ($ 2.76 US/market pig) from the week before. This week the pig to grain ratio was 6.13: 1(an increase of 0.09 from last week).

- On May 8th, Chuying (Truein) Group announced their intentions to construct a 3 million live pig base located in Wulanchabu City in Inner Mongolia. In addition, a slaughtering and processing plant and meat processing along with meat product deep processing will be initiated. An investment of 4.311 billion RMB (695 million USD) and about 5 years will see the completion of this project. Last summer, Chuying purchased 900 GGPS from Genesus Inc.

- The Consumer Price Index (CPI) continues to be quite interesting for the national government. The CPI is made up of about 31.8 per cent food found in the consumers’ basket. Pork is estimated to be about 1/3 of the food portion of the basket or in other words, about 10 per cent of CPI as a whole. CPI was 1.5 per cent for April 2015. March inflation rate was 1.4 per cent (the same as February) better than the market expected (January was the lowest in 5 years at 0.8 per cent ). Food prices (including pork) weakened significantly after Spring Festival with a 4.5 per cent decline. Currently, pork prices are rising and a sustained increase will cause the national government concern. As a measure, when pig prices increase, CPI should increase. China's GDP grew 7.4 percent in 2014, the weakest annual expansion in 24 years. China set this year's economic growth target at around 7 percent and its inflation control target at around 3 per cent .