CME: US Pork Exports at a Record High

US - Sharply lower pork prices in April helped move a lot of US product into export markets, but beef exports have gone down, write Steve Meyer and Len Steiner.The latest data from USDA shows US exports of fresh, frozen and prepared pork in April were 162,393 MT, 9.8 per cent higher than a year ago and the largest monthly export volume since October 2012, when pork exports reached 168,913 MT - an all time record.

The volume of exports in April exceeded our projection based on the weekly export data, which was calling for a 3 per cent increase.

May pork exports are still expected to be lower compared to a year ago but we will revise up our current projection for May.

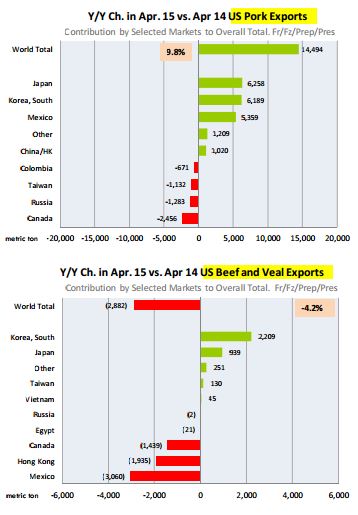

The chart shows that the increase in pork exports was driven by a sharp jump in shipments to traditional customers in Asia and Mexico.

Exports to Mexico, now the top market for US pork, were 45,385 MT, 13.4 per cent higher than a year ago. In the first four months of this year, US pork exports to Mexico have averaged 12.7 per cent higher than last year.

Exports to Japan also rose sharply in April, thanks to the lower prices but also a slightly stronger Yen. Total shipments were 45,121 MT, 16.1 per cent higher than a year ago and the largest monthly volume in more than a decade.

Last year, monthly pork exports to Japan averaged a little under 32,000 MT. April shipments were truly large.

Exports to South Korea have increased rapidly in the last few months, averaging 18,700 MT in the first four months of the year. April exports at 21,250 MT were up 22.4 per cent from a year ago.

Finally, it is worth noting the increase in pork exports to China and Hong Kong. Shipments to the Chinese market were sharply lower last year and early this year as the spread between US and Chinese pork values narrowed.

Lower prices in the EU also made European pork more competitive. However, that appears to be changing.

April exports to China/Hong Kong were 13,272 MT, 8 per cent higher than a year ago. In the first three months of the year, exports averaged 6,500 MT.

Weekly pork exports indicate the pace of shipments slowed down in May. This could reflect the seasonal increase in pork prices in the US as well as the effect of a stronger US dollar.

Exports will be critical this summer, however, as US domestic pork supplies remain plentiful. April may have been a big month in terms of exports but more is needed to help support prices over the summer months.

Beef exports were expected to be down given the sharp reduction in supply availability and extremely high beef prices.

If anything, we were surprised US beef exports in April were not down even more. Total shipments of fresh/frozen and processed beef and veal were 66,324 MT, 4.2 per cent lower than a year ago.

Demand for US beef continues to be strong - the reduction in volume simply reflects the price effects. In April 2013, total beef exports were 59,267 MT and both prices and supply availability was much better back then.

Traditional markets continue to buy product. Exports to Japan were 18,743 MT, 5 per cent higher than a year ago while exports to South Korea at 10,363 MT were up 27 per cent from last year.

The problem for the US beef export market has been North America. Exports to Mexico at 8,561 MT were down 26 per cent from a year ago while exports to Canada at 8,267 MT were down 15 per cent.

Hong Kong has been a much more challenging market this year. Last year, sales there were booming, and that helped support the value of plates and briskets.

Exports in April were 9,101 MT, 18 per cent lower than a year ago. And there are signs that the situation is getting worse, not better.

This could reflect the recent changes in the export rules for Brazilian beef going into China. A number of Brazilian plants have been approved and more are on the way. This has may have increased competition and limited demand for US product.

Exports to Vienam also have dried up. April shipments were just 221 MT compared to an average of 3,500 MT in 2012 and 2013.