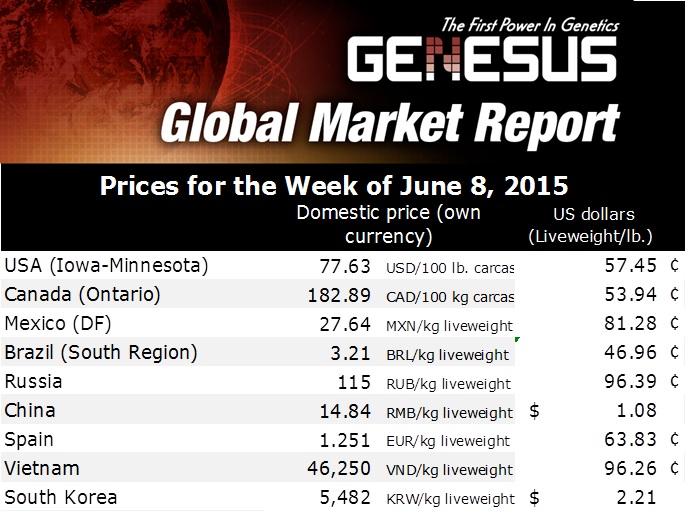

Mexico Hog Markets - Slaughter Price Continues to Improve

MEXICO - The slaughter prices are continuing to improve, write Carlos A. Peralta - President and R. Carlos Rodríguez – Vice-president.In June, the farm grain prices started as follows: i) corn at $246 vs $238 USD/MT previous month ($$3,860 vs 3,710 Mx/MT), 3.4 per cent above previous month in USD and 4 per cent above in Mexican Peso), ii) Sorghum $233 vs $234 USD/MT ($3,660 vs $3,660 Mx/MT), and non-movement previous month in USD and in Mx.), and iii) soybean meal $430 vs $445 USD/MT ($6760 vs$6,940 Mx/MT) 3.4 per cent below in USD previous month and 2.6 per cent below in Mexican Peso). The feed costs has had almost a constant value in USD and Mexican Pesos terms.

The Mexican peso volatility continues. At the moment when we wrote this article (06.13.15) the Mexican Peso: USD exchange rate was at $15.72 :$1.00 USD, but at the end of previous week the exchange rate grew up above $16.10 per USD due the fear in the financial markets due the expectations from the announcement about the increase in the interest rate planned by FED.

The trend and macroeconomics assumptions indicate the Mexican Peso will continue suffering a slightly devaluation that could get the Mexican Peso in-between $16.20 to $16.40 per USD.

The pig producers uncertainty continue the Mexican Peso fluctuation against the USD and how their production cost are affected to produce each pound per pig alive weight, as the low slaughter price reaction (increase) due this situation. Today the average national production cost per pound is around $0.6012 ($1.3346 USD/Kg or $21.00 Mx/Kg).

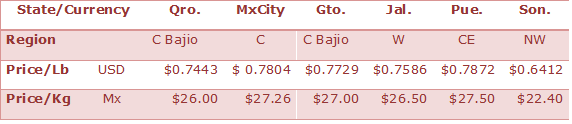

The life slaughter price in some Mexican Regions is as follow:

The average slaughter price for this week, compared with 6 weeks before, increased in 30.6 per cent .

As you can see in the previous chart, we have a slaughter price difference of $0.1460 USD/Lb ($5.10 Mx/Kg).

After the slaughter prices were in the deepest moment due the Easter season, the Mexican slaughter Prices recovered substantially, independently the pressure to stop the slaughter prices increase due to the imported legs coming from the USA and Canada at a ridiculous price of $0.7157/Lb ($25.00 Mx/Kg) at wholesaler level and selling to retailers at $0.8015/LB ($28.00 Mx/Kg). Owing to the actual slaughter prices, the whole pig producers in the Country have had profitable business during the last weeks.

Profits per slaughter pig at 255 Lbs (115 Kg)

The profits showed in the previous chart are considered as direct profits, and we are not included any government subsidy.

The President of one of the Pig Production Councils (CPM) mentioned during a Press Conference that Mexico requires specific laws to regulate pork meat imports at a competitive price and not at a dumping price.

The Mexican Pig Producers Organisations and the Canadian Pig producers Organisation appeal to the World Trade Organisation (WTO) to apply economic punishments to the USA due the COOL effect.

Last May the World Health Organisation – WHO – recognized Mexico´s as officially free of Classical Swine fever, and will help the Country to increase their pork meat export from 89K MT (2014) to more than three times bigger in 2016.

Talking about Figures:

The Food and Agricultural Policy research Institute – FAPRI - obtained in 36/Lb (16/Kg) Mexican per capita pork meat consumption for 2014 and estimated to get 38/LB (17.2/Kg) in 2016.

Mexico had during the first quarter of 2015 0.02 per cent increase in pork meat production.

Genesus México during the last two weeks of May we had in Mexico the visit from Fernando Ortiz, responsible for International Genesus Ibero-America, visiting a lot of pig producers in the Country, representing most of them more than 200,000 sows in production plus their own expansion.

During the first week of June was the 2015 World Pork Expo in Des Moines Iowa and Genesus had a big tend where received a lot of customers, friends and visitors around the globe. Thank you very much to all of you for visiting us during the WPX in Genesus tend.

Granjas Carrol de Mexico & Norson (Smithfield Companies) continuing their expansion in Mexico, one of the reasons the Mexican borders are really busy.

As all of us known, based in Jim Long´s weekly commentary, the number of sows’ reduction in China during the last 12 months are above 7 million. This depopulation is close to 12 per cent and has forced a reduction in the slaughter prices due the extra supply in pork meat. The pig producers are maintaining more productive sows in their inventories and diapering back yard slaughter houses, inducing the final customers to realized their pork meat shopping in supermarkets.

Part of the production increment of those two Chinese companies and other National pig producers will be focus in China´s present and near future imports of pork meat needs. These needs will help to increase the Mexican slaughter price in the near future.

Other Groups like Proteina Animal – PROAN -, Grupo Porcícola Mexicano – GPM. Kekén – and others continuing an real production expansion in Mexico.