CME: Pork Exports Strong, Beef Exports Down on Year

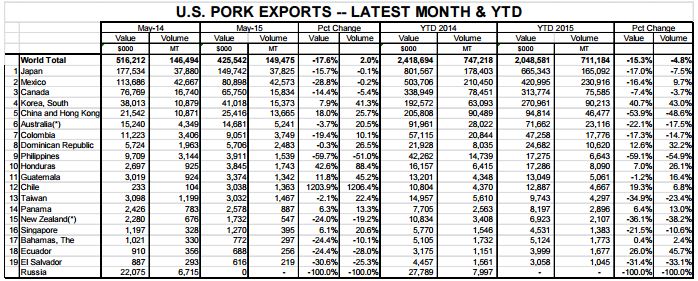

US - US pork exports enjoyed another strong month in May while beef exports fell well short of year-ago levels according to data released by USDA’s Foreign Agricultural Service, write Steve Meyer and Len Steiner.Pork tonnage fell slightly from April’s level which was enhanced by post-slowdown cleanup work at West Coast ports. The value of May pork exports, though, hit its highest level so far in 2015. Data for pork appear below.

Some highlights of the month’s export data are:

- US pork exports were 2 per cent higher than last year but the value of those shipments was sharply lower reflecting much lower domestic wholesale prices. The 2 per cent year-on-year increase follows a 10 per cent increase in April, a figure not doubt inflated some by the aforementioned cleanup of backlogged West Coast shipments.

- Japan remained far and away our largest valued pork market and remained second on the quantity rankings. Mexico remained number one for volume and number two for value with Canada ranking third on both counts. Shipments to all of those markets were lower this year while values were down dramatically, again reflecting lower domestic pork prices.

- Exports to China-Hong Kong continued to rebound in May, exceeding year-ago levels by 26 per cent in volume and 18 per cent in value. May’s pork tonnage to China-Hong Kong was over 3.5 times as large as January’s.

- YTD pork exports have now clawed their way back to within 5 per cent of 2014 levels. As with all of these comparison, the value figure is much worse but is improving as year-on-year quantity comparisons improve. The leader among major markets for YTD growth remains Korea which has taken 43 per cent more US pork this year — and that pork has a total value 40 per cent larger than one year ago!

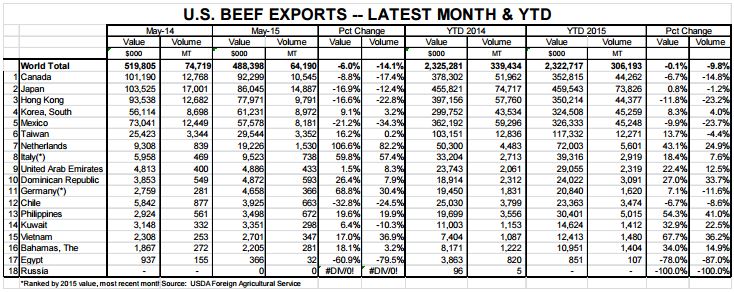

- Total beef exports amounted to 64,190 MT, down 14.1 per cent from one year ago. The value of these shipments was 6.4 per cent lower relative to last year as higher wholesale beef prices make up for part of the reduction in volume.

- Canada was our largest value market in May while Japan remained our largest volume customer. Shipments to Canada, though, were still 14.1 per cent lower than last year and the value of those shipments decreased by 8.8 per cent. Japan took 12.4 per cent less US beef versus May 2014 at a value 16.9 per cent lower.

- Hong Kong was our third largest beef market in terms of both value and volume in May but both levels were sharply lower than last year with beef volume declining by 22.8 per cent and beef value falling 16.9 per cent short of May 2014.

- Mexico ranked fifth among US beef markets again in May and shipments there continue to struggle, falling short of last year’s levels by 34 per cent in volume and 21 per cent in value. Mexico has always been a price-sensitive market so we expect these year-on-year declines to continue for the foreseeable futures.

- Of our major beef markets, only Korea grew in May relative to year-ago levels. Korean purchases increased by 3.2 per cent in volume and 9.1 per cent in value.

- On a YTD basis, Japan is still far and away our large beef market in terms of both value and volume. The 73,826 metric tons shipped to Japan so far in 2015 is 1.2 per cent lower than last year but the value of those shipments is fractionally higher than in 2014.

- Among our major markets, Hong Kong and Mexico have been the softest so far in 2015. A number of minor markets have grown significantly this year in both volume and value terms.