EU and Spanish Pork Markets

EU, SPAIN - Pork consumption in Europe is not the best at this point (particularly in Germany), the inventories are bigger and pork export is steady (China is slowly putting in some orders very cautiously just waiting for better prices in the market), writes Mercedes Vega, General Director for Spain, Italy & Portugal.On the other hand, Russia has extended by one more year a ban on some foods coming from Europe. This is not good for Europe obviously.

During the first quarter of 2015, the EU has increased by 5 per cent the number of slaughtered pigs from a year ago with some average prices also higher than a year ago, which means an increase of 6 per cent , reaching a record in March of 2 million tons produced in this month.

In the first 4 months of the year in the EU, there has been 85.6 million head of pigs slaughtered.

This amount is 4 per cent more than in 2014 and a rise in the production of pork by 6 per cent. For the Agriculture and Horticulture Development Board (AHDB) of England, this increase in production is due primarily to the rise of slaughter pigs in Denmark, Spain and the Netherlands. In the case of the last two countries 6 per cent , more hogs have been slaughtered than in April 2014. Against this, Germany has reduced its level of slaughter by 1 per cent .

In Spain, there has been a production of 1.35 million ton in the first quarter of 2015. This increased production is due to a small increase in domestic consumption, a small increase in fresh meat but a decrease in processed meat. On the other hand, strong export growth is presumably absorbing the strong growth of the meat supply.

Exports accumulated in the first four months, the EU has achieved an annual increase of 54,000 Ton (+ 6 per cent ) and remains at 42,000 Ton (-4 per cent ) below the records of 2013, when the EU (except Spain) could still export to Russia.

Without Russia, China is pulling to get the best European results. In January, over 2,000 more tons of EU pork was purchased than a year ago, but since February, China is buying something between 20,000 and 25,000 more tons every month.

During spring, Spain saw the lowest levels of prices and shorter margins. These issues involve the whole pork chain in 2015 compared to previous years. The carcass weight has decreased during the month of May just over a kilogram, the price has risen in just 1 cent of € when normally in previous years has been at least 10 cents higher. This does not mean that there are more pigs than last year, but higher than a year ago in 1-kilogram weights, which also involves a greater amount of meat produced.

We are witnessing a strange and very hot summer. During July temperatures in Europe have been very high, which has resulted in the average weights falling, even though there are not enough pigs reaching a normal "commercial weight".

According with Mercolleida (Spain’s pork sector market) carcass weight has dropped in Spain by 1.1 kilos (2.45 lbs.), 700 grams (1.5 lbs) in Germany, 900 grams (1.9 lbs) in the Netherlands, 1.3 kilos (2.9lbs) in Belgium.

There are too many pigs but at the same time, weights are lower. Packing plants have reduced killing shifts over the last month and a half. Very high and sustained temperatures are slowing down the growth rate of pigs. This situation is making no space for new pigs in finishing barns.

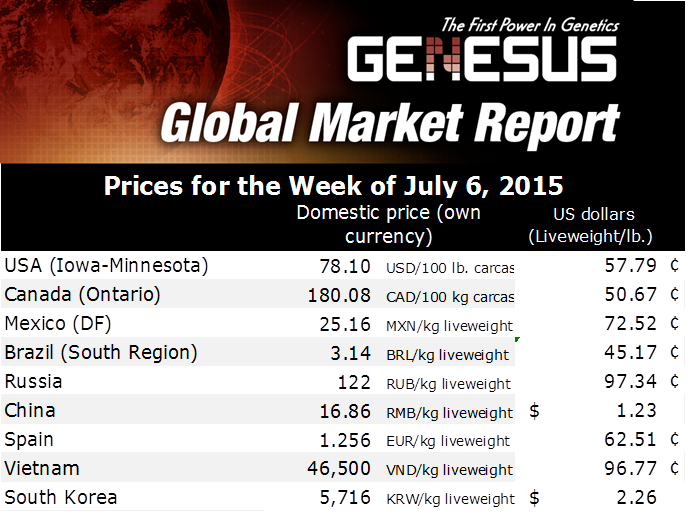

They are using their own production. Some farrow to finish producers are selling piglets because there is not enough room for them in the barns. The little pig market is in disarray, first there are no spaces to finish them and secondly the financial resource the producers used to have years ago is not in place this year, the freezers are filled with frozen piglets and there is no demand for export to Portugal and Italy as previous years. The price of piglets is on the Mercolleida market at €22.00 ($24.10 USD), while market hogs price is €1.256 / kilo ($0.63 USD/lb.) liveweight.

Portugal is in negotiations with China for exporting pork, the deal is expects to get it achieved by the end of the year. While Portugal is already exporting to Japan, is also expecting to export to Korea in 2016.