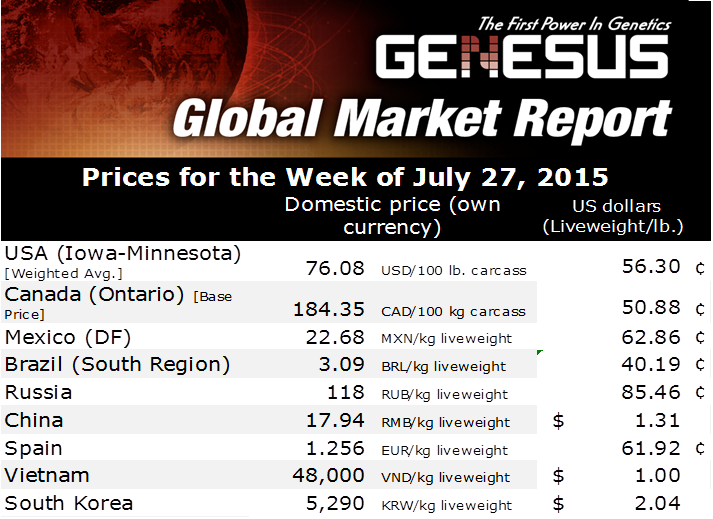

Mexico Hog Markets - And the Road Still Winding...

MEXICO - In July, the farm grain prices finished as follow: i) corn at $235 vs $246 USD/MT previous month ($3,900 vs. $3,860 Mx/MT), -4.4 per cent previous month in USD and 1 per cent above in Mexican Peso), ii) Sorghum $223 vs $233 USD/MT ($3,697 vs $3,660 Mx/MT), and 4 per cent reduction in USD and basically non-movement previous month in Mx.), and iii) soybean meal $420 vs $430 USD/MT ($6760 Mx/MT both months), writes Genesus Mexico, Carlos A. Peralta, President.The future market price for cereals has a 2 to 2.5 per cent cost reduction during the last quarter of 2015. The feed costs has had almost a constant value in USD but not in Mexican Pesos terms.

The Mexican peso volatility continue. Today (15.08.03.) the Mexican Peso: USD exchange rate was at $16.58 vs. $15.72: $1.00 USD during the previous report.

During the last 5 weeks, the Mx exchange rate felt down 5.5 per cent from the fear in the financial markets due to the expectations from the announcement about the increase in the interest rate planned by FED that has been delayed for several months.

The Central Bank of Mexico decided to increase the interest rates to avoid the money transfer to US due a higher interest rate in USD than in Mexican Peso. With this measurement they will stopped or decreased the continued devaluation and help to stabilize the Mexican peso exchange rate. The trend and macroeconomics assumptions indicate the Mexican Peso could go up to $17.00Mx: $1.00USD, but they believe the exchange rate will close 2015 at $15.50 Mx. per USD.

The pig producers uncertainty continue the Mexican Peso fluctuation and volatility against the USD and how their production cost are affected to produce each pound per pig alive weight, as the low slaughter price reduction. Today the average national production cost in USD per pound is around $0.5434 USD/Lb. ($1.2062 USD/Kg or $20.00 Mx/Kg).

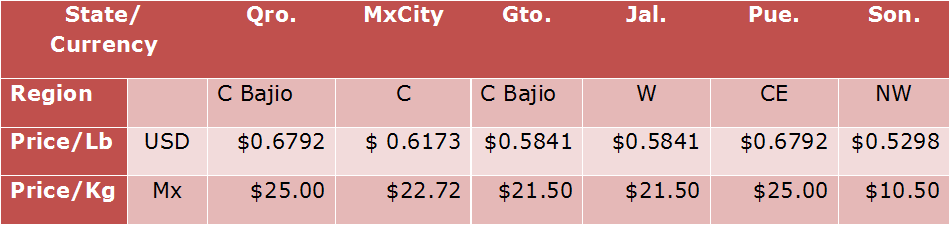

The life slaughter price in some Mexican Regions is as follow:

(USD per pound and Mexican Pesos per Kg.) at July 31st. 2015

The average slaughter continues loosing value in Mexican Pesos terms and even worse in USD terms.

In the previous chart, you can see a slaughter price difference of $0.0673 USD/Lb ($5.50 Mx/Kg).

Actually, in the metropolitan area of Mexico City, the National slaughter price was $0.6173 USD/Lb ($22.72 Mx/Kg) and for the Imported animals was at $0.7118 USD/Lb (($26.20 Mx/Kg), so the difference between them is $0.945 USD/Lb or 13.3 per cent higher the imported slaughter pig.

During August, we expect the live slaughter price will increase significantly related with the present prices due two main points: firstly, due to some adjustment in the National slaughter price related with the exchange rate and secondly, related in the consumption increase due the start-up of the next school year.

Owing to the actual slaughter prices, the pig producers in the Country have had variable results related with the region where they are located or where they sell their production.

Profits/Losses per slaughter pig at 255 Lbs (115 Kg)

The results showed in the previous chart are considered as direct results with an average production cost per pound of $0.5434 USD ($20.00 Mx/Kg.

Due to the fact that Mexico and Canada have appealed to the World Trade Organisation (WTO) to apply economic punishments to the USA because of the COOL effect, the USA House of Representatives approved the clauses to repeal COOL after the USA lost the lawsuit claim against Mexico and Canada who could punishment the USA in $3,123 million USD. The next step will be to know: When will the sanctions be applied?

Last June, the Mexican Ministry of Agriculture (SAGARPA) declared Mexico as an Aujeszkys Pig Industry free Country. This announcement will affect positively the National pig industry due the competitiveness and profitability of this economical sector. The Mexican Pig Industry total value is more than 5 billion USD.

During the last days of July, we celebrate the XLIX Congress of the Mexican Association of Swine Practitioners (AMVEC) in the City of Leon, Guanajuato State.

One more time, the total number of participants were above the expectative, all the topics discussed during the conferences were excellent with a high technical level and also the Congress was supported by the Industry suppliers and they were located in the commercial area, were all the participants found a nice place to visit the booths and enjoyed the coffee brakes. Congratulations to all the people involved in the organisation of the magnificent event.

We send our congratulations to Dr. Maria Elena Trujillo Ortega as new present of AMVEC for the period 2015-2017 and we will demonstrate to her all our personal and Genesus support.

Talking about Figures:

The Mexican pig industry showed a low growth rate due the imported pork meat consumer´s preference against Mexican pork meat. (CMP 15.07.10)

The Federal financial incentives to the Mexican meat producers grew up from 4.22 billion USD during 2014 to 9.0 billion in 2015 (CMP 15.07.02).

Genesus México Since the beginning of August second fortnight we will have semen doses availability from our new A.I. Stud in partnership with Semen Cardona, were you can ask for semen from two maternal lines (Yorkshire-Genesus and Landrace-Genesus) and Genesus terminal Line (Duroc-Genesus).

It´s the right moment to try to use Genesus semen doses genetic improvement offered to the pig industry from our A.I. Stud based in Mexico.