CME: Ham Values Fail to Perform Well this September

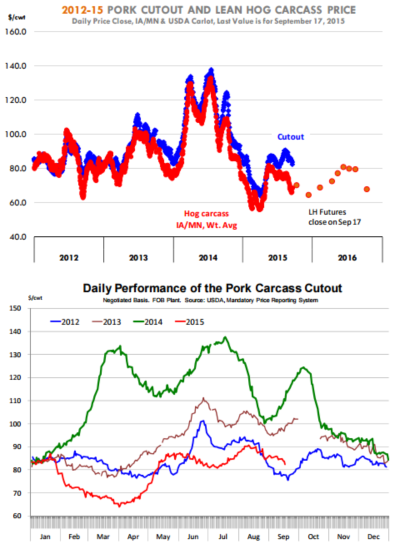

US - Hog markets have been trending higher in the last few weeks (despite all the volatility), buoyed by stronger than expected cutout values and expectations that demand this fall should be robust enough to support the seasonal surge in slaughter numbers, write Steve Meyer and Len Steiner.The nearby (October) hog futures contract closed last night at $70.575/cwt, 232 points higher than the previous close and at the highest point since early June.

At this point gone are projections of hog prices in the mid 50s that were being entertained in mid July—pork prices have simply been much stronger than expected.

The pork cutout last night was slightly lower but it is still hovering in the low 80 cent range, providing packers with good margins. Part of the reason for the +300 point jump in hog futures so far this week were reports that higher prices were being paid for hogs in the cash market.

IA/MN lean hog carcass was quoted last night at $68.54/cwt, $1.60/cwt more than a week ago.

The expectation last week was that hog prices would continue to drift lower with more hogs becoming available.

Hog carcass weights were notably higher following the short holiday week, which also implied that producers would be more aggressive in trying to market hogs. The fact that packers paid up to secure supplies certainly upended those ideas and futures markets participants have aggressively bid up hog prices.

Even as the performance of the pork market has certainly been better than most have expected, there are a number of factors that bear watching in the coming weeks. These could be bearish or bullish for the hog market depending on how they play out.

It is somewhat concerning for us that ham values have failed to perform well so far this September.

It is not terribly unusual for hams to slump in September, something we have mentioned a number of times before.

Slaughter starts to pick up and seasonal demand is not there yet to help soak up the additional supply.

Also, there is a large number of hams in storage, which also tends to nega- tively impact the quantity demanded during this time of year.

The ham primal value last night was quoted at $56.37/cwt, almost $14/cwt lower than where it was at the beginning of the month. The ham primal accounts for about a quarter of the carcass so it will be critical to get ham values to recover into October in order to offset the expected seasonal decline in some of the other primals.

Which brings us to the exceptional belly demand we have seen so far this summer. One needs simply run a ratio of belly prices to the value of the carcass for the last few years to recognize how dramatic the shift in belly demand has been recently. At this point we are in uncharted territory.

Retail demand for bellies seasonally falls off between now and November and we have no reason to believe this year will be any different. The key will be foodservice demand for bellies, especially as foodservice accounts for the bulk of bacon consumption in the US. Some are looking at the recent announcement by McDonalds to run all day breakfast as one of the reasons for belly prices holding firm deep into September.

Large as this company is, the belly market is quite deep. Rather, we think the shift in belly demand can be directly linked to the extremely cheap prices we saw last spring. At the time, foodservice operators saw an opportunity to increase the number of bacon features.

The decision certainly made sense given expectations of very large hog slaughter levels in the fall and the seasonal tendency for bellies to be weak that time of year. The result is a surge in the quantity of bellies demanded and a dramatic increase in the ratio of belly prices to the price of the carcass.

The risk is that those belly features do not last forever and once they go, we could be left with plenty of bellies looking for a home. Export demand also is a key wild card going into the fall.

Talk of China purchases has died down a bit and the USDA weekly export sales reports the last few weeks have failed to show a ramp up in China shipments. Will we see a recovery in Q4 and, if so, what kind of a premium does this warrant for the December contract. If not, maybe Dec futures are now fully priced, implying a cutout in the low 70s.