CME: Producers to Market Hogs More Aggressively

US - Cash hog prices have come under some pressure in the last few days as producers seek to market hogs a bit more aggressively following the short holiday slaughter last week, writes Steve Meyer and Len Steiner.USDA quoted the IA/MN cash hog base price last night at $66.44/cwt, 87 cents lower than a week ago and now almost 11/cwt lower than in mid August.

The national negotiated base price last night was quoted at $65.20/cwt. Before comparing these prices to futures, keep in mind that they are base prices, they do not include premiums or discounts. The CME cash index, on the other hand, is based on the negotiated net price. If you want to closely track the index, it is important to pay attention to the net price, which was last quoted (for Sep 11) at $70.11 (prod. Nego ti ated price). The trend in the base price, however, is important to watch as it provides a more ti mely indica ti on of the direc ti on in cash hog markets.

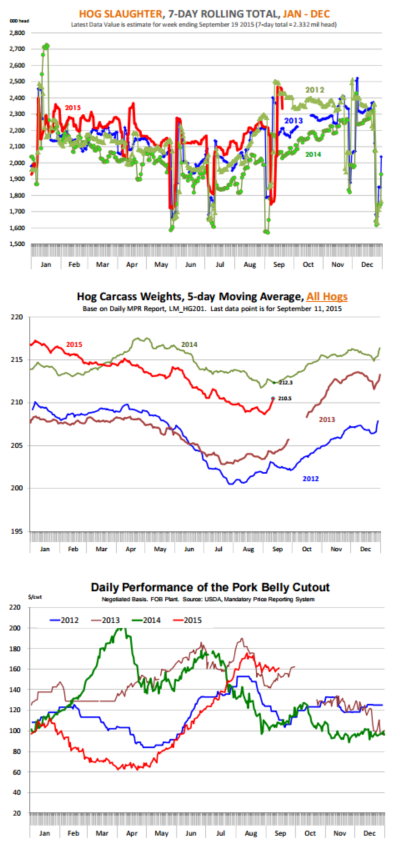

Hog supplies were lower last week due to the holiday but that will not last. For week ending September 12, hog slaughter was 2.040 million head, about 131,000 head lower than the previous week but about the same as the comparable holiday week in 2012 (we are comparing to 2012 as that was the last year we had a somewhat similar supply situation going into the fall).

The short week certainly has caused some hogs to back up and this can be seen in the hog weight situation, which has made a U-turn after drifting lower for much of the summer.

Day to day weights are quite volatile so we use a five day moving average. For week ending September 11 (this is also reported with a 1 day lag), hog carcass weights were 210.5 pounds, 1.63 pounds heavier than just two weeks ago but still below last year’s levels.

Cooler weather and feed quality improvements (corn harvest is around the corner) seasonally help hog carcass weight gains in the last quarter of the year.

The rapid raise in weights, however, has quickly changed the potential trajectory for hog carcass weights in the next two months and producers need to be much more aggressive in selling hogs in order to stay current.

It is interesting to compare the hog carcass situation in 2012 and in 2015. Weights rose rapidly during the Labor Day weekend in September 2012 but then drafed lower through the end of the month (see chart).

This was largely due to producers becoming much more aggressive in marketing hogs. In the very near term, this pressured the cash hog market but it also made for more stable hog carcass prices in Q4.

It remains to be seen how producers respond this ti me around. We estimate hog slaughter for this week at 2.332 million head, 14.3 per cent higher than a year ago and also 7.1 per cent higher than in 2013.

If this number is correct, it s ti ll would be about 3 per cent lower than the comparable week in 2012, however. The key this week will be Saturday slaughter. We have Saturday slaughter going up at the normal pace for this ti me of year (185k) but it is possible we are underestimating this number.

Pork prices have held up better than expected but as slaughter picks up, it could put some pressure on retail items that usually are weaker at this time of year. Belly demand has been particularly strong and has helped bolster packer margins. How belly demand performs in the next three months is a key wild card.