CME: Pork Exports Remain Relatively Light

US - Despite much speculation to the contrary, pork exports remain relatively light (given current supplies).Because of significant variation in how data was reported last year, looking at the year to year comparison may not be the best way to look at the pork export numbers. Rather, we suggest looking at the trend in exports to specific markets, China being the most important. Also, it is possible to come up with an estimate for monthly exports (based on weekly shipments) and then compare that estimate to the official statistics. The goal is to understand what kind of trend weekly data suggest for monthly exports going into the fall.

On the first count, weekly exports to China (at least as reported in the USDA report) remain quite limited. Keep in mind that the report covers only exports of fresh/ frozen muscle cuts. We keep hearing of significant quantities of pork byproduct going to China and that would not show up in this data set. Also, if exports to China are full or half carcasses that would not be captured either. Still, in the last four weeks exports to China have averaged only about 277 MT/week.

In March, April and May, weekly pork exports to China were averaging 1774 MT/week.

If exports to China were supposed to sustain the pork market going into the fall, that is not yet apparent in the export statistics.

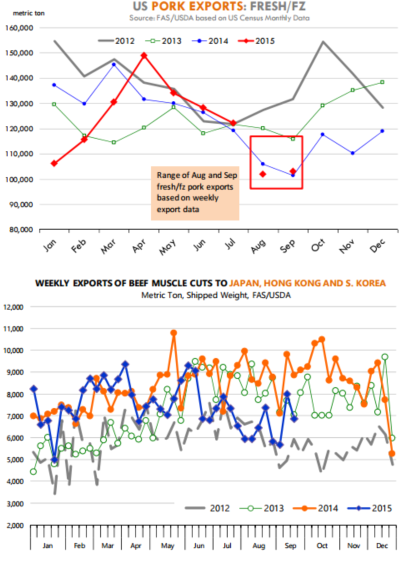

The pace of weekly exports at this point does not suggest any dramatic shift in trend. Based on the weekly numbers, we project August and September monthly exports of fresh/frozen muscle cuts at 71,000- 72,0000 MT. But this is only a subset of the official data which also includes items not part of this report.

Looking at the ratio of the weekly data to the official monthly statistics, the numbers are all over the place but for the most part the ratio seems to be 60-70 per cent . In June and July the ratio jumped to as high as 88 per cent but that seemed to us to be an aberration.

The chart below shows what the implied level of exports would be for August and September using a ratio of 70 per cent (red dots). If that is correct, weekly pork exports in August and September would be very near year ago levels, which were particularly light due to the impact of PEDv.

On the high end, exports of fresh/frozen pork in August and September would be near 118,000 MT, slightly under the pork exports we saw in 2013 and much lower than in 2012. The last point is important, we think.

In 2012, pork slaughter was similar to what we are seeing this year but overall production was lower because hogs were coming to market at much lighter weights than today. The pork cutout and hog prices were notably higher than today in 2012, in part because of that strong export demand. This is one factor that needs to be considered when comparing to that year.

Beef exports also remain quite limited, in part because slaughter has been relatively light but also because some markets have really pulled back in their purchases of US beef. Exports in the last four weeks have averaged about 10,297 MT, slightly higher than the average the previous four weeks but 23 per cent lower than the four week period last year. Exports to all major markets are down significantly.

Exports to Japan, the top market for US beef, were down 30 per cent in the four week period while exports to Mexico, the second largest market, were down 25 per cent . Hong Kong emerged as a major market last year and while shipments there are still significant, they are down about 30 per cent in the last four weeks.

Lower beef prices, especially for some cuts that are favored in Asia, could help bolster beef exports in the last part of the year. But it seems to us that overall beef demand globally has slowed down.

Evidence of this we think is the trend beef exports from Brazil, the top world beef exporter. Coming into this year we thought that higher cattle supplies and a favorable exchange rate would help bolster Brazilian beef exports. Through August, however, Brazilian beef exports are down 18 per cent . Weak commodity prices have negatively impacted a number of markets that are net beef importers and thus world beef demand.