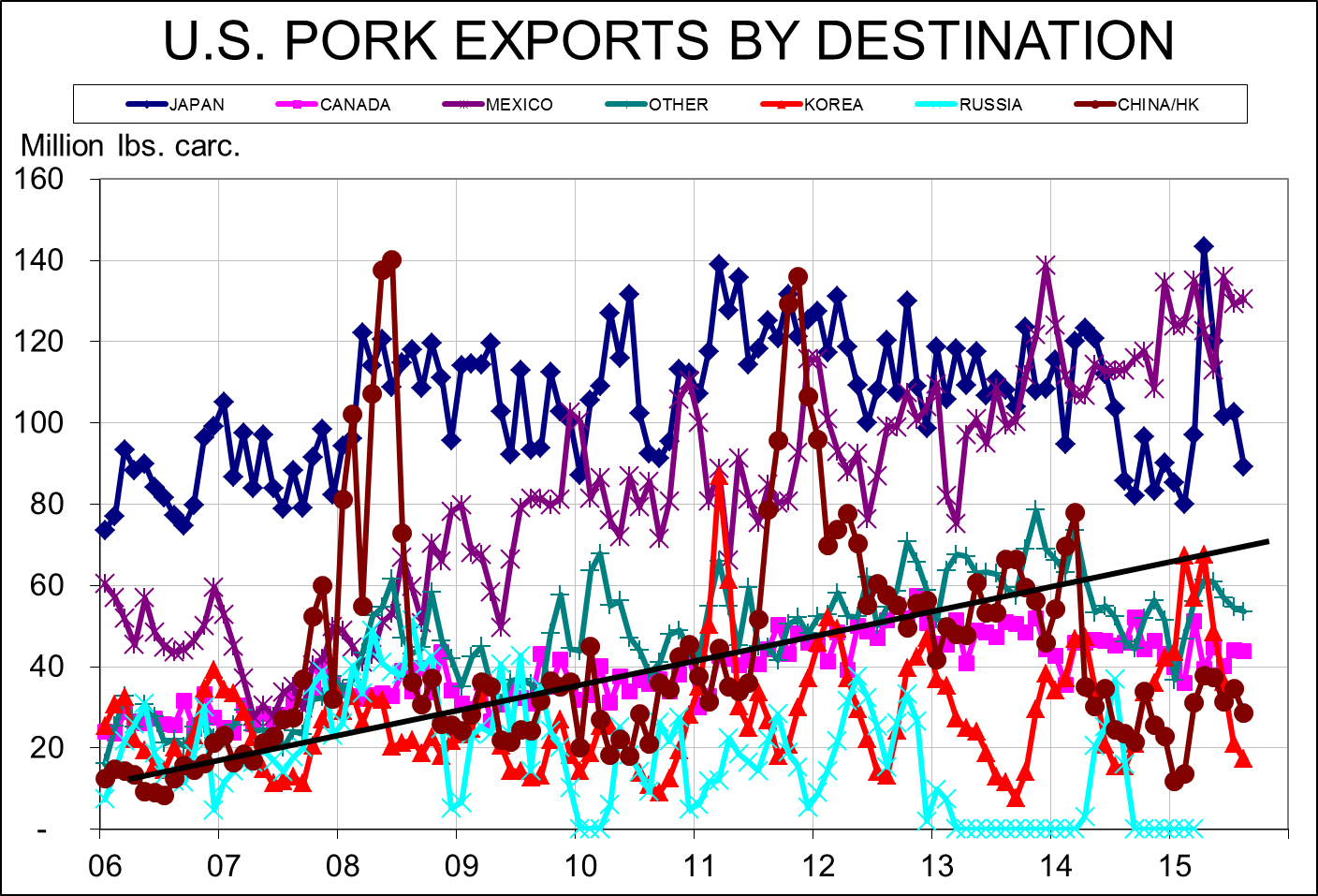

Pork Exports Continue to Exceed Year Ago Levels

US - Pork exports were one of the few bright points in USDA’s report of August meat and poultry exports last week. USDA’s Economic Research Service reported that August pork shipments totaled 373.828 million pounds, carcass weight equivalent, 6.5 per cent more than one year ago, writes Steve Meyer in the National Hog Farmer.For comparison, US beef exports were down 24 per cent, year-on-year, in August and US broiler exports were down 18 per cent compared to August 2014. While being larger than last year is good, winning the race with beef and chicken in August was not a particularly noteworthy accomplishment.

The August shipments pushed pork’s year-to-date total to 3.268 billion pounds, carcass weight, a total that is still 3.2 per cent smaller than one year ago. The encouraging part of this report is that exports continue to exceed year ago levels – which is good since shipments during the second half of 2014 were VERY bad – and push this year’s total closer and closer to last year. Recall that January exports were 21.5 per cent lower than in 2014, at least partially due to the slowdown at West Coast ports.

The year-to-date comparison to last year has gotten progressively better but to achieve an annual increase by the end of December, exports from September through December must be 7.16 per cent larger than last year. We have seen only one month this year in which exports grew by that much – April’s 10.9 per cent increase that was heavily influenced by the port clean-up efforts. Annual export growth for 2015 is far from a done deal but there is still a decent chance it will happen.

Major market players

Among major markets, Mexico took 15 per cent more than last year while Japan took 4 per cent more. That is only the second month this year in which shipments to Japan have increased and the first one was in April during those port clean-up efforts. Shipments to South Korea grew more slowly than in recent months but were still 12 per cent larger than last year. Shipments to China/Hong Kong continue to rebound, increasing by 22 per cent versus one year ago.

Mexico is still our largest volume market while Japan remains our largest value market. There is nothing new in either of those statements and I doubt that there will be anything new at the top of the rankings for the foreseeable future. Mexico (+12.5 per cent ), South Korea (+42.4 per cent ) and the Caribbean (+23 per cent ) remain our only growth markets for pork for 2016 year-to-date.

Pork variety meat exports continue to inch back toward year-ago levels. The August total of 25,227 metric tons was just 2.1 per cent lower than one year ago, the closest to a year-ago monthly level they have been all year.

The year-to-date variety meat export total climbed to within 10 per cent of last year’s level for only the second time so far this year.

Though variety meat volumes are improving, their values are still FAR below last year’s levels. August pork variety meat exports were valued at $431.437 million, 22.5 per cent lower than last year. The YTD total for variety meat export value is $431.4 million, 22.5 per cent lower than last year. The major factor in this decline is the stronger US dollar. A less critical but still important factor is that the supply of ractopamine-free variety meats is very likely a limiting factor for shipments to China/Hong Kong.

Stay tuned

The other trade news last week was, of course, the signing of the Trans-Pacific Partnership agreement. Pro-trade groups (of which NPPC and the Pork Board are definitely two!) hailed the agreement and anti-trade groups -even some in agriculture such as the National Farmers Union and R-CALF- opposed it. No surprise there. But the truth is that we don’t know any of the details of the agreement yet.

A USDA summary of the agreement (available at http://www.fas.usda.gov/sites/ default/files/2015-02/tpp_agriculture_fact_sheet_0.pdf) indicates the following for pork and Japan:

Japan will eliminated 65 per cent of its pork and pork product tariffs in 11 years or less and 80 per cent of them in 16 years. Its current 4.3 per cent tariff on fresh, chilled and frozen cuts will decline by half immediately with the remaining amount eliminated in 11 years.

The “gate price” system will remain but the specific duty on pork cuts will fall from its previous maximum of 482 yen per kg immediately (the document did not say how much the immediate cut would be) and would be reduced to 50 yen/kg by year 11. That’s a nearly 90 per cent decline!

During the transition (ie. 11 years), a US specific safeguard will be in effect that will temporarily increase duties when US exports rise above a specified target level. Recall that we once dealt with a similar safeguard when our shipments grew by more than a specified per cent age from the prior year.

The timing of triggering the safeguard caused some odd seasonal export patterns for a few years until exports to Japan got large enough that increasing them by a given relatively hefty per cent age (I think the number was 23 per cent ) became difficult. And finally, Japan will eliminate the 20 per cent tariff on ground seasoned pork in 6 years.

We need to know a lot more specifics but all of that sounds good except for the safeguard. Even that feature will not likely be a factor for very long. It appears that the effective gate price will drop substantially over the next 11 years, allowing lower-valued US pork items to enter Japan without large tariffs being added to their prices. That’s a good deal for US pork producers and processors.