Canada Market Report

CANADA - Ontario producers are by and large coming off a marvelous fall for harvest. They have been blessed with mostly favourable weather for getting fall work done and a bountiful harvest, with lots of comments ranging from crop far better than expected to (particularly for corn) one of their best crops ever, writes Bob Fraser, Sales & Service, Genesus Ontario.Along with this, the excellent fall weather has resulted in very dry corn with reports towards the end of corn coming off at 17 per cent moisture in the field. It was not that long ago that it would thought to have been impossible for corn to get that dry in the field in this “neck of the woods”. Ontario traditionally has spent considerable money on propane drying corn.

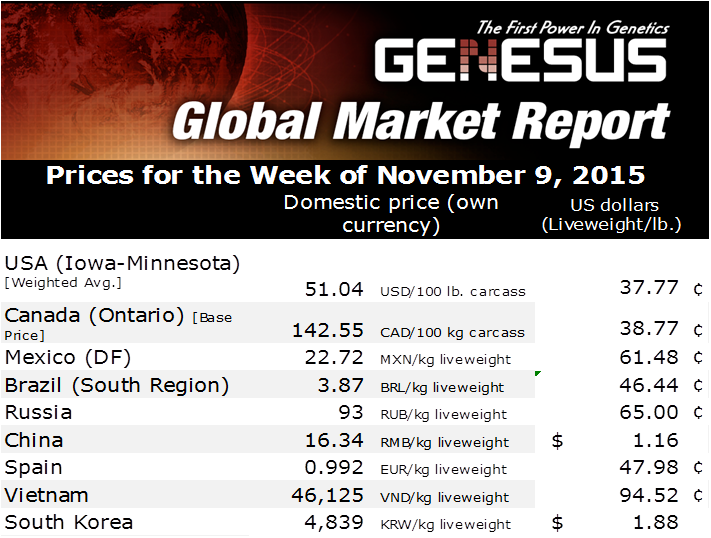

So this bodes well for lower feed costs going forward for the coming year. This is most welcome, as margins have turned decidedly ugly as we move towards the halfway mark of the 4th QTR.OMAFRA’s Ontario Weekly Hog Market Facts showing Farrow to Finish Margins after feed approaching fifty dollars less than my last commentary some six weeks ago.

So this dramatic drop in margins coupled with the ongoing challenge of finding adequate shackle space as I have discussed in previous commentaries has caused many producers to look to solutions. This caused the Ontario Pork Industry Council (OPIC) a volunteer driven industry organization to hold a Special Interest Meeting this past Monday titled “The North American Packing Industry – Challenges and Opportunities for Pork Producers”. It certainly caught the industry’s imagination with some 220 people registered and at least another 20 drop ins. This is a very significant crowd in an industry that just numbers 300,000 sows and a very high percentage of those sows were represented.

Ken McEwan, University of Guelph, Ridgetown Campus did a good job of highlighting some of the now well-known challenges. Although Canada on country basis appears to have a reasonable balance of slaughter capacity to production, on a regional basis it is considerably more complicated. Manitoba is running at 77 per cent plant utilization (the national average) and must certainly strain the processing side.

Where Ontario is running 96 per cent plant utilization that although favourable for the processing side is putting considerable strain on the production side. The loss of 25,000 plus shackles with the closure of Quality Meats approximately 18 months ago has certainly come home to roost. The problem had been being relieved primarily by the excess production going to Olymel in Quebec. However than had been greatly disrupted by a curtailing of processing capacity at Olymel’s L’Espirit plant over cooler issues.

So where might lie some solutions?

Representative from Olymel stated that equipment to alleviate their cooler issues has been installed and they are slowly returning to their former capacity. However, there is a considerable backlog to catch up in Quebec as well as from Ontario. With the short weeks of Christmas, fast approaching it is hard to imagine this solution providing significant relief until into the New Year. Further although Olymel is involved with the building of 5 X 2500 sow units in Quebec (Fermes Boreales) it was suggested this would be a considerably less net gain than 12,500 sows due to it representing many smaller producers investing in these sow units and shutting down their own smaller units. The suggestion was that Olymel going forward was going to require Ontario hogs. Ontario producers would certainly like to see that translate into better movement in the here and now.

Representative from Ontario Pork discussed the COOL Arbitration. For most Canadian producers this has felt far too much like “Ground Hog Day” of a seemingly never ending story of how we’ve won and the end is nigh. Unfortunately, many producers have grown old listening to the story. However, the consensus seems to be that the end is in fact close and favourable to Canada. This certainly would provide a much needed relief valve for market hogs and SEW/feeder pigs. Given the Canadian dollar this could turn out to be very much “back to the future” particularly for the movement of SEWs.

Finally, a representative for the Clemens Food Group gave perhaps the most encouraging presentation. Discussed their construction of plant in Coldwater Township MI that is running a pace for completion 4th QTR 2017. Expected capacity of approximately 10,000 head per day and typical of most US plants ultimate goal of going to a second shift. Although some 80 per cent of the first supply has been secured stated that Clemens very much saw Ontario in their plans for both plants (including their existing one in Hatfield PA). Seems they see Ontario for what it basically is part of the Eastern Cornbelt and logistically well placed to be a viable consideration for both their plants. However also stated that a good positive resolution to COOL would be most helpful.

Therefore, some light at the end of the tunnel that for once appears to be more than a train. The cavalry does appear to be coming. Unfortunately, they are some distance and time away. In some instances an indeterminate amount of time. The question remains whether the cowboys can hold out until such time.

Remember the Alamo!