CME: Hog Slaughter Lower Than Expected

US - Hog slaughter last week was lower than expected and there will likely be some debate as to what is driving the recent pullback, and what implications it has for pork and hog prices, write Steve Meyer and Len Steiner.At the start of last week, we expected weekly hog slaughter to be close to 2.35 million head. The expectation was that packers would run full daily slaughter of around 435,000 head per day Mon-Thur, 429,000 on Friday and then a Saturday slaughter of around 190,000.

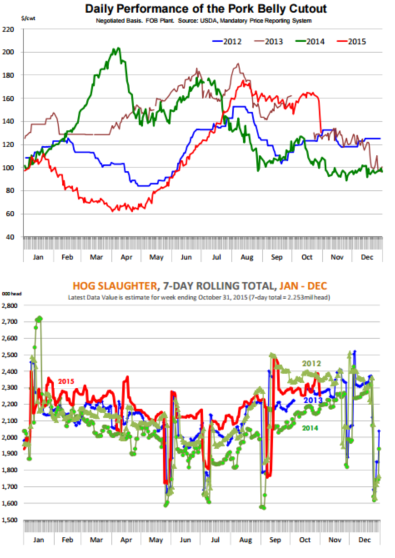

That projection, however, did not pan out, in part we think because the bottom appears to be falling out for the pork belly market.

In our report last Wednesday we showed a chart that illustrated the significant support that the overall cutout had received thanks to very firm belly prices.

On Monday of last week, the pork belly primal was priced at $161.43/cwt, 55 per cent higher than a year ago. The belly primal price on Friday was quoted at $130.31/cwt, a 19 per cent drop in a matter of days. One can argue that belly prices were simply too high for this time of year and it was a matter of time before they corrected.

However, the question is whether this simply reflects the effect of a long due seasonal supply adjustment or if this means a material erosion in pork belly demand.

It is curious that the decline in pork belly prices came almost immediately after the release of the WHO report but at this point we have no particular insight that this is a reason for the decline in bacon raw material prices.

It could simply be an unfortunate coincidence. More likely we think this has to do with foodservice operators adjusting their quantity demanded as their contracted supply reset.

The seasonal tendency is for pork bellies to be steady to weaker through the remainder of the year. If this is the case, we could see further weakness in this market.

Adding to the weakness in bellies, the price of hams also remains particularly weak. As we have noted before, it is not unusual for hams to lose ground in late October and early November. This may appear somewhat strange given the upcoming Thanksgiving and Christmas holidays.

However, the weakness has more to do with processor demand and how quickly they are able to put up the inventory needed for the holidays.

At this point lean hog futures appear to have priced a much lower pork cutout for late November and early December. In the short term, however, market participants will likely remain focused on the cash market and particularly on hog carcass weights to gauge if producers start to fall behind in their marketings.