CME: Livestock Futures Turn Bearish

US - It has been quite a rocky week for livestock futures, with both cattle and hog contracts losing significant ground and, in some cases, trading at fresh contract lows, write Steve Meyer and Len Steiner.The nearby fed cattle contract closed yesterday at $134.4/cwt, down 282 points from the previous close and down by more than 700 points since last Friday.

Feeder cattle futures were down as well, cuting short the impressive October rally. The nearby November feeder cattle futures contract was down 452 points yesterday and down about 900 points from a week ago.

Losses in hogs have been just as severe. It appeared that hog futures were finding some stability yesterday but once prices broke support levels prices galloped quickly to new lows and all hog contracts traded at new contract lows.

The nearby December hog futures contract closed at $55.4/cwt, down 197 points from the previous close and prices now are down almost 400 points from last Friday’s levels.

Why all have livestock futures suddenly turned so bearish and when should we expect the current wave of selling to stop?

Unfortunately we cannot answer the second point although we have our opinions on it. We strive not to make this letter about giving trading advice but rather focus on what the fundamentals in the market are showing at any point in time. So it is best for us to focus on addressing the first point (why markets turned gloomy this week) and let market participants (both bulls and bears) draw their own conclusions.

Cash prices have certainly been extremely disappointing this week and that has likely been the more immediate reason for the sudden downturn. Coming into this week the hope was that fed cattle prices would be steady to higher. It was only a few days ago that the December fed cattle futures contract was trading near $144/cwt. Speculation was that feedlots were holding out for prices in the high 130s with some indicating/hoping/believing that even 140 was doable. However, cash trade this week has developed at much lower price points.

Cattle slaughter has been near year ago levels as packers see little reason to be more aggressive in sourcing supplies. We estimate fed cattle slaughter for this week at 443,000 head, 0.9 per cent lower a year ago. But steer weights are heavier and the supply of market ready cattle on feed remains larger than a year ago.

The USDA 5-Market report pegged live FOB steer prices at $130.92 while dressed prices were 205.71. The choice beef cutout yesterday was $218.86/cwt, down $1.28/cwt from the previous day but in line with the price trends for this time of year. At this point we think packer margins are still relatively good but much will depend on order flows for the holidays.

Generally beef prices tend to be a bit soft in mid November, with retailer meat cases full of hams and turkeys. One factor that is positive for the beef market is that middle meat prices are actually holding up relatively well. Even chuck and round primals, which normally get weaker in November, are doing better than expected.

Also positive for the beef market are news that hiring in October was the strongest for the year. As we noted earlier in the week, foodservice business was showing signs of slowing down in August and September but the strong job gains normally imply robust foodservice demand going into the holiday.

Hog cash prices also have been extremely week the last few days, with producers apparently scrambling to get hogs sold now that supplies are quickly increasing (seasonal).

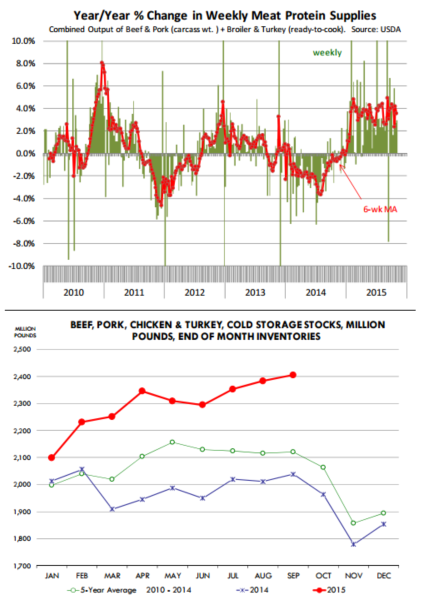

Hog slaughter has been large but producers have had to significantly lower the price in order to keep the supply moving. IA/MN negotiated base price was quoted last night at $54.95/cwt, $6/cwt lower than what it was last Friday. Supplies of not just pork but all other proteins are extremely heavy.

End users are in the process of liquidating inventories of holiday items. And with more meat coming to market, the inventory depletion has sapped some near term demand from the market, pressuring prices lower.