CME: US Hog Futures Notably Lower on Thursday

US - Hog futures were lower on Thursday on reports of notably lower prices for both hogs and pork in cash markets. The decline likely did not come as a surprise to those that read our report on Wednesday, showing the sharp drops in the value of hams as well as the seasonal tendency for hog and pork prices to be weaker in late October and early November, largely due to large slaughter weeks and heavier weights.The price of IA/ MN lean hog carcass last night was quoted at $63.06/cwt, $1.27 lower than the previous week and down almost $7/cwt from a week ago. This may appear like a very dramatic decline, warranting the futures response but we urge you to look at our report from September 30.

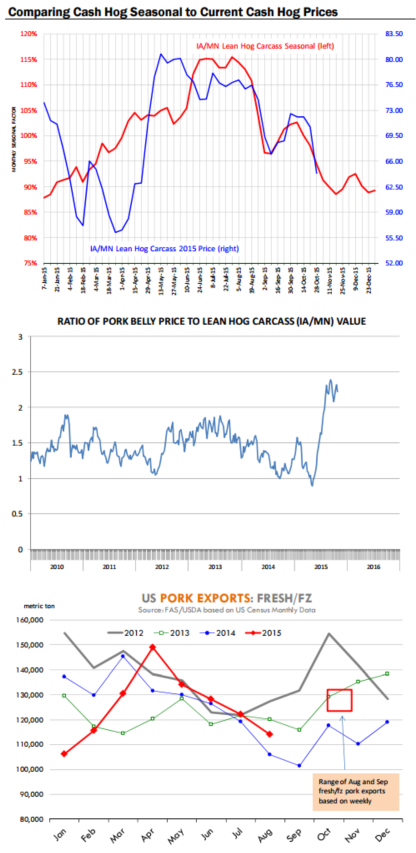

Back then we showed a chart on the seasonality of cash hog prices and how well 2015 values had been tracking with the seasonal trend, at least for late spring and summer.

The question we were trying to address then was why were prices rallying in late September. Based on the seasonal chart that actually was quite normal. We noted that once supplies started to ramp up, prices in cash markets would eventually adjust lower, which is what we are seeing at this point.

We have updated that chart from three weeks ago with the latest data points (see top). After briefly outperforming the seasonal trend in early October, cash hog prices have adjusted lower and the trend is for prices to drift lower a bit more into mid November.

The expectation is (based on the USDA inventory survey) that we could see 2.4 million slaughter weeks sometime between now and the end of November. The lowest prices and heavier weights also will motivate producers to ramp up marketings, which in the very near term tends to pressure prices.

One factor that also appeared to catch markets by surprise and added to the bearishness yesterday was the sharp decline in the value of pork bellies. The $15/ drop in one day is one of the biggest we could find in the database.

But some perspective is warranted here as well. Belly prices had been dramatically higher relative to the value of hogs for much of the summer and early fall. The price multiple jumped from under 1 earlier this year (with bellies significantly undervalued) to well over 2. The decline in belly prices

yesterday was very much in line with the sharp correction in hog prices.

Using a belly primal value of $142 and cash hog IA/MN price of $63 the multiple still is around 2.3. The decline in pork belly prices simply reflects increased availability rather than the start of a demand slump...at least in the very near term. How demand for bellies develops in the next three

months will certainly be critical for overall hog prices. Should demand soften up a bit, lowering the multiple to around 2, this would imply belly prices in the high 120 by the end of November.

Foodservice demand has been particularly strong and normally it takes some time for foodservice

operators to change their purchasing behavior. This makes it unlikely for bellies to collapse (say to 70-80 cents in the next couple of months).

For now, December hog futures appear to be trading sub 100 bellies and hams in the 50 cent area, which would be quite a bit lower than what fundamentals

indicate. How these items perform, especially in late November, will

be critical in where the December hog futures ends up.