EU and Spanish Pork Markets

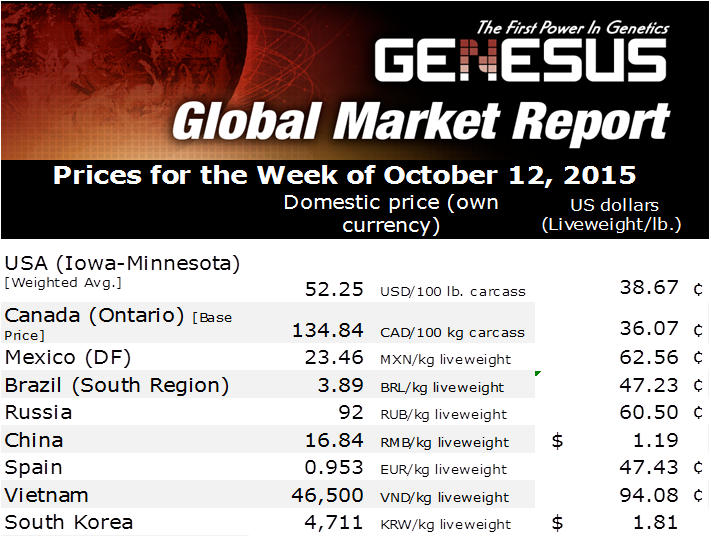

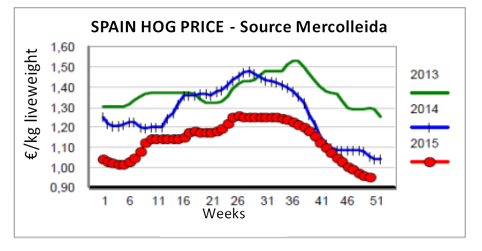

EU and SPAIN - This is the Sixteenth week in Spain that the pork price has been going down, reaching values not seen in the Spanish market since 2009, writes Mercedes Vega, General Director for Spain, Italy & Portugal.Last week the price closed at 0.953 €/kg bodyweight. Although the annual average of Spain (1.14 €/kg) is above Germany (1.08 €/kg) and France (1.13€/kg), we are currently below Germany’s price of 0.96€/kg against 0.97 €/kg.

From the top prices (January) to the lowest prices (August), the carcass weight dropped about 6 kilos in 34 weeks. Since then, liveweight has continued to increase, the carcass weight is now between 85 and 86 kg and from the lowest weights of last August we have seen an increase of 6 kg. The trend has not changed since the last report.

This shows that the offer is still greater than demand, because there is more production and less demand than in previous years; but this has been happening all this year and prices have maintained. Although these prices are good for the packers, there is no room to put that extra meat.

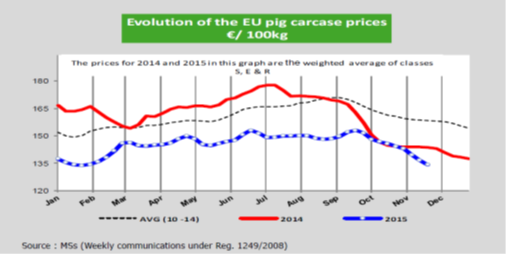

The below graph shows how Europe’s carcass price has fluctuated this year.

This data represents the market expectations for next year, especially with the outcome of the Management Committee of the Pork Meeting from the European Commission on December 1, which approved the opening of private cold storage aid from next January 4.

The main changes are: the amounts of support have been increased by 19% compared to March 2015. Subcutaneous fat and pigs up to 20 kg have been included in new categories and the early withdraw without penalty is allowed.

According to recent data presented at the VI SIP Consultors Conference, the average cost of production for the Spanish pork producers, from 2011 to the first half of 2015, has been from 119 to 109.8 c €/kg live.

While the market price (Mercolleida) has been the same in the period from 122 to 114.1 c €/kg live, it is clear we are experiencing the lowest price in recent years.

On the other hand there has been an improvement in the value of the cost of sales and discounts, ranging from 6.2 to 5.3 c €/kg live (more efficiency).

This leads to the average of the first 6 months of 2015, the average actual sales price has been 108.8 c €/kg liveweight, leading to an average margin of -1.0 c €/kg alive in that period. Reference has taken of the global feed price the current semester of 283 €/ton. This shows that it has been optimized the cost of production but is has been sold below cost price.

Domestic consumption is still steady and it has not increase throughout the EU. Exports are still stable but it is not enough to absorb the increased production from the whole EU, it should compete also with the higher US production. The consequence is that the European market is saturated.

At the international level, Spain has already exceeded the US this year on pork exports to China and has become the second largest exporter to this destination.

Portugal’s situation is no different from the rest of the EU. They are also selling below their cost of production. They have took 12 weeks of price declines with a drop in the price of 0.3125 €/kg carcass since September 3rd.

This scenario has led to Portuguese pork producers in a very concerning situation selling well below cost of production with no signs of any recovery in the near future, therefore, on the 26th of November a group of Portuguese pork producers have blockaded the Bolsa de Montijo do Porco (Portugal Board of Trade) stopping trade for the last two weeks.

Point in case is the Italian pork market, which is really critical. They are buying hams priced as shoulders and the price continues to fall. Due to the high weights pigs available in Europe at this time, Italy has a growing demand for live pigs from Spain and other EU countries much cheaper than those produced in Italy. This is a good opportunity for Spain because they can sell hogs a better prices with no penalties on excessive weight. Italy loves super heavy pig son its market.