CME: Lean Hog Futures Gaining Ground

US - Lean hog futures have been gaining ground since mid November and were higher again yesterday. The nearby February contract was up 72 points and it is now up almost 300 points for the year, write Steve Meyer and Len Steiner.Yesterday’s gains follow an improvement in pork cutout values and maybe confidence that pork prices in February will continue to gain ground and thus set the stage for even higher hog prices than what’s currently priced by the board. This could very well be the case and it is always possible that retailers may promote pork in February to take advantage of historically low prices.

Still, it is instructive to look at history and try to recognize what we should expect from a seasonal perspective and whether it is reasonable to project forward based on day to day changes.

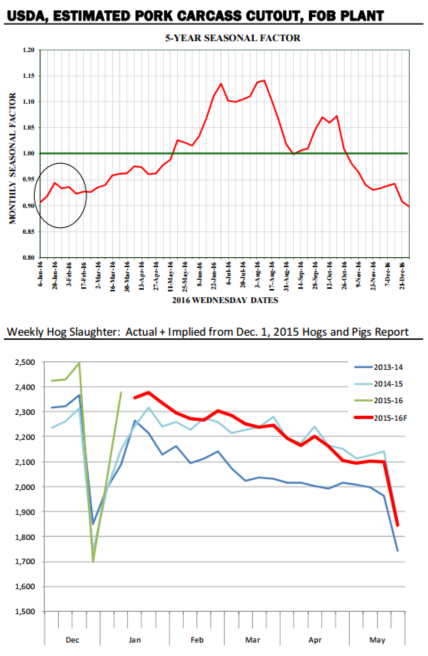

The chart below shows the five year seasonal factor for the pork cutout. This is nothing more than the price of a given week divided by the annual price and averaged over five years. So on average prices in January are about 7% lower than the annual average while prices in early August are 13% higher than the annual average.

It is interesting to note that in the past five years, there has been a tendency for the pork cutout to move higher in January but then prices have driofed a bit lower in February and early March. In any given year this may change a bit, in part depending on Easter dates.

We have found that when Easter is early, which is the case this year, ham prices tend to firm up in January and peak in early February as end users have less time to accumulate product. This tends to support the ham market in January but then ham values drift lower in February and early March as demand for this key item slows down.

Other factors also certainly play a role. Retailers were actively refilling the meat case in January after they promoted holiday items in November and December. Turkeys, hams and rib roasts are replaced by more traditional fare such as chicken breasts, ground beef and pork chops. But once that transition takes place, business tends to return to a more normal pace and price direction more clearly reflects supply conditions in the market place.

Are we going to see a decline in hog slaughter and pork production in February? That will most likely be the case. Will supplies be tighter than they were a year ago and comparable to what we saw in say 2013 (prior to PEDv)? Not really.

The second chart shows what the last Hogs and Pigs report told us about expected hog supplies in the first few months of 2016. So far, slaughter has tracked quite well with the USDA inventory survey. And while hog slaughter is expected to ease lower in February and March, it is still expected to stay above year ago levels.

Hog slaughter weights also are expected to stay relatively high. Based on the MPR data, hog carcass weights are now close to 215 pounds. In 2014, weights were around 213.5 pounds and in 2013 they were 207 pounds. Weights should move lower in February and the slope of that normal decline in weights will give us an inkling as to whether producers are staying comfortably current or struggling not to fall behind. The takeaway is that the combination of historically high slaughter numbers and near record hog carcass weights will leave the pork market well supplied at least until spring. So those retail features that many are counting on certainly are much needed in order to clear the market.

Whether they will be enough to not just clear it but also push prices higher, that remains to be seen. If there is one factor that remains critical, however, is pork exports. The situation in outside markets remains challenging. There are certainly concerns that deteriorating economic conditions in Asia may impact the outlook for our exports there. For now, markets will likely be keenly aware of any changes in export trends and how that affects beef availability domestically.