COOL Repeal Brings Ontario Weaners South

US - It’s old news now but the repeal of mandatory country-of-origin labeling just before Christmas still deserves a mention – especially given the amount of arguing I’ve done against this ill-advised law over the years. There is no reason to repeat that debate, and it actually ended up irrelevant to the situation at hand, writes Steve Meyer in the National Hog Farmer.The only relevant issues were a) the United States is bound by treaty to treat imported goods in a prescribed manner and b) MCOOL violated those commitments. Plain and simple: If you are going to play the game you must play by the rules.

It is shameful that the US Senate took so long to accept that obvious fact, but those “esteemed colleagues” did finally take the medicine for their insertion of this debacle into the conference committee version (no, it never received a vote of either house of Congress!) of the 2002 farm bill. A trade battle — and perhaps war — has been averted and industries not even party to this spat have been spared the damages that retaliatory tariffs could have caused.

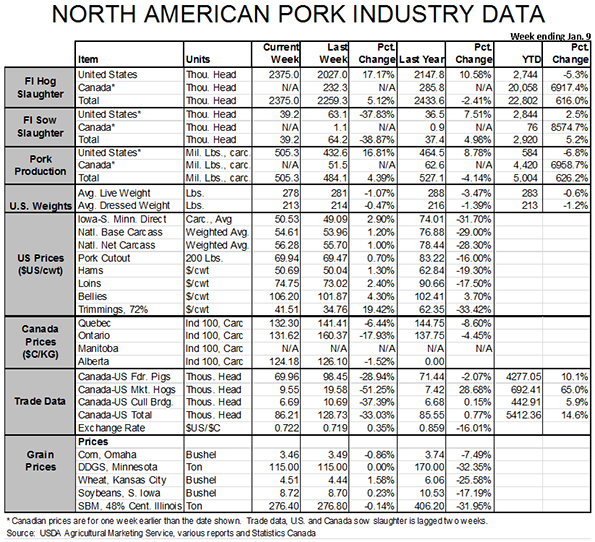

So what now? In the short run, I don’t expect to see much difference. Several packers have notified suppliers that they will now take Canadian-born market hogs. The freedom to process those hogs without segregation will allow plants to operate more efficiently. That change will, at first, help packer margins, but producers and consumers eventually will benefit from any increase in the efficiency of packing plants in either higher hog prices or lower pork prices or, more likely, a combination of both. We will also see a gradual increase in the number of market hogs and weaner/feeder pigs coming from Canada, especially with the US dollar so strong relative to the Canadian dollar.

Ontario packer shortage

The shortage of packing capacity in Ontario started more market hogs heading south last fall. Imports of weaner/feeder pigs trended upward from about 80,000 per week in January 2015 to the upper-80,000 range late in the year and a high of 98,500 the week of Dec. 18. I expect these trends to continue with the MCOOL hurdle removed, but we need to remember that US producers and packers compete with the pork from these pigs now either here, in Canada or in some other export market.

I do not see the MCOOL change fueling rapid growth in Canada — at least not nearly as much as the strong US dollar does. But that is really beside the point. We signed up to play the free/fair trade game so we must play by the rules until those rules are changed, especially if we expect others to do the same.

Stellar pork exports

While we are on trade, November pork exports were stellar — at least in volume terms. Total US exports amounted to 431 million pounds, carcass weight equivalent. See Figure 1. That is the highest monthly total since the last of the West Coast port cleanup efforts in May. It is 18.6 per cent higher than one year ago and it pushed the year-to-date total to 3.44 billion pounds, 1.1 per cent more than one year ago. This marks the first time since October 2014 in which year-to-date US pork exports have exceeded their year-earlier level. Shipments were higher than one year ago to every major US export market in November.

.jpg)

The flip-side of the volume news is that the value of those exports is still 9 per cent lower than one year ago. Even that figure is, to me, encouraging as it represents the smallest year-on-year decline in monthly export value so far in 2015. The first rule for getting out of a hole is to stop digging! Year-to-date export value is still 15.7 per cent lower than one year ago due to lower wholesale pork prices here in the United States. We need to remember that the stronger dollar means that those lower domestic prices have not been seen in most importing countries as it has taken more local currency to buy our products.

Variety volume up

The last noteworthy item in the November export data is that variety meat export volume was larger than one year ago for the first time this year. The 2.7 per cent year-on-year increase is modest, but it beats double-digit declines such as were seen in 16 of the previous 22 months. November marks the first year-on-year increase in variety meat exports since August of 2013. That is a pretty shocking statement as well but is indicative of the troubles that China’s ractopamine restrictions and enforcement and a strong US dollar have caused.

And the consequences are real. The decline in byproduct values has taken about $15 per head off the value of a hog and forced packers to put a bigger spread between the cutout value and the prices they pay for hog carcasses. The short run impact is to reduce producer incomes. The longer-term impact is to change the terms that might be included in future marketing contracts. Producers and packers need to acknowledge the importance of drop values in these transactions. That “92 per cent of the cutout value” contract implicitly assumed something about drop values and the last year shows that those drop values change in manners that may or may not be consistent with the changes in wholesale pork or hog values.

If a factor in a pricing mechanism is not constant, any assumption that it is will eventually set the mechanism up to fail. A deal is a deal but keep this in mind if you are negotiating a new deal with your packer or plan to do so in the future.

.jpg)