Russia Hog Market Report

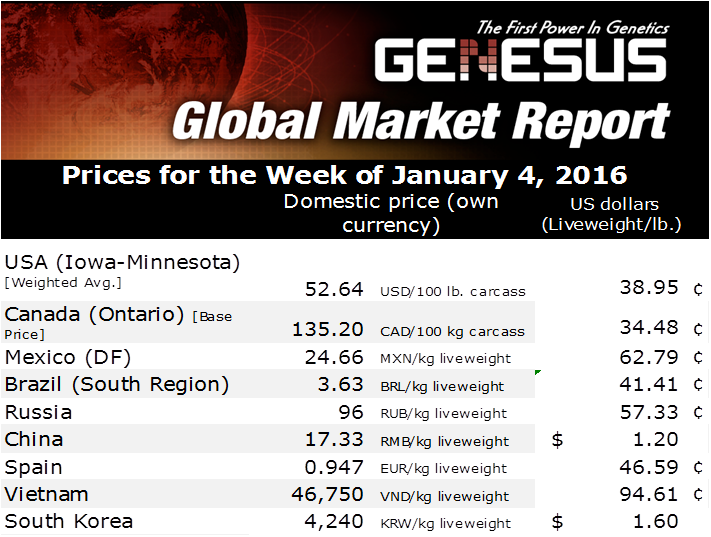

The new year starts with a pig price of 96 Roubles per kg live ($1.28) meaning the majority of producers are making money, with some of the large integrators still making a lot of money, writes Simon Grey, Genesus.What does 2016 have in store for Russian pig producers. This will I think have a lot to do with the structure and ownership of each individual business. Fully integrated business that grow crops to feed pigs have a very low cash cost of production (even if on paper they lose money, if you put grain into pigs at cost of production then 96 Roubles sales price means you still have a business with very good cash flow)!!

Russia has done its federal budget for 2016 based upon a $50 per barrel oil price. At least for the first part of the year there will be less money in the federal budget than expected. Therefor any money for direct subsidy will not be there, unless there are further devaluations of the rouble.

For oil as with all commodities the rules of supply and demand applies. With low price, even if production is not cut, then bankruptcy’s will cut production. No company, no matter how wealthy, can produce at a loss for ever!! The issue as always is only one of time!

For pig producers in Russia expect some changes. Some are easy to predict and others not so.

- Backyard production will continue to reduce, reducing production.

- Producers with very high cost (old farms and poor production, or those who have borrowed far too much money) will go bankrupt also reducing production.

- The modern and efficient producers will continue to grow. However, there are a limited number of new farms currently under construction and a limited number started last year. There will be increased production, but little in 2016 from new farms. Most new farms will be being stocked at the earliest in the 2nd half of 2016. This means extra production hitting the market in the 2nd half of 2017. These factors would mean little change to supply and there is little to say there will be much change in consumer demand. No particular reasons in the market for major changes in pig price.

- Less predictable is the situation with imports and exports. Russia currently has the lowest level of imports in recent history. Ant further devaluation in the Rouble would reduce imports further.

- Sanctions from EU and USA in place until at least June. The only sanctions that may have had any affect are those on banks (oil price much more significant). In general sanctions will benefit the Russian economy which is changing to be less oil dependent (this takes time). With current pig price in Europe it is likely the EU will lose about 1 million sows. The EU with all its environmental and animal welfare legislation along with high cost of labour make pig production costs very high. Even if sanctions are lifted the devaluation of the rouble makes imports from the EU expensive and by the second half of the year reduction in inventory will start to affect the number of pigs hitting the market.

- The biggest unknown for me and the one that would have the biggest impact on the market is China. Certainly there is a lot of general talk about increased trade with China. This did reduce in 2015, but whether this is a genuine reduction or simply Russia exporting less in general to compensate for sanctions is not clear. Certainly there are well publicised communication between major Russian producers and the Chinese. China has a 4,000 km border with Russia and vast areas of farm land capable of producing low cost crops and pig meat. It is an obvious supplier of considerable quantities of food to China. Watch this space.

One thing has and never will change in pig production. The best time to start is when prices are low. This is because low prices absolutely guarantee high prices between 1 and 2 years after the bottom of the market. When few people are building it’s a great time also to be negotiating with suppliers!

With 19 of the 20 top producers in Russia linked to government there are signs of maybe some delays to expansion, but certainly no talk of it stopping.

Predicting the future is not so hard. Empires fall, boom follows bust, conflicts end. Low pig price follows high pig price. The problem with the future is getting the timing correct. Russian producers need to learn and adapt to managing the pig cycle.