Hogs and Pigs Report Presents Cause for Concern

US - As a pork industry lifer like many of you, I also live in some degree of terror of the discovery of a serious, trade-impacting disease in the United States. And like you, I live with a smaller degree of fear of a food safety issue directly attributable to pork products, writes Steve Meyer in the National Hog Farmer.Behind those two fears, my biggest concern for hog markets this year is whether supplies will out-strip packing capacity this fall.

Let’s review the data from the December Hogs and Pigs report that are, in my opinion, cause for concern this fall.

- Breeding herd growth. The Dec. 1 herd of 6.002 million head was 63,000 head (1.1%) larger than it was one year ago. That is not a huge increase but it does mark the first time that the herd has exceeded 6 million since December 2008. While the breeding herd is not a good predictor of hog supplies, the fact remains that we must have sows to produce pigs and more sows will almost surely produce more pigs. How is that for some first-class supply analysis?

- Litter size growth. Average litter size has set records the past three quarters and porcine epidemic diarrhea virus has not exploded this winter. In fact, the number of sow farms in the University of Minnesota’s sampling that have broken with PEDV this winter is only slightly higher than one year ago. While the December-to-February quarter’s average number of pigs saved per litter is, on average, lower than is the September-to-November figure, historical relationships would suggest that this quarter’s average will be the second highest ever and the next three quarters will once again set three straight records. The December-to-February and March-to-May figures will be key determinants of fourth quarter hog supplies – and right now we would bet they will be large.

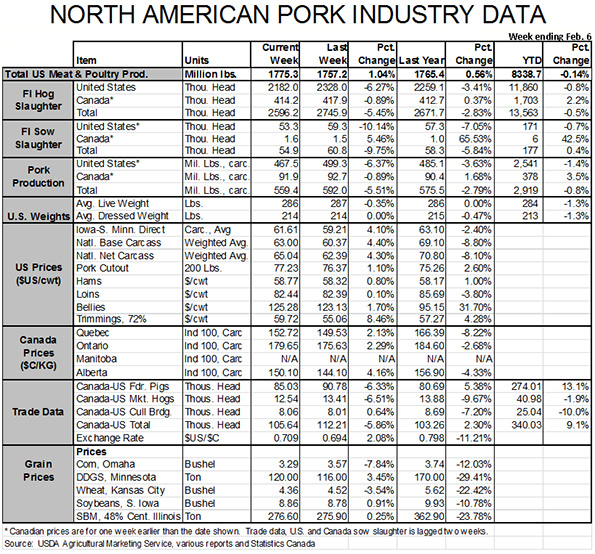

- More Canadian pigs. I was chided a bit last week by a Canadian provincial producer representative for comments I made at the Iowa Pork Congress regarding the potential for higher numbers of pigs coming south from Canada. He might think it unlikely, but I think it is clearly already happening. From July 1 through the last week in November, USDA data show that 1.827 million weaner/feeder pigs were imported from Canada. That compares to 1.680 million head one year ago, an increase of 8.8%. Those pigs were counted in the respective years’ Dec. 1 U.S. inventories. The 148,027 “extra” pigs in this year’s count will show up in slaughter from December through April. Since the end of November, 700,208 weaner/feeder pigs have been imported. That compares to 597,750 last year.

So, since July (seven months) just over 250,000 more Canadian weaner/feeder pigs have come to the United States. Many of those came before mandatory country-of-origin labeling was repealed.

The annual rate would be about 400,000, and I believe the pace will increase as more U.S. packers remove their restrictions. During that same seven months, 132,650 more market hogs were imported. I do not think that growth pace will continue since the jump last summer was caused by the closure of the Quality Meats plant in Toronto. But I think it is likely that the level of imports will continue.

Extra pigs, limited packing spots

The extra pigs are headed toward a limited number of packing spots this fall. My survey of packers (published in the July edition of National Hog Farmer) indicates that the sector could process 452,195 head per day or roughly 2.442 million head per week. Two plants added a total of 3,500 head per day to their capacities this fall, pushing those numbers to 455,695 and 2.461 million. That increase helps but it still appears that 7 to 9 week will challenge those restrictions this fall.

Could a new plant be up in time to help? That is the question raised this week when Glen Taylor, owner of the Minnesota Timberwolves NBA franchise, announced plans to renovate a closed Windom, Minn., beef plant to begin processing 5,000 hogs per day.

The announcement said they would have the plant up and running in nine months. That means it could help by November, right? Probably not. I don’t know exactly what renovations are required, but nine months sounds quick. In addition, starting operations and being running full are two very different things.

Get marketings current

What does this mean? First, get current in your marketings and stay that way through the summer. The key will be that we are current at the end of August because after that date there will be very little slack in U.S. packing plants. It takes slack to handle “extra” hogs to increase the currentness of marketings.

Second, be aggressive about your pricing decisions for this fall. Futures prices are higher than I have forecast for the fourth quarter so there are opportunities even now. Futures are but one tactic. Your broker can provide others that might fit your risk preferences and costs constraints.

.jpg)