CME: Dollar Value of 2015 Pork Sector Exports Posted Largest Decline

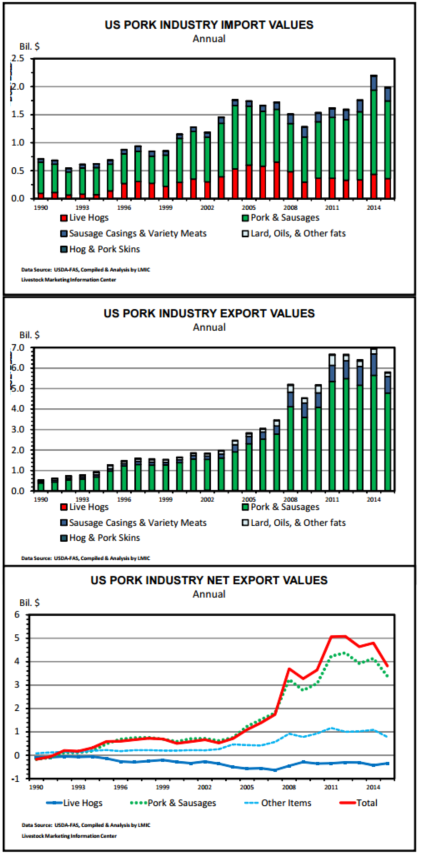

US - In 2015, the dollar value of US hogs/pork sector exports posted its largest year-on-year decline since 1985, writes Steve Meyer and Len Steiner.Pork and hog/pig trade values from USDA’s Foreign Agriculture Service are summarized into the following groups by the LMIC: 1) Live Hogs & Pigs (feeder pigs, slaughter hogs, and breeding stock); 2) Pork (includes fresh and frozen bone-in, boneless, carcass pork, and sausages); 3) Variety Meats (includes all edible offal and sausage casings); 4) Pork Lard, Fats, and Oils; and 5) Skins.

In 2015, the value of all US pork industry exports totaled $5.8 billion, down about 20 per cent from 2014’s. Only one category recorded annual gains and that was live hog exports. Exports of pork and sausages remained the largest category by far ($4.8 billion) but were hampered by global economic slowdowns, the increased value of the US dollar and stiff competition from markets such as the European Union who shifted more product onto the world market due to Russian market closures. To note, the volume of total hog/ pork exports actually increased almost 2 per cent compared to 2014. However, with significantly lower prices across the pork sector during 2015, the increased volume was not enough to offset decreased prices.

Although export value saw a significant year-over-year drop, pork industry import values also decreased compared to a year earlier. The difference between the dollar value of exports and imports is the net export value. In 2015, the US net export value of all hog/pork industry products was $3.8 billion, down 20 per cent from 2014’s and the lowest since 2010. The US hog/ pork sector maintained its status as a net exporter in all categories except live hogs/pigs, which is historically consistent.

Focusing on international demand, and China specifically, as always there are several unknown factors. Two articles were published last week addressing China’s pork demand, one from the South China Morning Post and one from Meat and Livestock Australia. Largely they agree, and describe a decreasing trend in Chinese pork production due to small and medium producers exiting the business because of lower profit margins and stricter environmental policies. Conversely, the rising price of pork in China is creating an opportunity for larger companies to enter the industry. According to Rabobank, Chinese pork production is expected to stabilize or even continue to decline as the increase in production from large companies will not fully offset the exit of small producers from the industry in the coming year.

Looking ahead, expectations are for improved US hog/pork industry exports during 2016. Tonnage exported is forecast to increase some, though prices of items sold will mostly remain near 2015 levels. The value of imported items may be near 2015’s; one category expected to increase yearover-year is live animals, the source of which is Canada.