CME: Pork Cutout Value Showing Strength

US - The pork cutout value has shown some strength lately, relative to last year’s depressed levels. For the week of 3/25/16 the national pork cutout value, reported by USDA-AMS, was $76.20 per cwt. compared to $67.02 one year ago, write Steve Meyer and Len Steiner.This cutout value is calculated using wholesale prices. The primal components that make up the pork cutout value are the loin, butt, picnic, rib, ham, and belly. Analysis of these respective wholesale prices show that currently the big “carrier” of the cutout value, or the wholesale cut performing the best relative to a year ago is bellies.

As of the last week of March, wholesale bellies were pricing at $147.62 per cwt. (weekly average). That was $72.72 higher than their very depressed price level a year ago, but also $16.72 higher than the five year average (2010-2014). Putting this price in perspective, relative to a carcass, according to USDA bellies make up 15.84% of a pork carcass. When the cutout value is calculated, primal cuts values are weighted by their proportional contribution to the carcass. The strength in belly prices is not new to markets. For a few years now bellies, or bacon at the retail level, has grown in popularity. Bacon is seen as an option to elevate a dish and not just as a breakfast food anymore.

Wholesale ham prices have trended down the last couple weeks, with the latest price point at $51.44 per cwt. This is $8.80 above year ago prices but almost $24 below the five year average. Hams, as a primal cut, make up 24.60% of the total carcass.

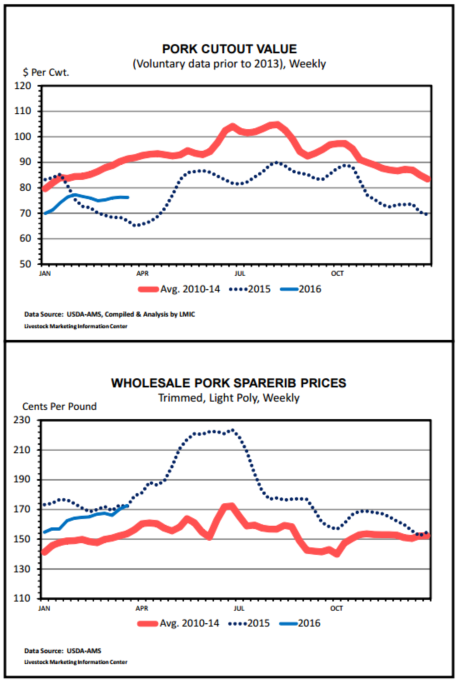

Moving on, wholesale sparerib prices are about even with their year ago levels and essentially not moving the cutout value up or down very much currently. For the last week in March, wholesale sparerib prices were $172.60 per cwt., only $0.88 above year ago but $19.04 above the five year average. As seen in the graph, spareribs seasonally see a ramp up in prices headed into summer, targeting July 4th festivities. The ramp up in prices during 2015 was more than seasonally normal.

Expect sparerib prices this year to experience a seasonal upswing, but it is unlikely price levels comparable to 2015 will be reached this year. The rib primal cut constitutes 4.70% of the total carcass.

On the other side, wholesale loin prices have been tracking below year ago levels since mid-February. The loin makes up 25.94% of the carcass, and these lagging prices are creating headwinds for the pork cutout value. The most recent wholesale loin prices were $90.24 per cwt. which is $10.30 below year ago and $37.09 below the five year average.

Looking at the pork cutout value, the graph shows seasonal strength in prices into summer. In the most recent five year average, the cutout has historically increased about 30% from the first of the year to midAugust. This would put the high for the cutout in 2016 at $92 per cwt., but this is obviously dependent on many market factors. Looking at the supply side quickly, federally inspected pork production year to date is even with 2015’s. The Livestock Marketing Information Center’s forecast for annual 2016 pork production estimates it will be about 1% above 2015’s production.

Pork in cold storage (as of the end of February) was 8% below February of 2015. With regards to specific cuts in cold storage, the only wholesale cuts with elevated levels compared to 2015 are hams (up 4%), spareribs (up 35%), and variety meats (up 7%). This uptick in cold storage levels of spareribs is one reason we probably will not match last year’s seasonal high price.