CME: Upward Revisions Made to US Pig Crop Again

US - USDA released on Friday, March 25, the results of its quarterly survey of hog producers, providing a benchmark for hog supplies as of March 1, write Steve Meyer and Len Steiner.The survey looks to capture the number of hogs that will come to market in the next few months, the size of the breeding herd, ongoing productivity improvements and producer expectations for growth in the next two quarters.

Below are some of the highlights from the report and implications for pork supplies/prices in 2016 and early 2017. Full details from report on page 3 (see full report).

USDA made a notable revision to the pig crop for Jun-Aug, which was expected since hog slaughter rates during Dec-Feb were quite a bit larger than the pig crop was indicating. This was the third consecutive quarter that USDA has made upward revisions to the pig crop.

Does this mean that we should take with a grain of salt estimates for flat supply growth in the coming quarters? Maybe, although more recent slaughter numbers are matching much better with the Sep-Nov pig crop estimates. It will be interesting to see how weekly slaughter numbers develop in April and May considering Sep-Nov pig crop is still pegged down 1.2 per cent from the previous year (probably too low)

The inventory of market hogs was reported up just 0.3 per cent from a year ago, in line with analyst estimates. This implies modest supply increases into the spring and early summer. The inventory of light hogs, those under 50 pounds, was down 0.4 per cent from a year ago, implying a modest decline in hog slaughter during July and early August.

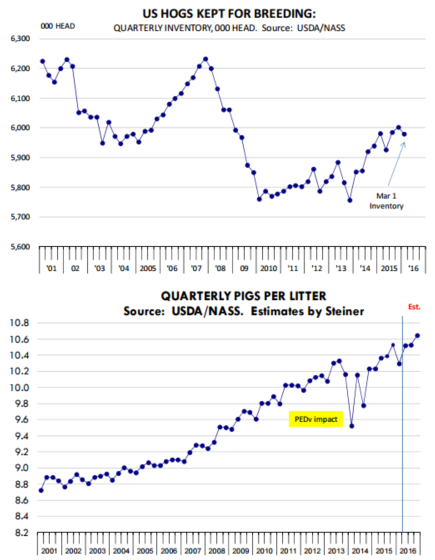

Analysts ahead of the report were projecting the breeding herd to be up 0.6 per cent from a year ago. We thought there was a chance it could be even larger considering sow slaughter trends and reports of lower gilt slaughter. The USDA survey, however, reported that the breeding herd was unchanged from a year ago and lower than what it was on December 1. This implies that gilt retention during this quarter was down significantly compared to the same quarter a year ago. The risk from PEDv has subsided and producers have likely concluded that they do not need as many breeding animals to support production. The Iowa breeding herd, the largest in the country at 980,000 head, was down 5 per cent from the previous year. The breeding herd reductions in IN, IA, MN, MO and NC were offset in part by increases in OK, PA, SD and TX.

One of the biggest surprises for us was the number of pigs saved per litter during Dec-Feb (remember these are hogs that will come to market during Jun-Aug). USDA reported producers on average saved 10.30 pigs per litter, this was just 0.7 per cent higher than a year ago and down 2.2 per cent from the previous quarter. In the last 20 years, the only other time we could find a bigger quarter/quarter decline in the number of pigs saved per litter was during the PEDv outbreak in the winter of 2013-14. Some in the industry attribute the decline to breeding issues last summer. It remains to be seen if this is just an aberration or if this implies we should start considering a slower growth rate for the next couple of quarters.

Farrowing intentions were lower for Mar-May by 0.5 per cent but a return of pigs per littler to 1.5 per cent growth rate would imply a 1 per cent increase in the pig crop and thus continued increases in hog slaughter during the fall of 2016. Jun-Aug farrowings were reported down 3.5 per cent, which if true, would imply fewer hogs coming to market at the end of 2016 and in early 2017.

Takeaway: Hog supplies should be adequate over the summer and fall are once again expected to be plentiful. Based on this report the capacity constraints will not be a serious concern unless farrowing rate improves for Mar-May and pigs per litter returns to a +2 per cent growth rate.