CME: Bullish Adjustments to Pork Balance Sheet

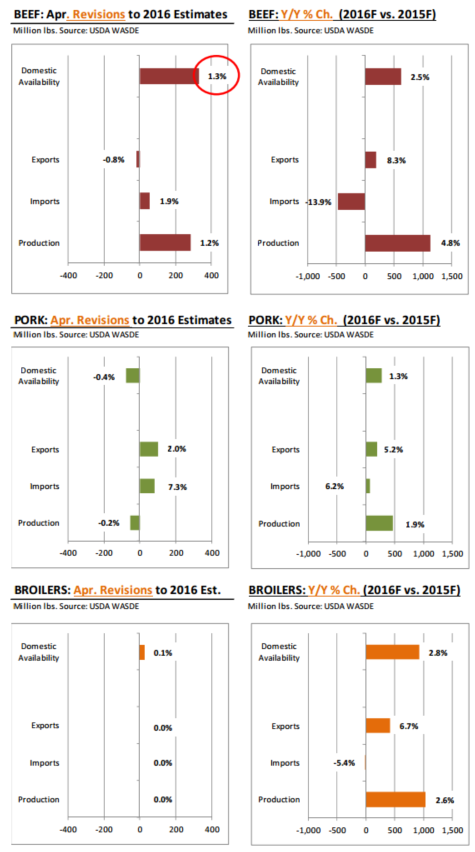

US - USDA made significant changes to its balance table for beef and pork but left chicken almost unchanged from its March report, write Steve Meyer and Len Steiner.The charts below graphically show the changes to the main components. Below are the numbers highlights and our first impressions following the release:

Beef: USDA expects US beef production in 2016 to be 24.889 billion pounds, a 285 million pound upward revision to its March estimate. If correct, this would imply a 1.134 billion pound increase (+4.8 per cent) compared to 2015 levels. The revision reflects both an upward adjustment to the number of cattle coming to market and cattle weights.

Steer weights continue to track well above last year’s levels and with feed costs low and heavier feeders going into feedlots in the spring the bump in weights makes sense. Feedlot placements are expected to increase in the spring given the feeder supply at the beginning of the year. This should bolster cattle supplies in the fall and early winter, something already reflected in the discounted fed cattle futures curve.

USDA also made some small adjustments to both imports and exports. Imports were raised by 55 million pounds even though shipments from Australia remain very light. Through early April beef imports based on US Customs data are down just 6 per cent compared to a year ago. Imports from Mexico (something we highlighted last week) are up 13 per cent from last year and imports from Canada are up 2 per cent.

US beef exports were adjusted by a modest 20 million pounds (-0.8 per cent) from the March estimate but they are still expected to be 8.3 per cent higher than last year while imports are expected to decline by 14 per cent.

Both estimates appear reasonable, especially if the US dollar continues to slide. Beef availability in the domestic market is now expected to be up 2.5 per cent from last year, an increase we think is already accounted for in the current futures levels. Demand continues to be a particular point of concern in the beef complex, especially in light of the supply expansion across all proteins.

Pork: The adjustments to the pork balance sheet were modestly bullish but for now futures are looking well past the report implications.

Exports were increased by 100 million pounds from the previous estimate and now, at 5.2 billion pounds, they are expected to be up 5.2 per cent from a year ago. However, much of this increase was offset by higher imports, which at 1.180 billion pounds were 80 million pounds larger than in the March report.

Domestic pork production was revised lower by 75 million pounds but at 24.988 billion pounds it is still expected to be 1.9 per cent larger than a year ago. For this estimate to be correct, hog slaughter in the second half of the year should be up less than 1 per cent compared to a year ago, which is in line with the latest Hogs and Pigs report.

Combined beef, pork and chicken disappearance in 2016 is forecast at 80.5 billion pounds, 1.8 billion pounds (+2.3 per cent) more than in 2015 and 5.8 billion pounds (+7.8 per cent) more than two years ago. And that, more than anything else explains why meat prices today are so much lower than their peak.