CME: Hog Cash Market Trending Sideways

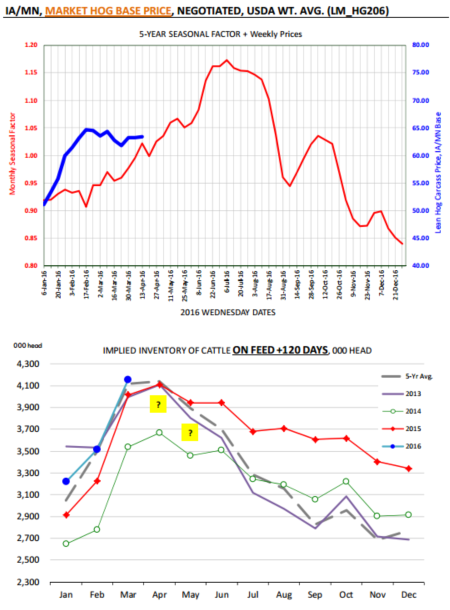

US - Cash prices in the hog market have been trading for the most part sideways since February (see chart). Prices gained ground quickly from the January low, in part because we started from a very low base, write Steve Meyer and Len Steiner.At this point cash hog prices are more in line with the seasonal trend. Keep in mind that the seasonal red line in the attached chart is not a forecast. All it does it is shows, on average, where prices in any given week trade compared to the annual average. In the last five years prices in June and July have averaged about +15% over the annual average while in late November and December prices have been 10-15% lower than the annual price.

At this point, based on the seasonal trend alone, one would expect prices in late June to be above 75 cents but the June contract comes off the board much earlier than that. At this point futures are pricing a healthy increase in pork demand going into the summer. Also, market appears to be looking past the supply imbalance that has been created in the last few weeks.

Hog slaughter last week was 2.197 million head, 1.9% lower than the previous year. Since March 1, weekly hog slaughter has been 1.4% lower than a year ago. This is well below the USDA Hogs and Pigs survey, which pegged the inventory of +180 pound hogs at 0.2% higher than last year. It could be the survey was wrong but it is also possible that producers have fallen behind in their marketings.

The hogs and pigs survey pegged the inventory of 120-179 pound hogs at +1.2% from the previous year. These are hogs that should come to market in mid April to mid May. Last year weekly hog slaughter during this period averaged 2.14 million head. Based on the USDA report, weekly slaughter this year during this period should averaged 2.16 million head. And if producers are behind in marketings then slaughter in the next two weeks should be closer to 2.2 million head. These are large numbers that could keep hog prices in check. However, demand will be the critical driver going into the grilling season. Particularly important will be demand for pork loins, which generally do well in May and early June as well as demand for pork bellies and pork trimmings.

In the cattle market bears have had the upper hand for much of the last six months. Boxed beef prices have been very strong in the last few days and the expectation is for prices to stay relatively strong through early May. Improving retail demand and robust foodservice business is expected to underpin the beef market in the near term. Packer margins at this point are in good shape, which is not that unusual for this time of year. The expectation is that packers will be more willing to bid on cattle with prospects of better beef sales into the grilling season.

Cash cattle prices last week were around $134/cwt. Those that hold a more bearish view of the market point out to the fact that supplies of cattle that have been on feed +120 days are still plentiful and feedlots need to stay aggressive in marketing them. Feedlots do not want to see a repeat of a year ago. Steer and heifers in feedlots also are much heavier than a year ago weights should bottom out in the next two weeks.

Last steer weight data showed them at 884 pounds per carcass, about 15 pounds heavier than a year ago. USDA will publish its cattle on feed survey results on Friday and it will be interesting to see how much bigger than a year ago March placements end up. By some estimates placements in March were up about 10% but marketings also were up 7% because of one extra marketing day.

Placements are expected to be large again in April but with one less marketing day it will tend to skew the numbers. The yellow boxes outline where the +120 day inventory would be given projected trend in placements and marketings. For now, however, market participants remain focused on prices in the cash market and willing to discount futures curve until convinced otherwise.