CME: Lean Hog Carcass Price Still Close to Early March Level

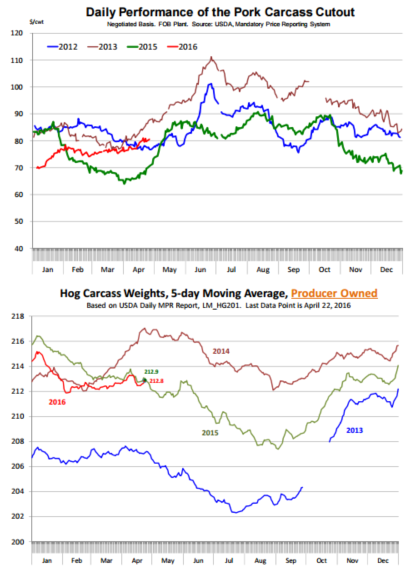

US - There is some hand wringing in the pork complex at this time, especially with the lean hog carcass still priced within a couple of cents of where it was in early March. Some of the uncertainty was evident in futures trading yesterday, with the June contract at one point down by 125 points before rebounding and closing down 37, write Steve Meyer and Len Steiner.The decline early in the day was somewhat surprising given a cold storage report that, on the face of it, appeared supportive of the pork complex. Total pork inventories at the end of March were pegged at 614.1 million pounds, 8.7 per cent lower than a year ago.

The inventory drawdown in March was 14.8 million pounds (-2.4 per cent) even as pork production for the month was 2.145 billion pounds, 33.3 million pounds larger than the same month the previous year.

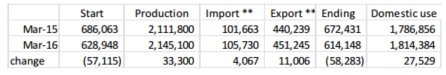

We don’t have the trade data yet but we can make some reasonable assumptions that give us an indication about the state of pork demand. Below is a summary of key pork numbers for March:

What the table shows is that total pork domestic use/disappearance in March was around 27.5 million pounds larger than a year ago (+1.5 per cent). However, there was one additional marketing day, which tends to skew the numbers.

Average daily disappearance actually was down 2.9 per cent from the previous year. Still, with the overall cutout up 12 per cent in March we still think that pork demand for the month showed some improvement compared to the previous year.

Going forward, there are a number of issues that pork market participants will have to contend with.

First, how big are hog pipeline supplies? Hog slaughter last week was quite large at 2.241 million head, 3.6 per cent larger than a year ago. But before you make too much of this number consider that the previous three weeks hog slaughter had been running below its projected pace. That’s why hog weights moved up in early April.

The inventory of hogs 120-179 pounds as of March 1 was up 1.2 per cent from the previous year. Last year average weekly slaughter during the period was around 2.14 million head implying hog slaughter of around 2.16 million, a fairly large number for this time of year.

The impact of large hog supplies on the ground can be seen in the big spread between hog carcass prices and the value of the pork cutout (bigger margins for packers). What is unknown at this point is how good those March estimates were, especially for the DecFeb pig crop.

Futures were willing to place significant premiums in the summer contracts given the pace of pork sales in March. That view has certainly changed. An even bigger question mark is on the Mar-May crop estimates (fall hog supplies). If producers understated the farrowing intentions for that period, we could very well be looking at a 1-2 per cent increase in the pig crop. It seems to us that at this point futures are still trading steady supplies and robust export demand.

After the June report the picture should be clearer. Another issue that is unknowable at this time is the impact of summer weather on hog weights. Hog weights normally drift lower between May and late July as temperatures rise. The timing and magnitude of the summer heat will be a critical factor.

Finally, we come back to the question of pork demand. Already we have seen exports to China increase sharply compared to a year ago.

Exports to Mexico also appear to be improving, which possibly accounts for the recovery in the ham market. Belly prices have declined, not unusual for this time of year but forcing market participants to reconsider those March bullish projections. Lower beef and chicken prices will continue to present a challenge, likely limiting the summer upside but even more problematic in the fall.