Mexico Hog Market

MEXICO - Mexico’s pork industry is projecting to expand a little bit further on international markets with a clear focus in Asia. With 1.4 million tons of pork production projected for 2016 (USDA projection), Mexico is still far to be self-sufficient. It is estimated that consumption of pork in Mexico would increase 3.3 per cent during 2016, to stand at 2.2 million tons (carcass). Since 2012 Mexico has expanded pork exports about 30 per cent (2012, 70,000 tons – 2015, 100,000 tons), writes Fernando Ortiz, Genesus Ibero-American Business Development .Having said that Mexico’s pork imports is about 1 million tons a year -for a value of more than $1,785 million US dollars- representing 14 per cent of imports of pork (meat and by-products) worldwide. The main supplier, prominently, is the US, which accounts for 84 per cent of sales -over $1,500 million US dollars. It is followed by Canada with $250 million value. Between both they add around 98 per cent of the volume and value of pork imports from Mexico.

I was visiting several pig producers and packing plants in Spain over the last two weeks. My feeling is that European’s packing plants, especially those from Spain, are focusing right now to target markets like Mexico and Colombia. The recently confirmed opening of the Mexican market to fresh pork from Spain is being seen by the European Commission (EC) as the first step in a process which will deliver similar export breakthroughs for other EU member states.

“The market is opening for fresh pork from Spain and we expect the go-ahead for fresh pork from France. Work is also ongoing for exports from Germany, Romania, Italy and Poland.” Mentioned recently a European Commissioner Representative. How much pork trade can be expected? Personally, I don’t think too much; here some reasons:

- There is maybe some potential in this market, but European exporters should be ready to face fierce competition with its North American counterparts in terms of price, due mainly to a quite higher freight costs.

- Mexico’s main pork import are hams. Ham is a relatively low value pork product in North America, while hams in Europe, mostly in Spain, are costly. I am not sure if Spain could afford to ship hams to Mexico to compete with those very cheap American ones. Now, if they (Spaniards) are thinking to add some value on them that would be a different story. In that case we would be talking about cured or cooked hams; area where Spain has a lot of expertise.

- Mexico is quite a large pork importer, taking around 1 million tons last year, but, as I already mentioned, most comes from the US (84 per cent) and Canada (16 per cent). There is however some room for sending offal to this country. Mexico is getting around 200,000 tons of offal/year. There might be more chance for EU’s type of products competing in that market, although currently the US and Canada dominate again.

There are a lot of concerns from the Mexican pork producers because of these new trade agreements. They feel like their federal government is doing nothing to protect them against this new imminent “threat” that would be mining its profitability, they say.

Currency issue

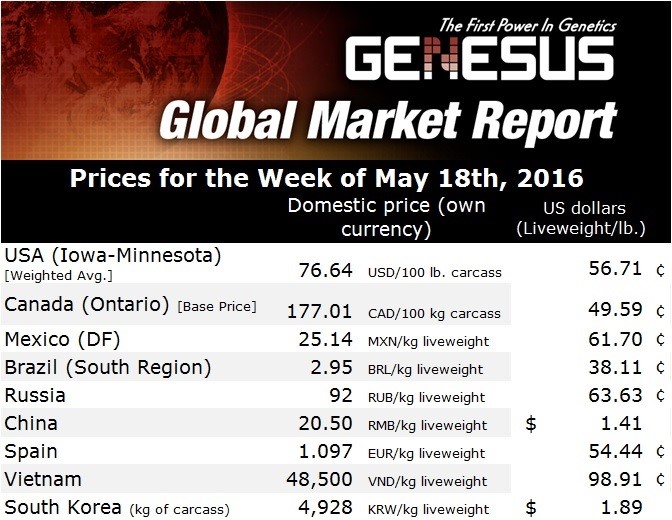

Two years ago the Mexican Peso was 12.50:1 against the USD. From them to now it has been a big dollar revaluation, like with most of the other currencies around the world. This week the US dollar has been quoted around 18.50 pesos after crossing the 19:1 mark last February. Other countries’ currencies devaluation look like this: Russia, (86 per cent), Brazil (52 per cent), Canada (18 per cent), Euro (20 per cent), South Korea (19 per cent), British Pound (17 per cent). Over 30 per cent Mexico’s devaluation currency is no good, but also is not too bad. On the worst case scenario producers are buying a definitely more costly imported grain than before (even when grain prices are lower in price in the country of origin). Since the price of a country's currency affects the price of their products on world markets, the currency's exchange rate can have a big effect on national exports and costs of imports. On the other hand, Mexican pork exporters are earning more margins by putting their product overseas.

Pork Price

As, is seasonally usual, pork prices have rebounded slightly in Mexico after Lent and Easter festivities. From the 22.60 MXN pesos/kg ($0.55/lb) Mexico experienced in February, the price has jumped over 26 pesos/kg ($0.65/lb) this week. If cost of production in Mexico is around 21.50 pesos/kg ($0.53/lb) average, Mexican pig producers are making now around 25 to 26 US dollars per head.

Production and consumption of pork in Mexico has reported growing trend at the expense of beef over the last two years. Jalisco and Sonora are the main pork producers by State, contributing with 18.9 and 17 per cent of the domestic supply in 2015, respectively.

Next in order of importance Puebla (12.3 per cent), Veracruz (9.2 per cent), Yucatán (8.6 per cent), Guanajuato (8.3 per cent) and Michoacán (3.2 per cent). However Sonora and Yucatan are the foremost pork export States.