CME: Few Changes Made to WASDE Livestock Estimates

US - In this Daily Livestock Report, we review two reports from last week: the World Bank (WB) updated economic forecasts (released 7 June) and the USDA’s World Agricultural Outlook Board (WAOB) monthly forecasts for crops and livestock (released June 10), write Steve Meyer and Len Steiner.We will wrap-up with some weekly market comments; note that the second page of this newsletter has a prices and production summary table, which uses data provided by the USDA-AMS Market News.

Global economic growth expectations were revised lower by the WB, the summary is available here, and the full report link is here.

The WB downgraded world economic growth in 2016 to 2.4 per cent from 2.9 per cent which was projected in January, as measured by Gross Domestic Product. So far this year, growth has been much more anemic than anticipated in commodity-exporting emerging market countries and in developing countries.

Advanced economies are expected to expand by 1.7 per cent in 2016, 0.5 per cent below the January projection by the WB. The US and Europe are forecast to remain growing but rather sluggishly. For 2016 and 2017, the US growth rate forecast is about 2 per cent annually, while the Euro region is at 1.6 per cent.

Japan stays mired-down at an annual economic growth rate of about 0.5 per cent for this year and next. China is forecast to grow at 6.7 per cent in 2016, 0.2 per cent below a year ago and remain at that growth rate in 2017.

Brazil and Russia are expected to remain in deep recessions throughout 2016 and could climb-up slowly in 2017.

USDA-NASS released their monthly Crop Production report on Friday. In terms of wheat numbers reported, the big change came from NASS revising winter wheat yield up 6 per cent from their May estimate.

The report described that based on June 1 conditions, the national average yield was forecast at 50.5 bushels per acre, up 2.7 bushel from last month and up 8 bushels from last year. If realized this would be the highest yield on record for the US This revision pushed production up 6 per cent from May estimates, at 1.5 billion bushels, and if realized will be 10 per cent above 2015’s. This could create some downward price pressure in the market place. If corn and bean prices continue to increase, more wheat could be seen in livestock rations.

The World Agricultural Supply and Demand Estimates (WASDE) report was also released on Friday and the noteworthy changes were in current year (2015/2016) crop numbers. Starting on the crops side, there were downward revisions made in Brazil’s 2015/2016 corn and soybean production estimates.

Brazil’s second-crop corn production was revised down 3.5 million tons to 77.5 million tons due to dry weather reducing yield. The Brazil 2015/2016 soybean crop was reduced 2.0 million tons to 97.0 million also due to hot, dry conditions. Domestically, for 2015/2016, US corn exports were revised up, forecast price was revised up $0.10 per bushel for a new range of $3.60-$3.80, and ending stocks were revised down 95 million bushels on higher exports.

WASDE expects US corn to remain more competitive in 2016/2017 due to lower production in Brazil and forecast 2016/2017 prices between $3.20 and $3.80 per bushel. US soybean 2015/2016 exports were revised up 20 million bushels and crush was raised 10 million bushes, lowering ending stocks by 30 million bushels to 370 million and raising 2015/2016 prices by $0.20. This created lower beginning soybean stocks for 2016/2017 and coupled with the expectation of increased exports, the price range for was raised $0.40 per bushel to $8.75-$10.25.

On WASDE’s livestock and meat side very few changes were made. For 2016 beef, pork and broiler production, all were decreased slightly and subsequently prices were raised slightly. Forecasts for 2017 production and prices were essentially unchanged.

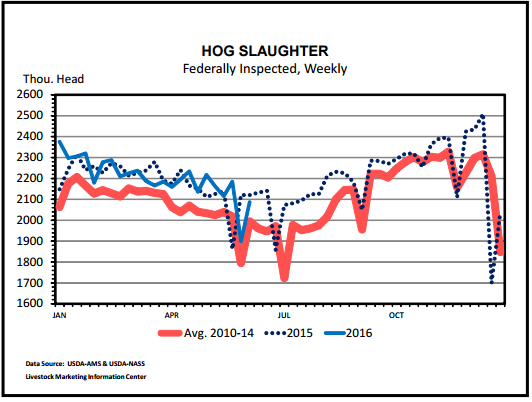

Last week, cattle slaughter remained large while hog numbers slipped seasonally. Cattle weights and hog weights declined weakover-week and year-over-year. Cutout values for both beef and pork gained for the week, with beef values remaining well below 2015’s while pork was up slightly. Cash corn reached its highest level since July of 2015 and cash soybean meal stayed at its current lofty levels.