CME: Summer Hog Futures Fail to Break $84 Mark

US - Summer hog futures have sought to mount a rally twice in the last three months but failed to break past the $84 mark. It is not unusual for pork prices to move up into the summer, largely because of the seasonal pullback in pork supplies.Lower pig crops during the winter and a steady decline in hog weights set the stage for the seasonal decline. In order to argue for a more bullish market going into June, July and August some of the supply fundamentals would need to diverge from current trends.

The “China demand” factor remains an important driver but it is important, in our view, to first have a good handle of the supply dynamics. The March 1 Hogs and Pigs report provided some guidance as to the number of hogs expected to come to market over the summer months. So far, we think the slaughter numbers have tracked relatively well with the report.

There has been quite a bit of volatility from week to week but often that was due to one large packing plant that was idled for maintenance reasons. The average weekly hog slaughter between the first week of March and second week of April was down 1.2% compared to +0.2% for the +180 pound hog category in the report.

The difference may have been due to the plant closure distruptions but also producers slowing down marketings given the early premium for the April contract. For the period mid April and mid May, however, weekly hog slaughter averaged +1.43% compared to +1.2% indicated by the 120-179 weight category.

The March survey pegged the inventory of 50-119 pound hogs up 0.8% compared to the previous year. This would imply average weekly hog slaughter mid May through early July of around 2.06 million hogs per week.

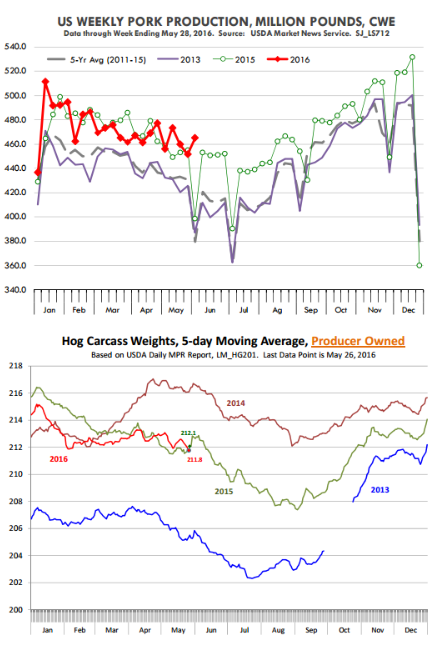

The fact that slaughter is expected to be a bit higher than a year ago is key considering that last year markets had trouble absorbing +2 million hogs/week. One needs to consider the production chart above to recognize the departure from the 5-yr average and 2013 levels that last year represented. In 2013 the pork cutout jumped from under $80/cwt to $100/cwt between late May and late June.

During that period hog slaughter was about 100,000 head per week smaller than currently projected, hog weights dropped steadily from 206 pounds per carcass to under 204 pounds. Exports in May 2013 also jumped 7.5% from the previous month, helping clean up pork inventories. Those arguing for a similar rally in pork cutout values will likely pay close attention to daily slaughter numbers and especially Saturday slaughter.

This week slaughter will be light because of the Monday holiday. Daily slaughter should be around 427k-430k head per week and Saturday slaughter around 180k. The pace of slaughter should be viewed in tandem with the trend in hog weights.

This will provide an indication as to whether producers are staying current and what kind of impact rising temperatures are having on hogs on the farm. To best track weights we think it is appropriate to utilize the data from the daily Mandatory Price Reports rather than the weekly USDA reported number.

The hog weight numbers reported in the weekly report SJ_LS712 simply rely on a 6-week moving average and thus will lag the actual number. The Mandatory Price Reporting data will be closer to the real number (5-day avg.).

So to recap, watch the trend of hog slaughter against the March report baseline, watch the trend of hog weights vs. year ago and continue to monitor those weekly export sales. As for the fall market, talk of burdensome supplies seems to have died down but that is temporary. Market participants will likely wait to see March-May pig crop estimate (June24) before refocusing on that portion of the curve.