CME: Cash Hog Price Decline Continues

US - Cash hog prices continue to decline and this has added to jitters in the pork complex about the outlook for hog values as we go into the fall and early winter months. The IA/MN base price last night closed at $74/30, down $1.36 from the previous close and now down $4.35 compared to just two weeks ago, write Steve Meyer and Len Steiner.Normally hog prices should go the other way in July and August as hog supplies decline and packers work with tighter margins in order to keep the flow of product moving. The current decline in hog values is more a reflection of the supply of hogs on the ground that it is a sign of waning pork demand, in our view.

Sure export sales may not be as big as some were hoping but the lofty expectations piled on the market back in May and early June were quite unrealistic to begin with.

Yesterday the weekly export data from USDA were quite a bit lower than the previous weeks but keep in mind that this was a holiday shortened week, of course export numbers would be low. If we take the weekly export data as reported and adjust for the holiday, pork and beef exports were in line with the levels we saw in June. In other words, they were good but not enough to straighten up the market all by themselves. The reality is that hog supplies are expanding, something we noted in our report yesterday.

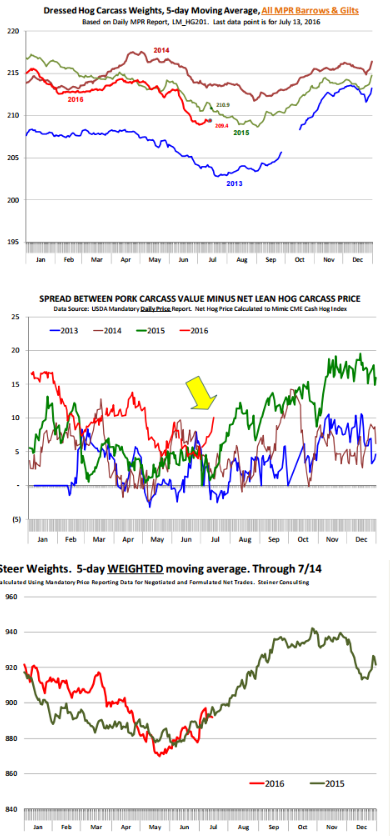

Slaughter this week and next week is expected to be over 2.1 million head, a big number for mid July. For reference, hog slaughter at this time in 2013 was hovering a little over 2 million head (and with much lighter weights) and in 2012 it was under 2 million. There is no shortage of hogs out there and packers at this time are taking full advantage, as evidenced by their meat margin.

Normally the spread between the pork cutout and net cash hog prices is around $5/cwt at this time. Last year, when supplies started to increase into August the spread increased to over $10/cwt. Now we are in the middle of July and the spread is already at $10.

Hog futures for August are currently priced at around $78.60/ cwt, which would imply that the market believes that meat spread will continue to expand (maybe in the $12-13 range) and that assumes that the cutout will stay near current levels. One thing that could change that calculus is the fact that hog weights, which have not seasonally declined much so far, could drop given prospects of extreme heat in key production areas.

Weights on barrows and gilts have increased modestly the last few days but that is mostly because of the long holiday weekend flow disruptions. A sharp decline in weights in the next two weeks could change the outlook for hog prices into August. As for pork exports, don’t put too much stock in last week’s numbers. Ham values remain very firm, which is an indication that Mexico export business is actually in good shape. Also positive is the fact that pork trimmings are holding up well and there is always the risk of belly prices moving up as they seasonally do in July and August.

As for the cattle market, hot weather should not have much impact on supplies. Hot weather normally is seen as negative for beef demand but it will depend greatly if it hits heavily populated areas. Steer weights as reported by USDA yesterday are moving up. Keep in mind that USDA number is for two weeks ago. Our data shows that as of mid July weights are on par with last year.

This does not necessarily mean that producers are behind in marketings, after all we are placing ever larger animals on feed.