CME: Lean Hog Future Break Sharply Lower

US - Lean hog futures broke sharply lower yesterday as market participants reacted forcefully to some truly shocking developments in both pork and hog cash markets, write Steve Meyer and Len Steiner.On the pork side, the most surprising number was the sharp drop in the value of bellies at a time of year when pork belly prices actually are supposed to move higher. USDA quoted the pork belly primal yesterday afternoon at $116.39/cwt, down $17.4/cwt from the previous close and down $26.1/cwt compared to Monday’s levels.

In a matter of two days the drop in the value of the pork bellies has removed over $4/cwt of value from the carcass. We do not have any first hand evidence as to what happened to cause belly prices to decline as much as they did.

Pork belly stocks in cold storage are heavy and with larger slaughter expected it is likely that end users are opting to liquidate inventories early. Still this does not account for the big two day drop. It could also be that packers are not seeing the level of orders they expected from retailers at this time of year and they see little benefit in storing bellies rather than dumping them in the market. The break was quite shocking in its magnitude and market participants will likely pay close attention to the noon sheet to see if the belly cash market recovers after the unexpected break the last two days.

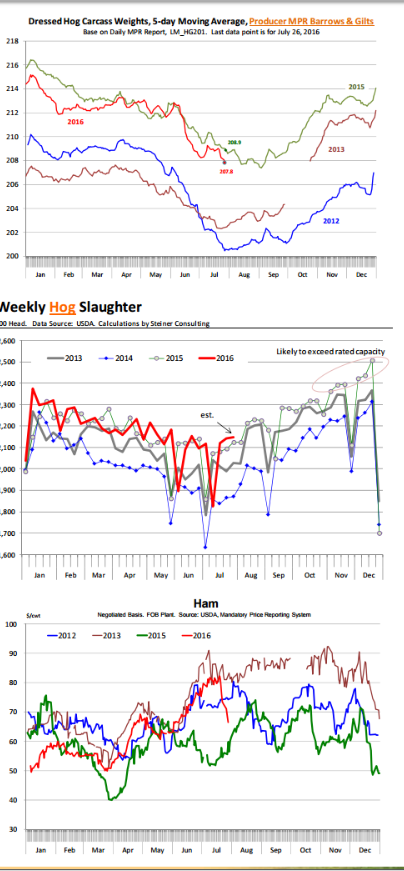

But bellies have not been the only surprise for pork prices. Ham values normally hold up well in July and August (see bottom chart). In the last week, the ham primal has lost significant value, which has further contributed to the weakness in the value of the cutout.

The ham primal value yesterday was quoted by USDA at $66.48/ cwt, down $1.78/cwt from the previous close and down almost $16/cwt since Monday, July 18. The decline in the value of the ham primal in the last 10 days has also removed almost $4/cwt from the value of the carcass. So between lower ham and belly prices the pork cutout is about $8/cwt lower than just a few days ago, a counter-seasonal development that has fueled the selling pressure in futures.

The weekly export numbers that just came out this morning did not offer much support, in our view, to a pork market that needs all the help it can get. According to USDA, shipments of pork muscle cuts for week ending July 21 were 18,572 MT.

Exports to China were just 2,401 MT, the lowest weekly export volume since early February.

Remember that it was talk of booming exports to China that injected a lot of positive feeling in the pork complex in May and early June. Exports to Mexico for the week were 6,313 MT, down from over 7000 MT the week prior. Based on the level of weekly shipments we project exports of fresh/frozen pork in July at around 120,000 MT, slightly lower than what they were last year, which is disappointing given the ever expanding supply of pork coming to market. And that brings us to what is truly ailing the pork market - the number of hogs coming to market and the number that is expected to come (see slaughter chart).

Hog weights normally come down in the summer but the decline so far has not been as big as in past years, another indication that hog numbers on the ground are heavy. USDA quoted the IA/MN lean hog carcass base price last night at $68.28, down more than $10/cwt compared to July 1.