CME: Things are Getting Worse for Hog Producers

US - Last week was quite difficult for hog producers and so far this week things have only gotten worse, write Steve Meyer and Len Steiner.IA/MN base price closed last week at $67.09/cwt, down 15 per cent for July. So far this week prices are down another 2.5 per cent, closing last night at $65.45/cwt. Packers have been lowering their cash bids for the last four weeks given the supply glut, slowing export sales and apparently some demand erosion given the increased availability and price competitiveness of beef at the retail case.

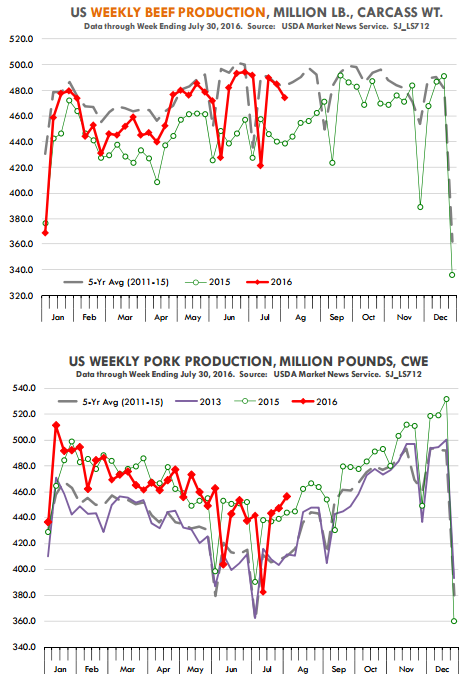

Hog slaughter last week was 2.184 million head. While this may not appear like a big increase, consider that it represents an 8.6 per cent jump over the five year average and the largest weekly slaughter for the month of July ever. It used to be that we would get 2.2 million weekly kills in the fall. Now we are getting them smack dab in the middle of the summer and with major holiday demand already behind us.

This week we expect slaughter at 2.14 million, +0.7 per cent from last year. But even with the last four weeks (including this one) averaging +2.0 per cent more hogs than a year ago, it is too early to start calling for a miss on the latest ’Hogs and Pigs’ survey results. Remember that the June report indicated that the supply of hogs +120 pounds were 1.2 per cent higher than a year ago. This is basically the supply of hogs that would come to market between early June and mid August. We will not know for sure if the survey was off until all the hogs have come to market.

However, consider that for the period June 5 - July 30 hog slaughter was 16.728 million head, 0.6 per cent higher than the same period a year ago. It seems to us that the USDA survey may not be that far off after all.

In the last three weeks of July hog slaughter was up 2.3 per cent from last year but this also could be due to the odd calendar this year, with July 2016 having 2 fewer full slaughter days than July of 2015. It does appear that hog producers fell behind in their marketings, maybe because of the premiums built in those July and August contracts in the spring. It is interesting to note that weights of packer owned hogs have declined twice as fast as the weights of producer hogs in the last four weeks.

Despite the heat, weights have not declined as much as expected, another indication that producers likely are behind in their markets. On the demand side, we did indeed see a slowdown in weekly pork exports last week and it is expected that exports will be even softer this week. What is unclear is if this is due to a true demand slowdown rather than a shift in purchases into the fall. For now the increase in pork supplies and slower exports have created a short term glut that has pressured the entire pork complex.

But as often is the case, the fix for low prices is low prices and both retailers and foodservice operators are now presented with some excellent pork fall featuring opportunities.

Going forward, a more problematic issue for hog producers this fall remains packing capacity (Steve Meyer recently wrote at length about this point). As we have mentioned in this report in recent weeks, we could see a few weeks in November and December when weekly slaughter exceeds rated capacity. At this point the market is trying to force producers to pull marketings forward and thus avoid a repeat of 1998. We still think that with proper planning that kind of debacle may be avoided...maybe.

While the pork market appears to be difficult for the moment, the beef complex shows some improvement. The choice beef cutout last night was quoted at $1.9920/cwt, up $1.6/cwt compared to last Friday. The comprehensive cutout value last week was higher than the choice beef cutout, an indication that packers are making more money from select, no roll and export sales than they were a couple of months ago. Packers will fight hard to hold on to their margins and can slow down Saturday slaughter if they have to.

However, Labor Day business is ahead and our Asia exports may benefit from reduction in Australian supplies. The price of 50CL beef has been coming down, not unusual for this time of year as ground beef sales slow down. One of the big positives for the beef cutout so far has been the strength of middle meats (steak cuts). Seasonally end cuts (rounds, chucks) improve in the fall. If middle meats continue to outperform, this bodes well for beef prices and ultimately fed cattle values this fall.