CME: Confluence of Factors Pressuring Prices Lower

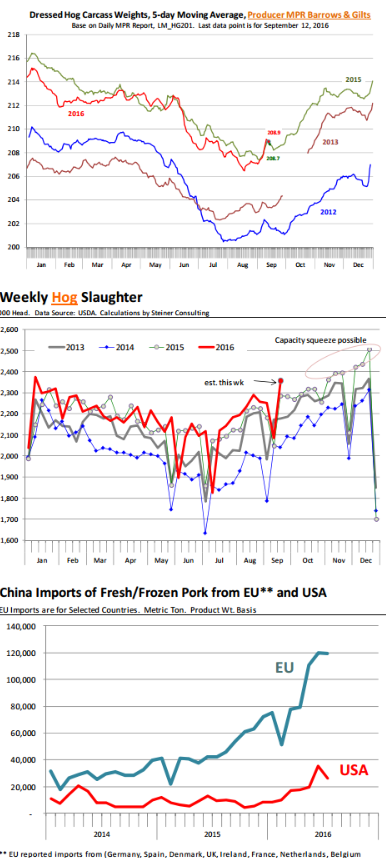

US - The down move in the hog complex in the last few days has been quite ferocious and it is hard to point to one single factor that would explain why market participants have wiped off $7.5 (‐13 per cent) since September 1. Rather, there seems to be a confluence of factors that, at least for the moment, continues to pressure prices lower, write Steve Meyer and Len Steiner.Rapid increase in weights may imply supplies on the ground are bigger than many expect. The weight of barrows and gilts marketed by producers is currently running at around 209 pounds per carcass (this is a 5‐day average), about the same as it was last year but 2.5 pounds (+1.2 per cent) higher than what it was in mid August. It is not unusual for hog weights to increase into September but the pace of the increase in recent days has exceeded expectations. We think the short holiday week was the primary catalyst but also the fact that a large plant was idle for a few days further contributed to this. Market participants are looking at the parallels of this year with last and have discounted Q4 hogs accordingly.

Hog slaughter this week is expected to be 2.357 million head, about 3 per cent higher than a year ago and higher than the 2.2 per cent increase implied by the last Hogs and Pigs report. So far packers have been able to benefit from the widening spread between hog and meat values and excellent margins will likely continue to drive larger kills. It will be imperative to keep an eye on the value of the pork cutout and the ability of the market to absorb the increase in supplies.

Another negative that seems to have hit the pork market particularly hard in recent days is speculation that the US Federal Reserve is likely to raise interest rates in its meeting next week. A stronger US dollar is negative for US meat exports and it tends to impact hogs more than others since we export a larger share of pork than of any other protein. The outlook for exports is particularly important in Q4 when US hog supplies will hit annual highs and the market will need all the help it can get to absorb the additional supply. US packers have made significant progress in

expanding the supply of hogs that are not fed ractopamine so as to increase the volume of pork available for export to China. Chinese imports of fresh/frozen pork so far this year have averaged 135,100 MT per month compared to 48,700 MT per month two years ago. China is indeed importing a lot of more pork, as many analysts expected last year. The problem is that German, Danish and Spanish producers have benefited the most from that increase in demand. The value of the US dollar relative to the Euro as well as relative cash hog prices will be critical factors for the pork market this fall. At this point, market participants appear to have discounted expectations for double digit export growth in Q3 and Q4.

The sharp decline in cattle prices also appears to have taken a toll on the outlook for pork prices this fall and winter. As we noted yesterday, the supplies of all proteins have expanded but the growth in beef production (+5.2 per cent in 2016) has outpaced growth in other proteins. Retailers at this point are struggling to hit their revenue targets while trying to sell more pounds. In this environment, beef has an advantage.

The decline in sales price has increased its perceived value in the eyes of the consumer and beef sales have more of an impact on the revenue targets than pork or chicken. More beef features going into the holidays are welcome news for cattle producers but they also make for a far more challenging environment for pork.