Pork Commentary: US Hog Prices – Down

US - The US hog industry is now hovering around breakeven with Hog Prices averaging about 61.50 cents/lb lean or 46c/ liveweight, writes Jim Long, President and CEO Genesus Genetics.The low cost of corn is keeping the industry from hemorrhaging dollars at these prices but sow units are losing money if they are selling Early Wean Pigs at last week’s USDA average of $20 per pig or 40 pound pigs at $28.71. They are kissing away $15 per head.

The more pigs you have, the more you lose. Size is not an advantage when you start losing money in gabs. We expect a lot of plans for expansion in the USA, whereas Canada and Mexico are having the brakes put on. With lean hog futures below 60 cents for the next seven months, the cash flow negativity and what that does to the psyche will not be expansion-conducive.

We expect that projects currently under construction will be finished. Current events in the industry will likely delay or end plans for any contemplated projects.

The other side of the coin is packers’ margins. With USDA cutout closing on Sept. 9 at $81.67, it doesn’t take an economist to subtract the average lean hog price of $61.50 from $81.67 to get a $20 difference and with the average carcass at 208 lbs a plus $40 per head gross margin. Good time to be a packer. You can also see from that spread why the mad dash of builders of new processing plants to get finished as fast as they can. 2.2 million market hogs per week in USA a $40 spread equals gross margin minimum of $850 per week. A new plant at 10,000 head per day would be equal to $2 million per week gross margin.

The best news for producers in this scenario, new plants under construction. Historically, the packer spread with competition in the market place is closer to $15 per head. Also, lean cut-outs are 81 cents, meaning that pork is selling at a strong price relative to hog supply. We have positive demand, yet producers are not making money while packers and retailers are. Packers are like us producers, they can’t stand profits. We producers made lots of money in 2014. 2015 was good, but instead of being satisfied, human nature kicked in and we expanded. We ended up working for less or zero dollars. The same thing will happen with packers. Next summer, when new plants come on stream, packer margins will be half of what they are now. Why? There will be a fight for retail shelf space and export orders. The low prices now are cutting hog supply for next year.

Rabobank

As the world’s largest agriculture bank, it’s a good idea to pay attention when they report something. They recently released a new report.

Highlights

- The US had a momentous year for animal protein, with the largest increase in US meat consumption since the food scares of the 1970’s.

- 2015 was unusual not only due to the almost 5% increase in per capita consumption, but also because the growth was reached without beef, which had flat consumption.

- US protein production projected growth of 2.5 per cent per annum through 2018, down from 3 per cent in 2015 – with beef being biggest contribution.

- Trade will remain stabilized.

- International markets are not expected to absorb new production growth.

- US protein consumption will continue to increase amid lower meat prices.

- By 2018, expect a more challenging profit environment across the US meat industry.

- Global meat trade is increasingly competitive.

- Exchange rate volatility is a key factor in determining market advantages.

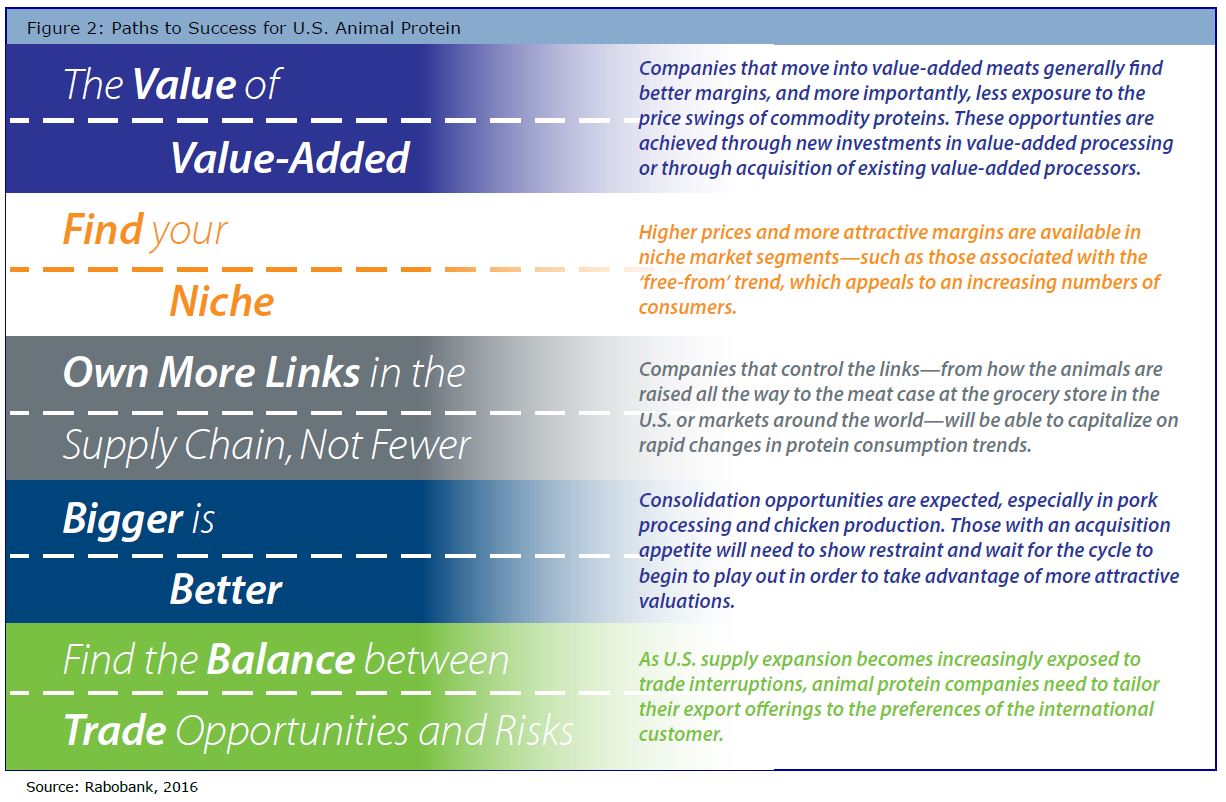

Rabobank foresees five paths to success for US Animal Protein Companies listed below:

Our Comments

Rabobank sees a more challenging profit picture by 2018. Seems to us the US-Canada market is already there. Rabobank sees little opportunity for increased production growth in exporter markets.

After our recent trips to China, Russia, and the EU, we think the same. China and Russia are going to produce more pork, while the European Union will be holding steady. Export markets are going to be tough unless the US dollar declines relative to other currencies. The 5 paths by Rabobank are valid, and the challenge for existing producers to find a spot in the 5 paths.