Chinese Pork Imports Surge in 2016

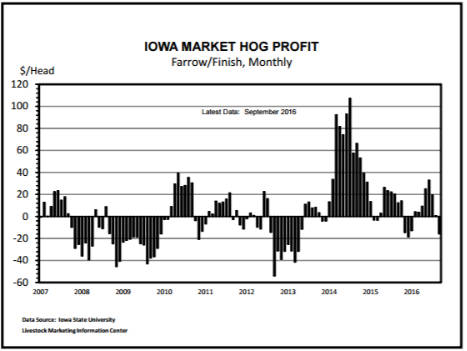

US - China’s role in the world pork market continues to grow, writes the Steiner Consulting Group.Monthly estimated farrow-to-finish hog producer returns fell deeper into the red for animals sold in September. As calculated by Dr. Lee Schulz at Iowa State University (ISU), returns do not include locking-in prices at higher levels earlier this year and all economic costs of production are incorporated in calculations.

The ISU hog returns dropped in September due to lower slaughter hog prices. Barrows and gilts sold in September posted a negative return per animal sold of $-18.41 without adding the value of manure produced and was $-15.77 per head after valuing the manure (including manure value is graphically shown). Those were the largest losses for any month since December of 2015. Producer hog profitability may not improve substantially until spring of 2017.

Now we turn to some insights provided by USDA’s Foreign Agriculture Service (FAS) twice annual “Livestock and Poultry: World Markets and Trade” publication which was released last week. Besides background data on selected countries regarding livestock numbers, exports, etc., the FAS report highlights trends and contains some special (more in depth) analysis. Today we focus on pork and

tomorrow beef and chicken.

China’s role in the world pork market continues to grow and their imports have surged in 2016. As stated by FAS, “Already the world’s largest pork producer and consumer, China has now achieved the

position of the world’s leading pork importer, forecast to account for over a quarter of global trade in 2017…. The majority of trade gains have been captured by the EU which retains a 70 per cent market share”. Prior to this year, Japan was the world’s largest pork importer on a tonnage basis.

Even though the EU by far gained the most market share in China, importance of that country regarding US pork exports is increasing. China became a more critical market to the EU after the Russian blockage of EU products.

FAS forecasts that Chinese pork production is ramping-up due to higher hog prices and because of government programs to reduce corn costs to livestock producers. Both of these factors are enticing

herd expansion, especially by large commercial operations. So, both EU and US pork shipments to that country will slip some in 2017.

Even though exports to China may begin to drop some in 2017 they will remain very large by historical standards. Growing world trade will be critical to price levels, as global pork production in in 2017 is forecast to increase by 3 per cent and set a new record high. In 2017, gains in production are forecast for China, US, Brazil, and Russia.

From a US perspective, other key markets should more than offset the expected slippage in sales to China; importantly sales to Mexico, Japan, and South Korea may all increase, but probably not enough to offset increases in US pork production. For 2017, USDA currently puts US pork production up 3.8 per cent year-over-year in 2017 or an annual increase of about 430 million pounds on a carcass weight basis. FAS now forecasts 2017 export tonnage to rise about 3.9 per cent year-over-year, which is less than 100 million pounds. On a tonnage basis, US pork production is expected to continue outpacing gains in exports in 2017.