Pork Commentary: USA-Canada Hog Market a Mess

NORTH AMERICA - It doesn’t take an Excel spreadsheet to understand that the US-Canada hog market is a mess. With 53-54 per cent cash lean hogs last week around 52 cents a pound, writes Jim Long President – CEO Genesus Inc.Dec. Futures at 42.60, Feb. 49.30, and April 49.30. There is no way anyone can do anything but lose money at those prices. Those prices aren’t just a little bleeding, but a gushing wound.

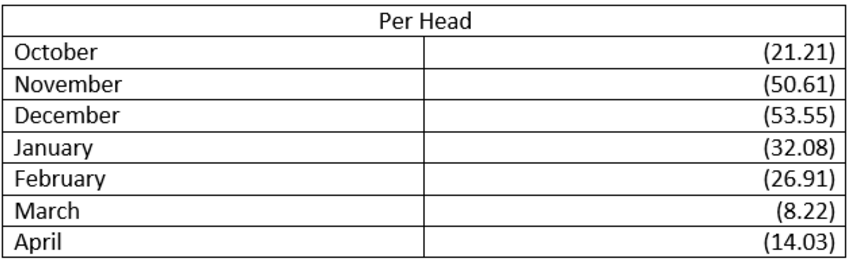

Robert Hunsberger does a weekly hog economic sheet in the Canada-Ontario market. His latest calculations for losses (Canadian $), based on futures, is dismal.

Overall, a less than happy scenario for the next seven months. Robert Hunsberger also calculates a packer kill and cut gross margin/pig weekly. Last week, he calculated plus $54.72 pig (C$). A little farmer arithmetic and you can see why all the new packing plants are trying to get up and running as soon as possible. No one wants to miss the gold rush.

Last week, the US marketed 2,427,000 hogs. A year ago in the same week, this number was 2,293,000, or about 6 per cent less. The 53-54 per cent lean hog price a year ago was 73.77 or $40 a head higher.

The USDA September 1 Hogs and Pigs Report had 4 per cent more hogs year over year in the weight range going to market now. It appears to us that hog weights are running lower than a year ago.

Currently at about 210 lbs carcass, this number was 211.5lbs last year. We believe the fear of the lack of shackle space and even lower prices are encouraging producers to get hogs to market.

USDA pork cut-outs were 73.40 a pound last week, a reflection of good demand for pork despite abundant supply. This is positive for our industry, as it tells us that the pork is moving and that consumers and importers want our product.

Summary

It’s a tough time for hog producers. The losses we are seeing over the next few months will lead to fewer sows in inventory. The hog cycle is alive and well. Consequently, new packing plants will come on stream with no increased production, and packer margins will get back to historical averages.