US Barrows and Gilt Cash Prices Decline Steeply

US - Cash prices for barrows and gilts (B/G) have declined sharply since last summer as large hog supplies bump up again available processing capacity. We are being told that packers are doing their best to maximize the number of hogs they can process in a day, including shuffling labor around the plant so as to process more hogs, writes the Steiner Consulting Group.The IA/MN lean B/G carcass base price last night was quoted at $41.57/cwt, down 15 per cent compared to what it was at the end of September and almost 20 per cent lower than what it was a year ago. If we were to use the IA/MN price as the benchmark for calculating producer profitability, it would imply deep producer losses and strong incentives to rein in the rate of supply expansion in the hog industry.

But things are not what they used to be and there are nuances in the current hog market that bear watching, especially with regard to signals for supply contraction and overall profitability. For one, the shift towards marketing more hogs on some sort of marketing formula/arrangement has become more pronounced in recent years.

Furthermore, producers have also benefited from producing hogs that have special attributes, be this hogs from crate‐free sows, hogs that are not treated with antibiotics or hogs that have not been

administered ractopamine.

Granted, in some cases the cost of raising such hogs is higher, which accounts for the premium that producers are receiving. However, the arrangements also make for a closer tie between the packer and producer and thus tend to dampen the shock from the extremely low prices in the negotiated market.

One way to observe some of the changes that have taken place is to compare the base negotiated price (either national or IA/MN) relative to the CME hog index, which is based on net prices for all producer sold hogs.

In November 2013 the average spread between the CME index and the IA/MN base price was around $4/cwt. It is currently running about double that as producers receive larger premiums for hogs sold through ways other than direct negotiated trading (which is how most hogs are sold).

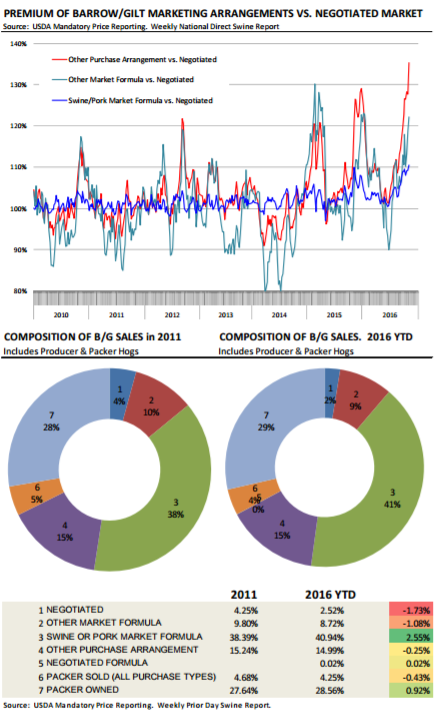

The top chart illustrates that point. For week ending November 5 USDA pegged the average price of hogs sold through “other purchasing agreements” at $59.24/cwt, a 35 per cent premium to the national negotiated price. This is by far the largest premium for such hogs we could find and largely reflect the wider spread between cash negotiated hogs and the pork cutout. The premiums for hogs sold through other formulas and agreements are lower but still substantial. Hogs sold using “other market formula” currently hold a 22 per cent premium to the negotiated price while hogs sold using swine or pork market formulas command a 10 per cent premium to the negotiated market. On page 2 we have included the definition, as received from USDA, of these various marketing arrangements. The pie charts to the right show the composition of hog sales so far this year and compared to what they were five years ago.

Takeaway: It appears to us that the use of marketing agreements has helped cushion some of the impact from sharply lower negotiated hog prices. Negotiated trade is extremely thin today (2.5 per cent of hogs sold) and it could get even thinner tomorrow as producers increasingly rely on other forms of price discovery. When discussing cash hog prices, it is important to consider the entire picture rather than traditional benchmarks, such as the IA/MN lean hog base price.