December Hog Futures Dramatic

US - The rally in December hog futures has been more dramatic that most participants expected, us included. In the wake of such shifts there is always the temptation to discount the volatility as simply a result of “crazy“ markets but we somehow find it hard to subscribe to the illogical market theory, writes the Steiner Consulting Group.Rather, it is more useful to take advantage of the hindsight, review the data and learn lessons.

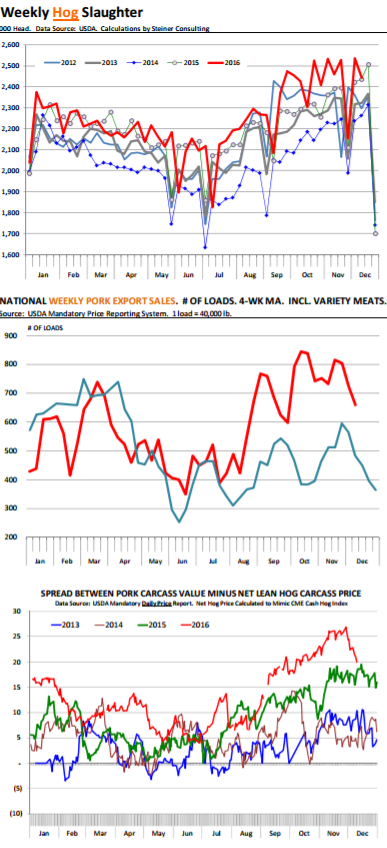

Last summer, there was growing recognition that hog supplies were building at a much more rapid pace than earlier expected. Moreover, there was a real threat that, if nothing was done, the swell of hog supplies could overwhelm available processing capacity and lead to another market crash similar to what happened in 1998. This threat was real and the supply of hogs that have come to market this fall justifies the worry. Consider that weekly slaughter in September, October and November averaged 2.394 million head/week, 4.9 per cent higher than the same period the previous year.

This compares with the September ‘Hogs and Pigs’ report which implied that the supply of hogs available for marketing during this time would be about 3.5‐4 per cent higher than the previous year. During this period, there were three weeks during which slaughter exceeded 2.5 million head.

Producers got the point that they needed to do their best to avoid having too many hogs around in late November and the first two weeks of December. The market also sent them a clear signal as

evidenced by the discount between October and December hogs at the time.

October hog futures settled in the low 50s while Dec futures were wallowing in the low 40s. The aggressive marketing pace helped accomplish a number of things. It allowed producers to get more current, thus providing them a bit more leverage into the holiday season. It also helped keep hog weights flat during a time when carcass weights generally move up. This limited the total supply of pork coming to market.

More importantly, the lower prices helped put more pork in retail counters, foodservice menus and, just as importantly, helped bolster pork shipments. The topic of pork exports is always one fraught with uncertainty. This is in part because market participants get the official export data with a 6 week lag.

In the meantime, there are plenty of rumors floating around, there is a weekly export report that FAS publishes and then there are the pork export sales reported under the mandatory

price reporting system. We often mention the first two but it is useful to also highlight the last one given that it is based on actual sales that major packers report weekly. The second chart to the right shows weekly export sales in 2015 and 2016.

These are total loads and to smooth out some of the big variation week to week we have presented a 4‐wk moving average. Clearly there was a shift in pork export sales starting in August and then accelerating in October and November.

The report does not say when those sales were going to deliver but it is still useful as an indicator of export orders that packers have take on. Total pork sales in October exceeded year ago levels by around 400 loads a week. This is around 16 million pounds of additional pork that was being sold into export channels every single week. And while sales have been slowing down, they still remain about 200 loads/week above last year. Hog prices have rallied about 30 per cent since then as markets no longer fear a capacity crunch. The meat spread (cutout minus hog carcass) remains quite large from a historical perspective but it has pulled back to more reasonable levels. The key going forward, in our minds, is whether packers are able to sustain the sales pace, particularly to key export markets, such as Mexico.