Significant Year-Over-Year Difference for US Hog Marketing Chain

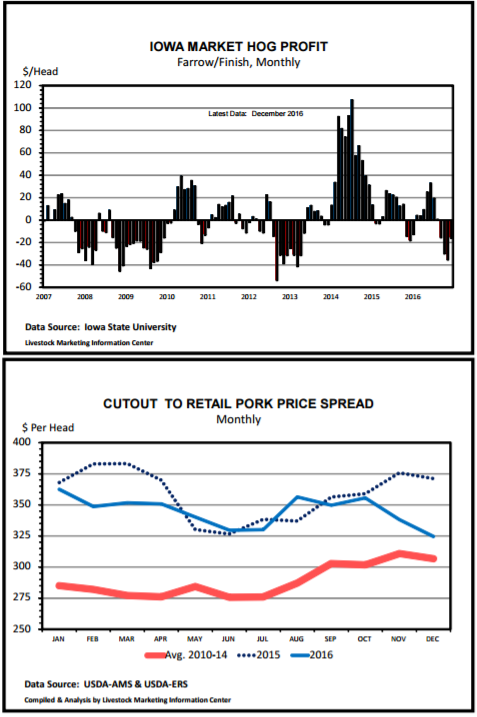

US - Today we will begin by highlighting some profitability and margin dimensions in the hog/pork complex. Across the hog/ pork marketing chain, there are some significant year-over-year differences, writes the Steiner Consulting Group.First, at the producer level, Iowa State University estimated for December that farrow-to-finish operations posted losses on a total cost basis (-$16.03). That was the fourth consecutive month in the red. Still, it was slightly better than a year ago (up $2.30 per hog). Hog prices rebounded in December from their November lows, however not enough to cover all production costs. Details are available here. Averaging the last 12 months, the per head profit was negative (-$1.26), compared to a positive $7.93 in 2015.

Turning to gross packer margins, which is the difference between the cost of a live animal and the pork cutout plus byproduct value. December’s margin (as calculated by the Livestock Marketing Information Center) was barely reduced from November’s record high level (not adjusted for inflation) coming in at over $60.00 per animal. On a year-over-year basis, that December margin was up 28 per cent. On an annual basis, the gross packer margin was up 26 per cent compared to 2015’s and

declined 4 per cent from 2014’s record high (not inflation adjusted).

With the release of USDA Economic Research Service (ERS) calculations of retail pork prices last week, that agency and many analysts do calculations of gross margin at that level (cutout value to retail price spread). The monthly ERS calculated retail pork price for December was the lowest for any month since May 2103. Driven by falling retail prices, the calculated retail margin dropped month-over-month in December. That was the fourth consecutive monthly decline and for December was down 13 per cent year-over-year. For calendar year 2016, the cutout-to-retail margin was down 4 per cent compared to 2015’s.

On a different topic, we point readers to a recent report by USDA-ERS, written by Fred Gale: “China’s Pork Imports Rise Along with Production Costs”. The full report is available here.

To paraphrase their summary, China is now a leading importer of pork and a contributing factor has been that their hog production costs have increased. Comparisons in this report show that hog producers in China face higher feed and labor costs than U.S. producers. Rapid wage growth is spurring

China’s transition toward larger-scale hog farms, but labor productivity remains low. With rising production costs, constraints on land use, and stricter environmental regulations in China, the country is likely to remain a large importer of pork.