US Frozen Red Meat Inventories Down at End of 2016

US - USDA-NASS reported that frozen red meat inventories at the end of 2016 declined 2 per cent from a year earlier although there was a marked divergence in trends for pork products versus beef, reports the Steiner Consulting Group.Beef inventories were up 11 per cent while pork inventories were down 13 per cent. Most notable was a 67 per cent decline in pork bellies. Poultry inventories were up 2 per cent, year-over-year (USDA-NASS link).

The increasing frozen beef inventories are consistent with exports in the last quarter of 2016 that are on track to be up 15 per cent-20 per cent from a year earlier and beef imports that are running 5 per cent-10 per cent above the same quarter in 2015. Frozen beef inventory levels have tended to reflect product in staging areas for both imports and exports.

The 37 million pound increase in beef cold storage holdings over the course of December was the second largest increase for that month since 2006. The biggest increase was in December 2014, a 43 million pound increase. The increase in December 2014 did not seem to have a big impact on beef values during the first quarter of 2015, as the choice beef cutout averaged $2.48 in 1Q2015 versus a $2.49 cutout value average for the last quarter of 2014.

Considering that most of the beef in cold storage is boneless beef, 90 per cent lean beef trimming prices in 4Q2014 averaged $2.96 followed by a $2.97 average price in the first quarter of 2015.

There were some issues for imported lean beef prices, however, as Australian 90 per cent lean values dropped from $2.83 in the last quarter of 2014 to $2.41 in 1Q2015. The decline in imported beef prices in early 2015 was primarily a function of beef imports that were up 47 per cent from a year earlier during that time period. Currently, the Livestock Marketing Information Center (LMIC) is expecting US beef imports in 1Q2017 to be down 10 per cent-15 per cent from a year ago.

The declining frozen pork inventories during December provides more fodder for questions than any other frozen product statistics from the USDA-NASS cold storage report.

Frozen pork inventories during December declined by more than any other December over the last 10 years. The drop in pork totaled 41 million pounds during the month. The year with the next biggest decline was 2006, with a 26 million pound reduction. Ham inventories fell by 36 million pounds for the month.

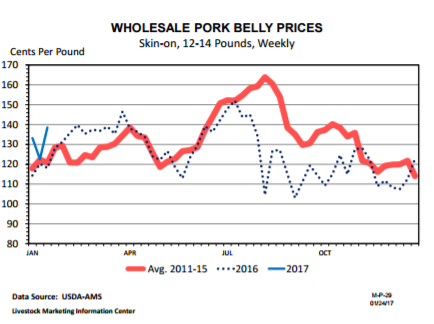

Pork belly frozen inventories for the end of the year were the lowest on record, going back to 1973. Belly inventories at the end of 2016 were 17.8 million pounds, down from 53.4 million pounds a year earlier. The next lowest end of the year inventory was 28.2 million pounds at the end of 2002. In

December 2002, the value of the pork belly primal component of the hog carcass was 78 cents per pound (source:USDA-AMS).

Prices declined in January but then increased steadily through July 2003, averaging $1.02 that month. Pork belly prices in 2002 made their bottom following bacon-lettuce-tomato season in

September 2002 at 61 cents. This past summer, the pork belly primal value bottomed in August 2016 at 90 cents and averaged $1.04 in December.

In 2015 and 2016, frozen belly inventories were 63 and 65 million pounds, respectively, on April 1. In order to get inventories to that level, 21 million pounds of bellies had to be reserved from winter quarter pork belly (i.e. bacon) consumption in 2015 and 12 million pounds of bellies had to be frozen to build inventory in 2016. This year, in order to reach the 65 million pound frozen inventory on April 1, winter quarter bacon consumption will have to be reduced by 47 million pounds. Rising prices are the classic economic tool for cutting consumption. The January pork belly market is performing consistently, with the value of pork bellies rising from $1.15 in the last week of December to $1.38 by the third week in January.