US Hog Futures Take a Step back

US - Hog futures took a step back yesterday, with the nearby February futures contract declining by more than 260 points. The decline followed some weakness in the cash market for pork cuts, which is not unusual for this time of year, writes the Steiner Consulting Group.As we have noted before in this report, the pork cutout moved counter seasonally higher in December, largely due to excellent demand from both domestic and export channels. The latter cannot be overstated in our view.

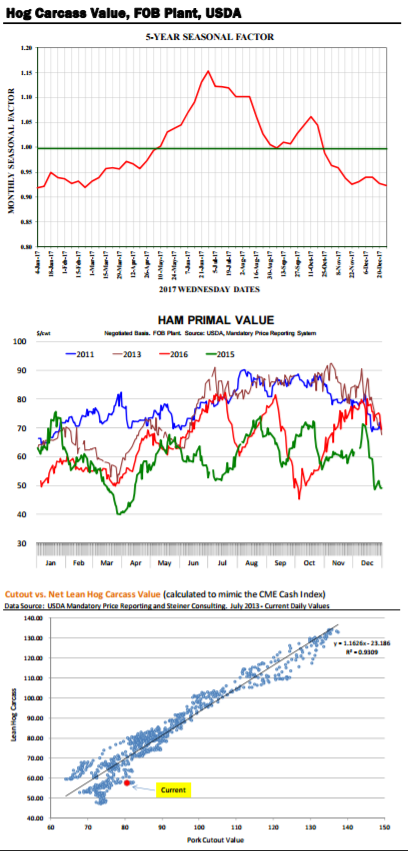

The weekly export numbers have revealed how strong Mexican demand in recent weeks, which largely translates into robust demand for hams. But in the short term there is some concern that seasonal factors may eventually catch up with the pork market. Hog futures are currently pricing demand to stay strong all the way into spring.

Consider that hog futures for February are currently around $64/cwt, which would imply a pork cutout value in the high 70s or close to $80/cwt. How so? The meat margin, which is basically the difference between the value of the hog carcass and the net hog price is currently running at an astounding level, reflecting the effect of excellent pork demand and ample hog supplies on the

ground.

The cutout last night was around $80.5/cwt while the CME hog index is calculated at around $57‐58/cwt. The meat margin therefore is around $23.5‐ $24.5/cwt compared to $16.5 a year ago and $5/cwt in 2015.

Normally the meat margin declines into February and March, in line with the normal pullback in hog supplies. Last year the meat margin dropped from around $16/cwt in late January to under $10 in early March. But with hog supplies expected to be +4 per cent higher this year than last year it may be reasonable to expect those margins to stay quite large for a bit longer. New hog processing plants are expected to come online this year but the larger ones are not expected to be operational until late summer and fall. For now, processing capacity still remains somewhat tight and has put packers in the drivers seat in terms of dictating pricing direction.

Obviously this is a cyclical industry and we can point to other times in the past when it was producers that were forcing packers to made do with tighter margins.

Over time, however, there is a fairly strong relationship between the pork cutout and hog prices. The bottom chart shows that relationship in recent years, using daily values, and also highlights how far off the regression line current prices are.

So what seasonal pressures could come into play and what are some of the risks in the short term for pork and hogs? Hams certainly will come into focus. The price of #23‐27 hams last night was $57.72/cwt, down $15.77/cwt (‐ 21 per cent) from just a week ago. But take a look at the chart of the ham primal, it is not unusual for ham prices to fall like a rock after Christmas, it is something that ham

buyers know well and wait for every year. At this point retail ham buyers looking to secure hams for Easter likely are sittng on the wings waiting for a bottom before they wade in. Easter in 2017 is on April 16, about 20 days later than it was last year. As a result we could see buyers probably take a bit more time before they start working their Easter needs. Export demand is a bit more uncertain.

The value of the Mexican peso continues to erode. In mid December a Mexican buyer needed 20.2 peso to buy 1 USD. Today they need 21.7, which is basically a 7.4 per cent price increase. And then there is the uncertainty of the policies that the new administration will pursue after it comes to power and has the ability to issue executive orders.