Wholesale Food Prices Drop Sharply

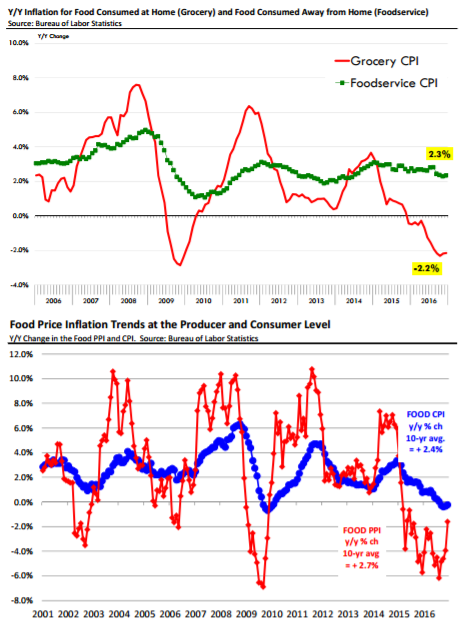

US - Wholesale prices are down sharply across a number of categories but so far the response from grocery retailers and foodservice operators has been vastly different. According to data published by the Bureau of Labor Statistics, the price of food products sold for consumption at home was down 0.3 per cent from the previous month and now 2.2 per cent lower than a year ago, writes the Steiner Consulting Group.Grocery store food prices have been declining for eight consecutive months and the pace of deflation has surpassed the levels experienced during the great recession of 2008‐09. Foodservice operators, on the other hand, have barely responded to the lower wholesale food prices. Prices for food consumed away from home in December were 0.2 per cent higher than the previous month and 2.3 per cent higher than a year ago. A number of factors that have contributed to the widening gap between grocery store and foodservice prices.

As the chart below shows prices at foodservice tend to be less volatile and stickier than those at the grocery store level. Restaurant operators cannot change menu prices very often (impractical and confusing). This is true especially for full service restaurants but QSR concepts also tend to hold menu board prices relatively steady and rely on short term promotions to drive traffic. Also keep in mind that most products going through foodservice outlets tends to have some processing steps (pre‐cooked, portioned, etc) while retailers sell a considerable portion of fresh products. We also think that foodservice operators continue to struggle with the effect of rising labor costs, health care costs and distribution costs.

Therefore they are looking at the decline in food costs as a way to bring a margin back in their businesses. One thing that is not well understood is how the BLS survey handles changes to product

specifications that often take a toll on restaurant food margins but may not be particularly obvious in the menu price. Many foodservice concepts have in the last few years sought to source so‐called “high attribute” products, be this cage‐free eggs, no antibiotic ever chicken or RBST‐free dairy products. Some are doing this because they truly believe in these products and others because they offer a way to differentiate their products from competitors. Whatever the reason, they tend to raise expenses and keep overall prices high even as the broader commodity prices have been pressured lower. Whatever the reason for the widening gap between grocery and foodservice food prices, we think the net effect is that grocery stores likely are gaining foot traffic as a result. And this will tend to benefit proteins that generally have more exposure at the grocery store level (eg. Pork).

Going forward, however, it will be interesting to see if the gap starts to narrow and how that affects foot traffic. We would think this would be of particular interest to beef producers as beef still holds a favored position in the center of the plate.

The gap between food prices at the wholesale level and retail level shrunk considerably in December, in part because of higher wholesale prices for meat protein and dairy products. The beef and pork cutout gained ground in the last month of the year. Dairy prices, particularly butter prices, also were higher as was the price of eggs.

The average price of beef at retail in December was $5.62 per pound, 5.9 per cent lower than a year ago. The average value of beef at wholesale (choice cutout) was $1.94 per pound, down 3.2 per cent from the previous year. The average price of pork at retail in December was $3.58 per pound, down 6.8 per cent from last year. The wholesale price of pork (cutout) was $0.78 per pound, 10.4 per cent higher than a year ago.