Will the US Take Retaliatory Measures Against the EU?

EU - The United States announced in late December that it intends taking action against the EU because of trade discrimination against US beef. Consultations are now taking place before a final decision is taken. If retaliation does take place, this could well be in the form of additional import duties on EU agricultural products.In the case of the meat sector, the EU exports significant quantities of pig meat to the US (but not beef). In addition, pork volumes are growing and the US represents a market for EU high-valued cuts, especially loins, ribs and bellies.

The background to this issue is that the EU established an autonomous beef quota in August 2009, in resolution of the hormones dispute between the EU and the United States. This quota allowed for the importation of 20,000 tonnes per annum, subsequently expanded to 48,200 tonnes from August 2012.

The beef has to be sourced from steers and heifers that had been fed a hormone-free diet using concentrates and/or feed grains. The product specifications were designed specifically for the US beef industry but other countries have subsequently been able to satisfy them. This especially applies to Australia, Uruguay and Argentina. The US share of imports has declined as a result and hence given rise to the current US concerns.

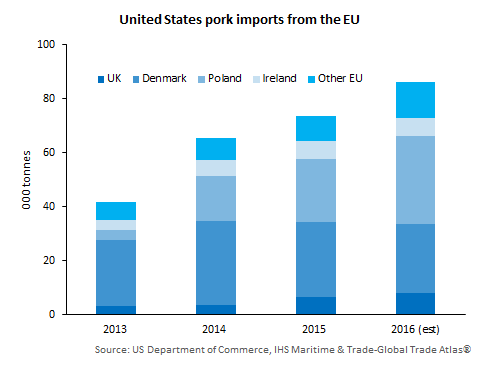

For chilled and frozen pork, the United States is the sixth largest market for EU exporters with a 4 per cent share of the market. However, of more significance is that it has been one of the fastest growing markets in recent years. Trade is expected to top 85,000 tonnes in 2016. US import data for January-November shows that supplies from the EU were up 21 per cent on a year earlier, even though shipments have tailed off in recent months, presumably because of the large downturn in US pig prices.

EU trade had been dominated by Denmark but its share was down to an estimated 29 per cent in 2016. This is due to sharp increases in recent years for Poland which established itself as the largest EU supplier in 2016, with a 38 per cent market share. No doubt the growth of the Polish processing sector, which has included foreign investment, and its lower costs have contributed to this development.

The UK has also seen steady growth in its trade, with shipments up 29 per cent in January-November on a year earlier, making it the third largest EU supplier. Ireland, the Netherlands and Spain are other significant but smaller suppliers.

Besides pork there is also a small EU trade in processed pig meat with the US including 15,000 tonnes per annum of canned hams, mainly from Poland and Denmark.

There was a similar dispute in 1999 when the US announced in July of that year that a number of EU products, including pig meat, would be subject to 100 per cent ad valorem import duty. This again was related to the use of growth hormones in cattle production in the US as the World Trade Organisation (WTO) ruled that the EU ban on beef produced with hormones was inconsistent with WTO rules. However, what was significant about this was that the UK was excluded, as it had always been opposed to the imposition of the hormone ban.

Whether the United States again takes retaliatory action and if that action applies to all EU countries will become clearer in the coming weeks with a post consultation hearing scheduled for mid-February. The policy of the new Trump administration on this issue is at present unknown. However, it is already indicating that it will be taking a more hard-line in respect to international trade agreements. This could represent a threat to the small but growing UK pork trade. It might also mean that other EU exporters to the US would divert high quality pork to other markets inside and outside of the EU.