Global Market Report: South East Asia Paul Anderson

The difference 12 months and the closure of the Chinese border to live Vietnamese pigs in November, pig prices have melted from May 2016 US $1.07 per pound live weight to the current pig price of US $0.37 per pound live weight, with production costs in the region of US $1.70, this means the pig producers are currently receiving less than half the cost of production and face huge losses.Global Market Report – South East Asia

Paul Anderson

General Manager South East Asia

[email protected]

Vietnam

With production up 3.2% to 3.7m tonnes, the situation is problematic. Minister of Agriculture and Rural Development Nguyễn Xuân Cường has submitted a variety of potential solutions to Prime Minister Nguyễn Xuân Phúc to help the struggling pig-farming industry recover. The move comes after the price of live pigs kept falling, With no indication of an end to this downward spiral.

Immediate solutions Cường has proposed include reducing the price of animal feed and veterinary medicine, and finding a stable market for the consumption of domestic pork meat. Cường has also suggested that the Government direct banks and credit institutions to charge off debts of pig breeders, and people selling animal feed to help them recover their losses.

In the long term, the ministry will push for the use of modern technology in housing and genetics to reduce the production costs, improve productivity and seek potential export markets for domestic pork meat. The ministry has planned to instruct localities across the country to review, suspend and not issue licenses for more animal-feed processing facilities as the current productivity is 31 million.

The government are said to be actively talking to China to resume exports. While the Public fork out VNĐ 80,000 (US $1.58) for a pound of pork at wet markets and VNĐ 100,000 (US $1.99) at supermarkets, the intermediaries, processors, packers and distributors are selling at a huge margin and therefore reducing the potential growth in pork sales through offering at a lower price.

Philippines

Less than a two and a half hour flight, we can see the complete opposite the pig price at farm gate continue to go up and up due to limited local supplies, currently at an average of US $1.16, It is expected to be favorable until June/July 2017 being the seasonal pig price peak and may reach US $1.27. The average cost of production is around US $1.80 so providing a profitable time for the pig producers although the government is planning to import an additional 7,000 tonnes of pork in an attempt to stabilize the pork prices.

The profitable situation in the Philippines doesn’t help to focus the business mind on improving performance to increase output and finally to reduce the cost of production, enhance profitability and make the business more financial secure, but this is exactly what the pig business should be focusing hard on now.

Thailand

Pig price in Thailand in the second quarter of 2017 jumped 12% to THB 67 (US $0.86)/ pound liveweight due to shortage of supplies. This is a result of droughts that hit Thailand in April, which is the warmest month in the country.

The price hike also indicates an increase in consumption of pork in Thailand. The Thai Swine Raisers Association reported that the shortage of pork was severe in large retailers and supermarkets across the country.

The price of pork belly in the supermarket in the first week of May was as high as THB 135 (US $1.72)/pound, loin at THB 134(US$1.70)/pound and ham at THB115 (US $1.49)/pound. The association, which is the largest national grouping of pig producers in Thailand, said the price would continue to be high as it would take some time for the production to recover, at least until the end of June or when the summer ends.

There are also a couple of reasons that affect the pig inventory and price in Thailand now:

Firstly, it is a strict control of animal movement along the border with Laos and Cambodia. It is being known across Indochina that the pig price in Vietnam is falling sharply. The gluts of pigs are rampant in Vietnam because China bans cross border trade of live pigs. Coupled with increasing imports of pork carcasses and portioned pork from the US, massive of pigs from Vietnam are coming into neighboring Laos and Cambodia, and hence Thailand.

Secondly, increasingly stringent on control of illegal growth and lean meat stimulant in Thailand is making difficult for reckless pig farms to sell their pigs to abattoirs. This is because the authorities are extensively checking the lean meat stimulant agent at pork stalls and butcher shops. Once spotted, they trace the source of the agent to the farm level. Farms that use the agent will be unlisted from accreditation as certified to the government’s standard. Without the accreditation, they cannot send their pigs to approved abattoirs. Once unlisted, the farms will have their license revoked for five years.

Malaysia

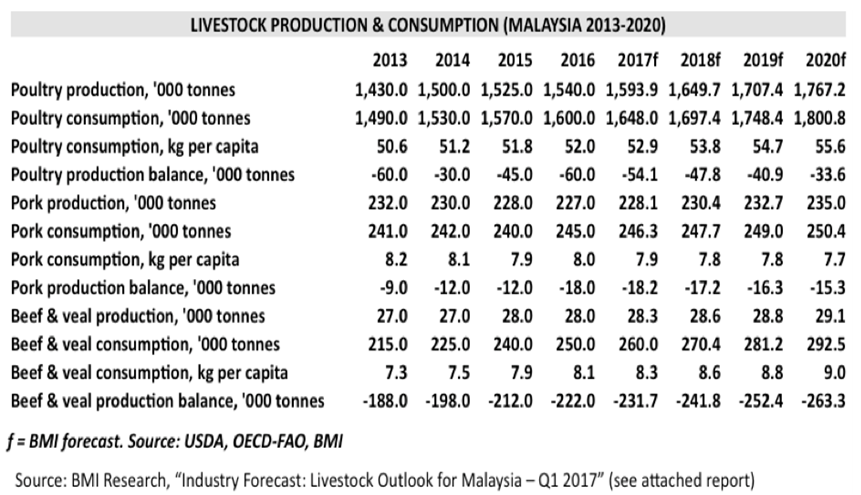

BMI Research recently produced the attached Q1 2017 livestock outlook for Malaysia. As you will see in the chart below, both pork production and consumption (in tonnes) in Malaysia are expected to grow in the coming years.

Authorities in Muslim-majority Malaysia have seized some 2,000 paintbrushes labelled as "halal" but made with pig bristles. Officials from the domestic trade ministry conducted raids on shops throughout the country after some of the brushes were sent for testing at a laboratory. Muslims consider pigs to be unclean and pork and its by-products are "haram" or forbidden, It is against the law in Malaysia to sell products made from any part of a pig unless the items are labelled and stored separately. The paintbrushes would not have been seized had they been correctly labelled and separated from halal products, although unbelievable this is not fake news.