Japanese Pork Imports Still Growing for Now

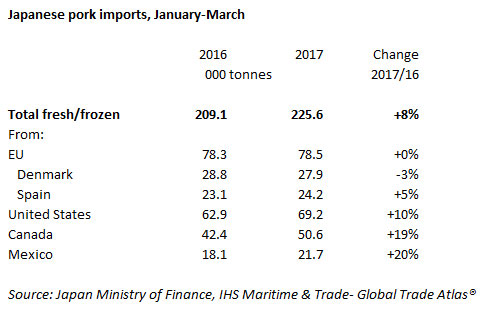

JAPAN - Following a trend seen throughout most of 2016, Japanese pork imports continued to grow modestly during the first quarter of the year being up 8 per cent year-on-year, reports Bethan Wilkins, AHDB Analyst.In contrast to the trend seen early in 2016, the US and Canada were the main beneficiaries of the import growth. Volumes from the US were 10 per cent higher than 2016 levels, while Canadian shipments grew a healthy 19 per cent. In contrast, EU shipments did not show any increase on the year and consequently lost 2 per cent of the market share.

The stagnation of imports from the EU, which consist almost entirely of frozen product, likely comes of the back of elevated shipments when prices were low in 2016. Supplies are reported to have exceeded demand from processors, leading to a 5 per cent increase in stocks at the end of 2016. As such, the EU may struggle to make gains on the Japanese market this year not helped by increasing EU pig prices.

Conversely, the majority of North American shipments are fresh/chilled products. Supplies are expected to be plentiful this year, following expanding US production, which should keep prices competitive and support Japanese import requirements.

However, whether import growth continues through 2017 is uncertain. This is due to an anticipated slight decline in Japanese consumption on the back of competition from rival proteins; poultry and beef. The latest USDA forecasts anticipate Japanese pork imports to be down around 1 per cent on the year during 2017

UK pork does not currently compete on the Japanese market, however as the fourth largest global pork importer, developments are important to ensure that supply and demand are balanced on the global market. Whether developments in Japan have any dampening effect on the global and UK markets this year remains to be seen. However, tightening supplies within the EU and growing demand from other Asian destinations, could counter any difficulties faced.