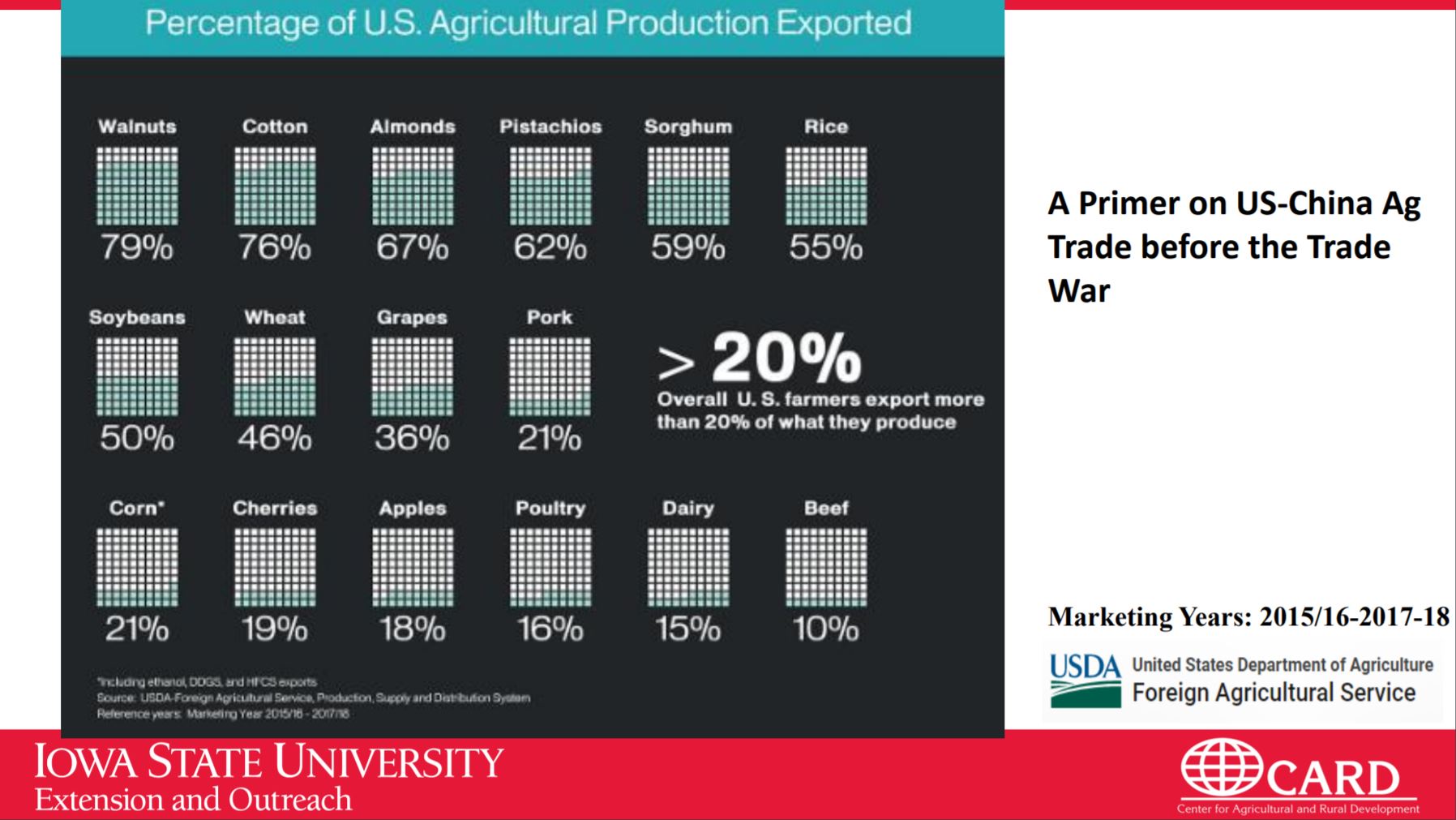

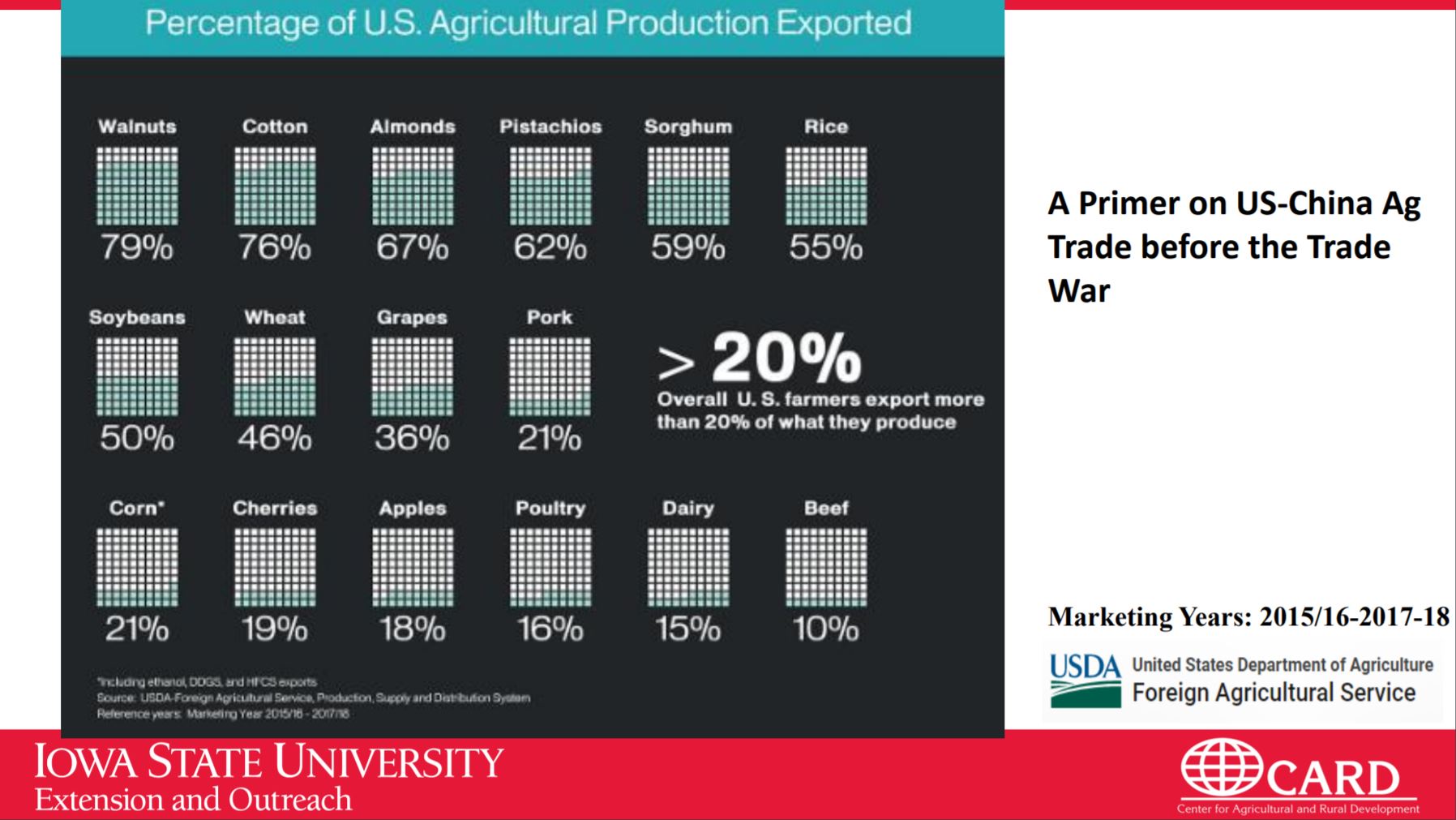

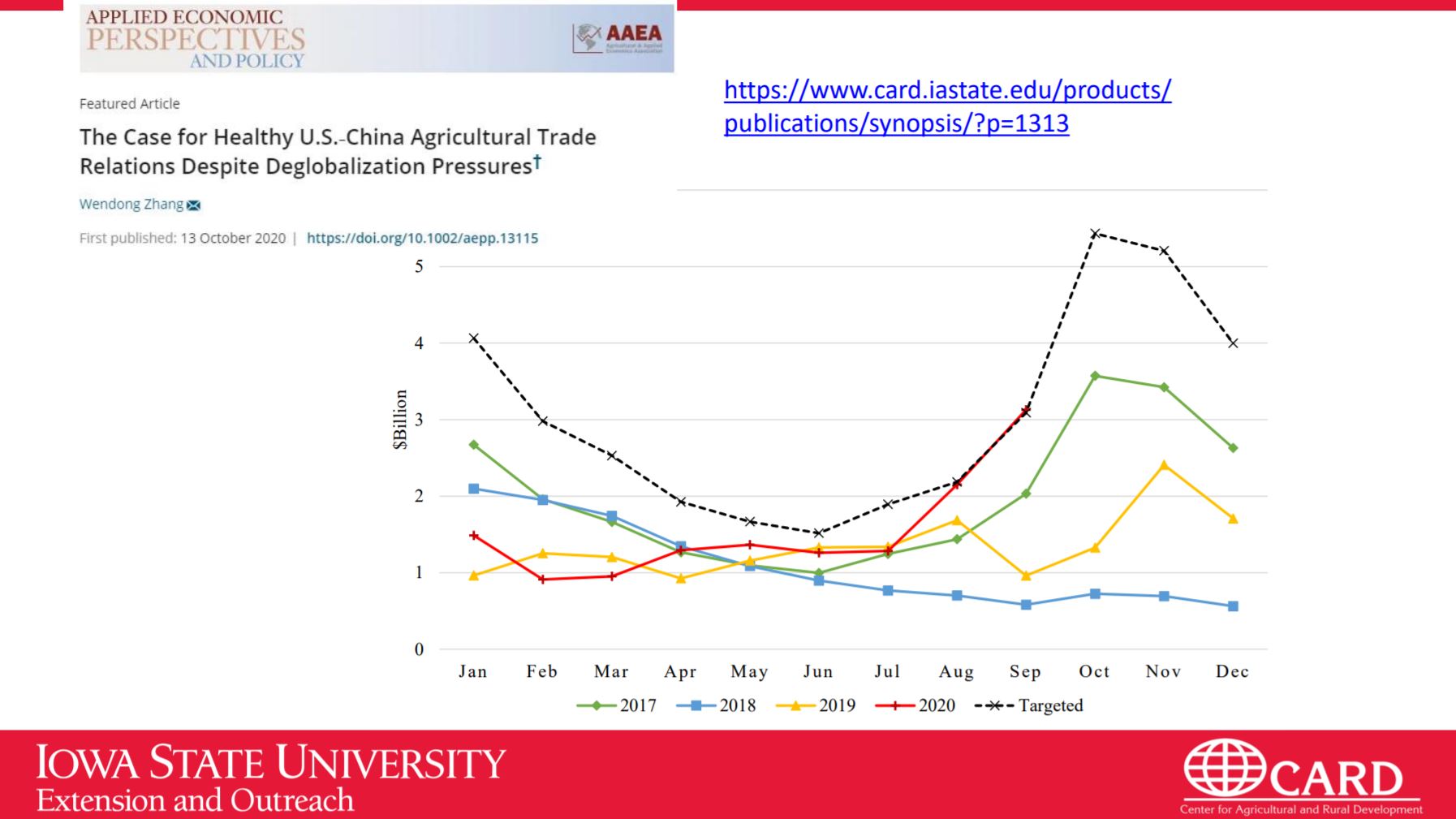

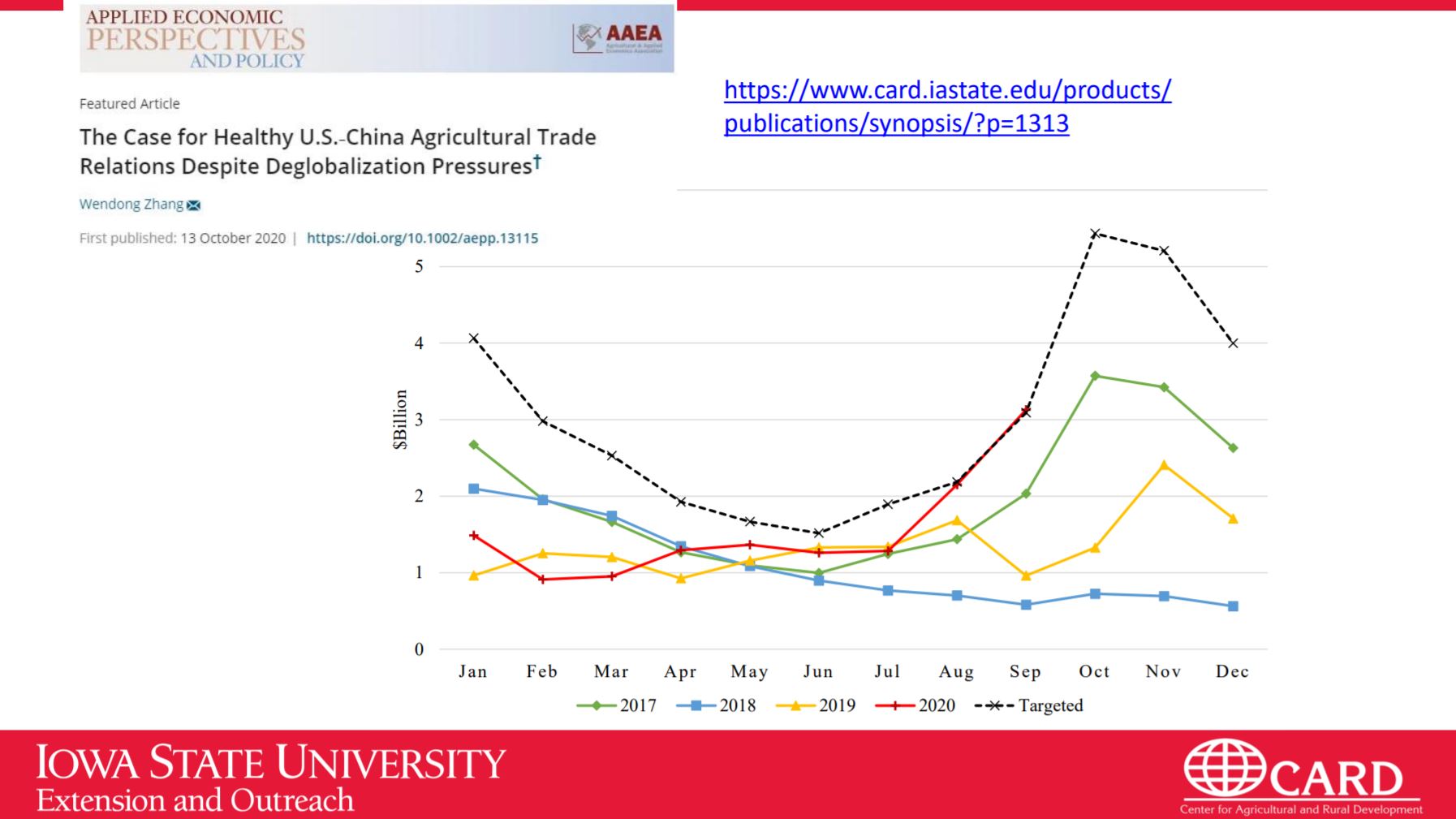

U.S.-China trade relationship remains indispensable on global stage

Despite having hardships, the trade relationship between the United States and China is indispensable, and one of the most influential on the global stage.

© Wendong Zhang

© Wendong Zhang

© Wendong Zhang

© Wendong Zhang

© Wendong Zhang

© Wendong Zhang