July Lean Hogs – New Contract High

Jim Long Pork CommentaryLast week Lean Hog Futures dropped big time and then recovered the losses by Friday's close. When the dust settled July closed at $107.15 a new contract high. We believe July will be $1.20 plus before it goes off the future board.

Some Other Observations

- Much angst at the first of last week over the effect of COVID lockdowns to China's domestic pork demand and import potential. If markets reflect demand, look no further than China’s National hog price it increased last week from 22.93 RMB/kg ($1.44 U.S./lb.) to 23.17 RMB/kg ($1.48 U.S./lb.). Seems China's domestic market did not get hurt by COVID lockdowns.

- The U.S. corn price seems to be hitting some headwinds. March corn closed to 646’2 or 25¢ a bushel net loss for last week. We continue to wonder how this can’t be further pressure on corn prices when U.S. exports are substantially lower than last year (-40%). A week ago, corn exports 13.6 million bushels compared to USDA expected export levels of 48.4 million bushels. Seems the lack of water in the Mississippi is restricting exports from less barge movement. We don’t see how current poultry and livestock inventories will increase corn consumption. Corn for Ethanol seems stable. Seems to us lower corn exports could continue to put pressure on the corn price including basis.

Always makes us wonder why USA – Canada with surplus grain and oilseed production doesn’t put together strategies to produce more red meat to export for added value rather than just ship grain and oilseeds.

- Due to the Avian Flu, the U.S. has culled 50.5 million birds mostly chickens and turkeys. The UK and Europe have also experienced major Avian Flu breaks. In the U.S. a large dozen of eggs was $3.50 last week. At first of the year, they were $1.00. One of the latest breaks a 1.8-million-layer flock in Nebraska. Less eggs and poultry meat are supportive of hog prices. Looking at the current egg price it appears the saying “One person’s misery is another’s opportunity” seems to be true.

- Seems the U.S. hog price currently is lower than Europe’s. For several months it was the other way around making U.S. pork less competitive in global markets. In U.S. dollar liveweight a lb. a week ago U.S. 62¢, Spain 77¢, France 71¢. We expect this difference in pricing will help USA – Canada pork export sales.

- Last week it was announced JBS has purchased assets of Tri-Oak of Iowa. It is reported to have no real estate involved. Tri-Oak is reported to have 70,000 sows and was already sending their market hogs to JBS harvest plants. This acquisition will push U.S. JBS swine operations over 200,000 sows. JBS also has significant sow production in Brazil and the United Kingdom. To us, this is part of the domestic global consolidation ongoing. The big are getting bigger. 39 producers in the U.S. control 65% of the U.S. sow herd (one of the 39 was Tri-Oak). Recently Seaboard Foods acquired some sow production from the Maschhoffs. We are hearing of other major changes in ownership coming. “Change is inevitable, except from vending machines.” – anonymous old quote.

China

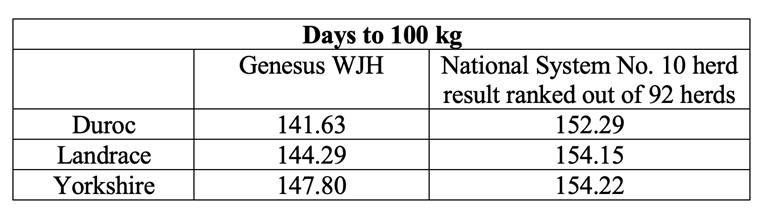

In China, there are 92 swine nucleus farms in the National Breeding Pig Evaluation Program. As part of the program, the data is evaluated by comparing and ranking the performance of each participating nucleus. With 92 farms participating we are unaware of any such comparison ongoing of such scale in the world. Our understanding is all major swine genetic companies have nucleus farms in the national program. It’s quite a unique structure. When you consider the scale and competition for the 92 farms, we were really pleased to see Genesus Nucleus Meishan Wanjiahao Pig Breeding Co., Ltd. (WJH) dominating the recently published data reports. Genesus WJH No. 1 Duroc 141.63 days. Genesus WJH No. 1 Landrace 144.29 days. Genesus WJH No. 2 Yorkshire 147.80 days.

We only have data of the top 10 herds of each breed but already you can see the dominance of Genesus.

WJH was an import from Genesus and has been operated as part of Genesus Global Genetic Program – MaxGen. We congratulate the WJH team on their execution of the Genesus Genetic program and excellent production management.

We believe Genesus has the fastest-growing genetics. Fast-growing pigs have a high appetite and that lowers wean to finish mortality. Our Jersey Red Duroc doesn’t only grow fast but produces pork with the best eating attributes that consumers crave.

92 nucleus farms in the China system, every major global genetic company is represented. Data shows Genesus domination.