USDA June 1 Hogs and Pigs Report: Conflicting Data?

Jim Long Pork Commentary

Observations

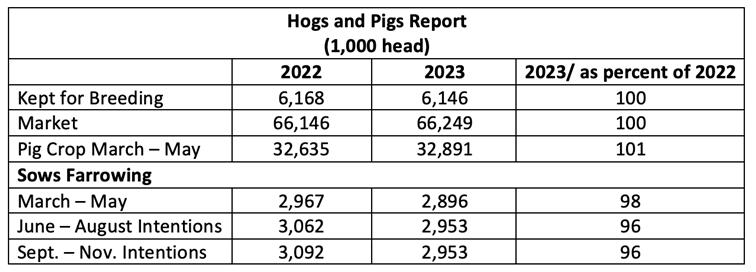

- USDA reports Breeding Herd and Market Hog Herd same as a year ago.

- Farrowing last quarter down 2% from a year ago with projections of farrowing down 4%.

- March 1 Breeding Herd was 6,096 – June 1, 6,146. A gain of 50,000 in the three months. Indicating must be bullish despite losses in the $40 per head range in much of that quarter?

- Industry must be holding sows and not breeding them with farrowing intentions down 4% on the same breeding inventory or maybe breeding herd has declined and that’s why fewer farrowing intentions?

- Illinois must be the most profitable place to produce swine with 50,000 sow increase (+8%) year over year. Iowa down 40,000.

Summary

- Same number of sows but 4% lower farrowing intentions. Doesn’t line up too well.

- Over the next six months report indicates market hog numbers will be similar year over year. The key point will be pork demand. Hog prices were significantly higher year ago with the same number of pigs.

Corn

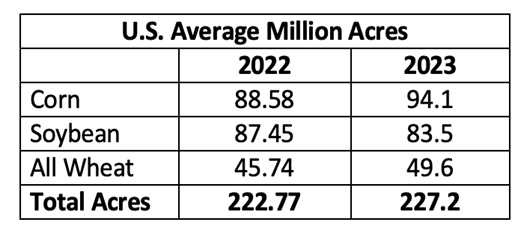

It's amazing what rain and more corn acres can do to price. On June 21st the National Corn Index was $6.71 On July 1st it's $5.31 a bushel - a decline of $1.40 in 10 days. Talk about a free fall. The $5.31 is the lowest in the last year by a significant amount. Last June National Corn Index hit $8.00 a bushel. Lowest Cash Corn averages are in North Dakota - Minnesota at $4.75 a bushel on July 1.

September corn futures closed at $4.88-bushel last Friday. Corn in Brazil is in the $4.50-bushel range.

Flipside less soybean acres then projected lead to jump in soybean meal Friday to $420 ton up $16.

Corn acres of 94.1 million acres was 6% higher than a year ago. The third largest corn planting since 1944.

Soybean average of 83.5 million acres is 5% lower than a year ago.

About 4.5 million more acres in 2023 than in 2022.

Looks like a good chance that with the regular rains, corn could be in the $4’s for a while. A welcome relief for the swine industry which has been hammered by high feed prices.

Summary

Hogs and Pigs Report has some confusing data. Same number of sows but 4% less farrowing’s projected. Same number of market hogs year over year. Hog price was a lot higher last year. Lots more corn, less soybeans. Feed prices should continue lower year over year. No matter what USDA Hogs and Pigs Report says we believe sow herd is liquidating.