USDA cuts Q3 pork output on tight hog supplies

Hog prices stay firm as processors bid up spot market

Third-quarter 2025 US pork production is lowered about 145 million pounds to 6.6 billion pounds on persistent, lower-than-expected availability of slaughter-ready hogs and a fractional decline in average dressed weights, according to the US Department of Agriculture's Livestock, Dairy, and Poultry Outlook for September.

This revised forecast quantity drops third-quarter 2025 production to 2.3% below the same period of 2024. Third-quarter prices of live equivalent national producer sold hogs are unchanged from last month, at $77 per cwt, more than 17 percent higher than a year ago.

Fourth-quarter pork production is forecast at about 7.29 billion pounds, down about 35 million pounds from the August forecast, a volume (still) up—1.1%—from the fourth quarter of 2024. The factors that are impacting third-quarter production are expected to persist to some degree into the fourth quarter. Hog prices for the fourth quarter are increased by $2 per cwt to $69 per cwt, almost 10% higher than prices a year ago.

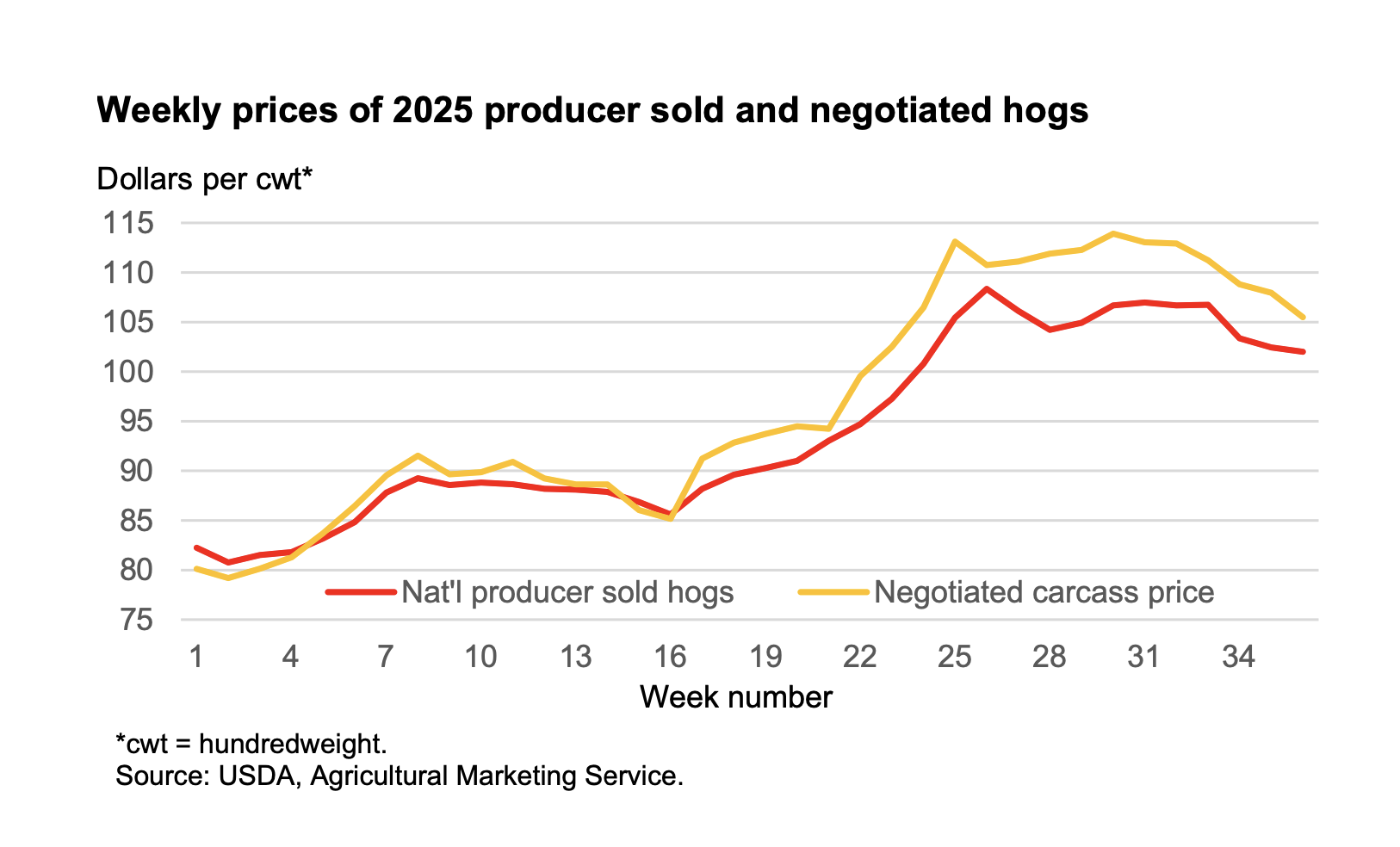

The figure below shows 2 series of 2025 weekly prices for hogs. The national producer sold hog series is a weighted average of market arrangements used by producers to sell hogs to buyers. One of the arrangements included in the weighted average is the negotiated carcass price, or a spot price for hogs. When hog markets are largely in equilibrium, the gap between the spot hogs price and the broader producer-sold hogs is minimal. The persistent gap in the figure, particularly since late June (week 25), suggests that processors are “chasing hogs”. Processors appear to be bidding up spot prices, likely to fill in gaps in processing plant schedules to fulfill pork buyers’ product contracts. The spot hog premium adds further evidence that slaughter- ready hog numbers have been fewer than expected, particularly at the beginning of the summer.

First-half 2026 hog prices are raised $1 to $65 per cwt in the first quarter and to $70 per cwt in the second quarter. These changes bring 2026 prices into line with historic quarterly price relationships, given the price changes made in the second half of 2025.