Maple Leaf Foods beats Q3 revenue estimates

Company warns inflation to persist; pricing actions set for 2026

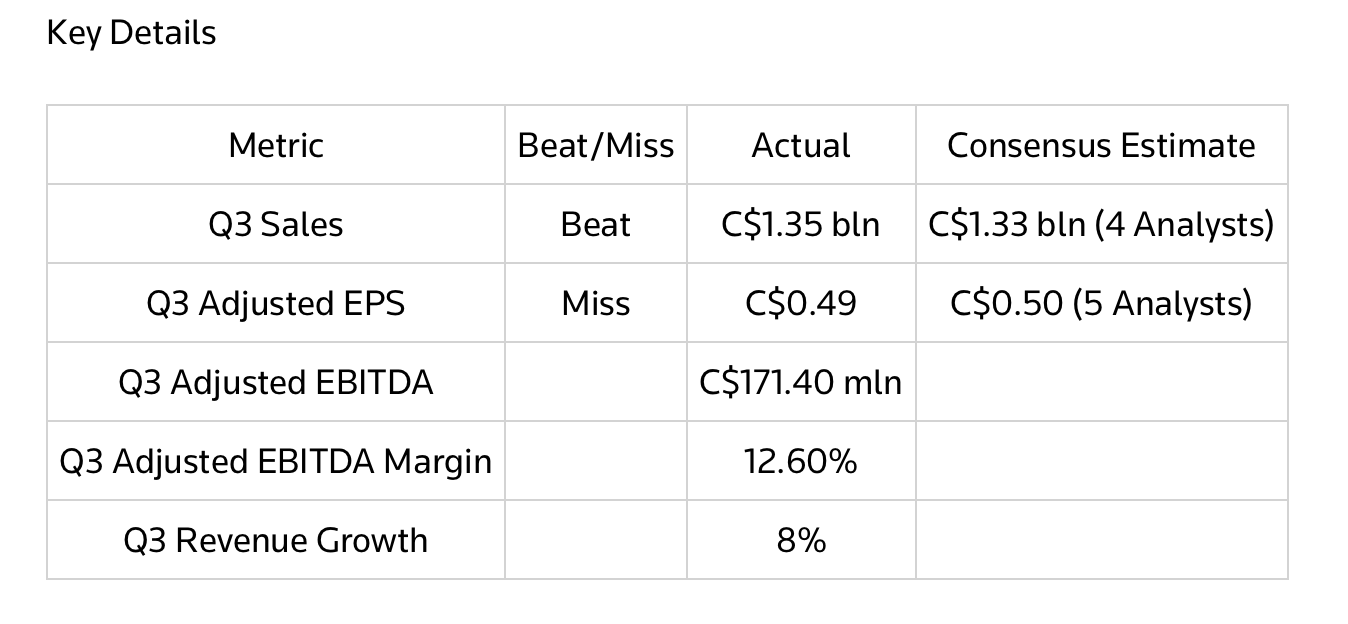

Maple Leaf Foods reported an 8% increase in third-quarter revenue, beating analyst expectations. However, adjusted earnings per share missed estimates, reported Reuters.

The company completed the spin-off of its pork operations, marking a significant strategic shift.

Maple Leaf Foods said it expects input cost inflation to persist into the fourth quarter of 2025. It plans to implement new pricing actions effective in the first quarter of 2026.

Analyst coverage remains positive, with the current average rating on the shares listed as “buy.” Of eight analysts, seven rate the stock as “strong buy” or “buy,” and one rates it “hold.” No analysts recommend “sell” or “strong sell.”

Wall Street’s median 12-month price target for Maple Leaf Foods is C$36.00, about 26.9% above its November 4 closing price of C$26.30. The stock recently traded at 15 times next 12-month earnings, compared with a price-to-earnings ratio of 14 three months ago.

The company said its previous 2025 outlook is no longer applicable following the pork spin-off.

Revenue growth was driven by strong performance in the Prepared Foods, Poultry, and Pork units. The company faced input cost inflation in Prepared Foods due to strong pork market conditions.

Maple Leaf Foods said completion of the pork operations spin-off represents a key milestone in its long-term strategy.