CoBank's Brian Earnest says US bacon prices are sizzling

What's causing the price boost in bellies?I’m getting a lot of interest in bacon these days (more than typical anyways), with many pointing solely to the Supreme Court Ruling to uphold California’s Proposition 12 as the proponent of the belly rally. While we can't rule that out, without having intimate market contact on this one, fundamentals suggest that Prop 12 may have been a propellant, but not necessarily the only noteworthy feature of a market that was ready to pop.

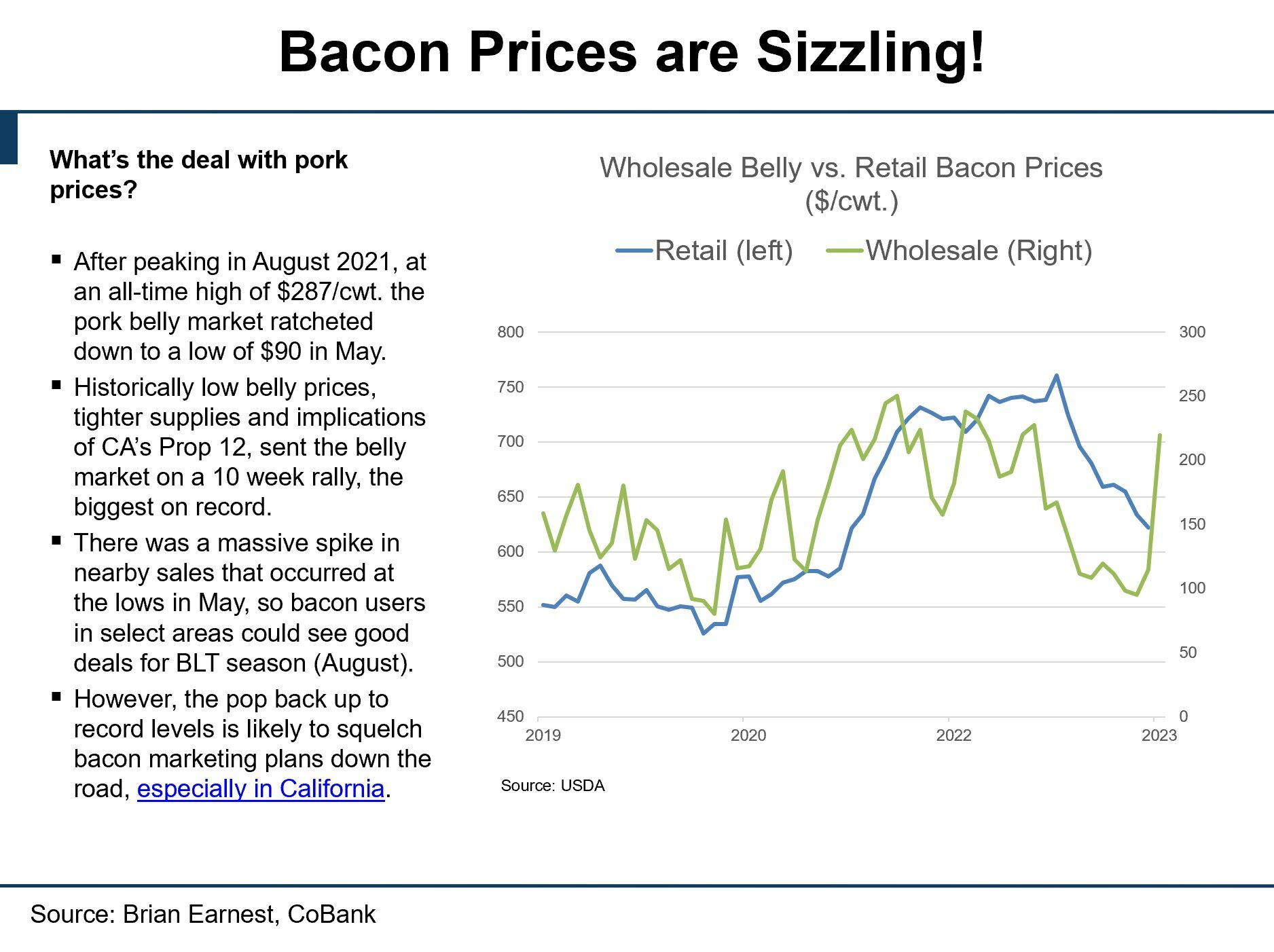

After just over a year of historically high belly prices, that age old saying; “the cure for high prices is higher prices” signaled bacon demand was more wholly satisfied by supply during the second half of 2022. Belly market conditions softened from August 2022-May 2023. More recently the lows ignited interest.

The bellies went from averaging in the low 90s in May, to more than $265/cwt. last week. Bacon support usually peaks in August, so the timing of the current run-up is not abnormal, but the rate of change over the last 10 weeks is historical. Wholesale bellies are up more than 130% from where they were 6-weeks ago.

Ahead of the CA Prop 12 deadline to have pork in freezers, (regardless of compliance on July 1) all things pork saw strong support. Support for other items has been waning since then, but bellies have marched on through the height of peak seasonal interest.

Seasonally larger hog supplies and waning interest in bacon should calm the market zeal in the months ahead. But the question remains as to where all the excess supply of pork will go as Prop 12 needs fall short of supply and non-prop 12 complainant product is displaced elsewhere.